Index Cooperative is a DeFi project that’s going after the multi-trillion dollar ETF (exchange traded fund) market. At its simplest, an ETF is like a basket of assets (be it stocks, bonds, commodities, or crypto) that can be traded in a group. Companies like Blackrock (under its subsidiary iShare) and Vanguard each have over a trillion dollars under management in the form of ETFs. ETFs have been so popular, that people like Michael Burry (of The Big Short ) have called it a “passive investment bubble”.

The Index Cooperative is building a platform to incentivizes the creation of Ethereum asset indices. We’ve looked at their first crypto ETF previously, the DeFi Pulse Index.

Index Cooperative just launched its farming program that will allocate 9% of the $INDEX tokens to the community. The tokenomics are attractive, with a 70% allocation for the community through initial distribution, liquidity mining program, etc. and 30% going to the team. The creators of this project are Set Labs and DeFi Pulse are two well known players in the DeFi space.

The fact that both of these companies are working on the project lends a lot of credibility to the brand. I also liked the strategy of launched a product first before launching a liquidity farm. This shows that there is product market fit before enticing users with extraordinary yields. Early adopter of the $DPI were awarded 1% of INDEX tokens as part of their distribution program.

If you want to see a more-detailed breakdown of the DeFi Pulse Index underlying tokens, click here (and then click ‘see more’ at the bottom).

I’M INTERESTED IN THE INDEX COOPERATIVE, HOW DO I GET IN?

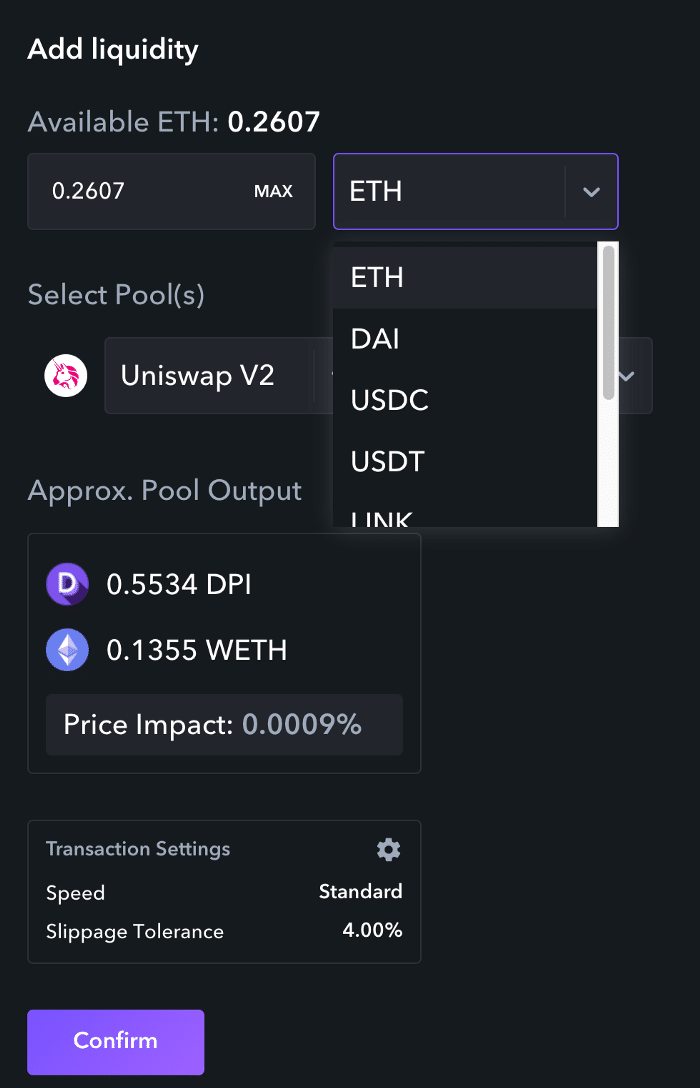

There’s a two-step process to enter into the staking protocol. First, you provide liquidity for the DPI/ETH pool on Uniswap. The easiest way to do this is via zapper.

You click on the ‘Add Liquidity’ button and select any of the 8 DeFi-friendly tokens which Zapper accepts, and deposit by signing on Metamask. Ether gas prices fluctuate, but for reference, recently we paid 0.02 ETH to deposit 7 ETH into the pool. In essence this turned 3.5 of the ETH into around 15 DPI tokens. Note, there is a real risk of impermanent loss with this liquidity pool, but since it’s an index of the top 10 DeFi projects, it’s not unreasonable to think that if ETH does well, this pool will too, or if one lags, so would the other.

Once you’re invested in the pool, there’s a second step to maximize your rewards. During the 60 day period (which began October 7th, 2020), there will be 9% of all Index tokens distributed through a liquidity mining program. If you’ve provided liquidity to the ETH/DPI pool through zapper.fi as explained above, your metamask will reflect Uniswap ETH/DPI LP Tokens.

The next step is to go to the farm page on indexcoop.com and stake the tokens. In the use case above (7 ETH), this costs another $2 or so in ETH fees. At present pricing, this will produce around 117% APY. Obviously the liquidity mining event isn’t going to last a whole year, but it’s an excellent return in the short term.

This is a great opportunity to enter into a solid, broad-based DeFi protocol with the risk spread out among many established players for a generous APY. Long-term, the sky’s the limit, as the ETF market is measured in trillions of dollars, not billions, and if this finds greater adoption, you’ll be glad you got in early.