In this article, we want to tell you more about how the Eidoo Hybrid Exchange works from a technical point of view.

To do so, we have prepared a technical paper about the Eidoo hybrid exchange, a new architecture which provides efficiency, security and transparency.

This hybrid exchange is an important part of our roadmap and, as explained on our social media channels, a first version will be released in March.

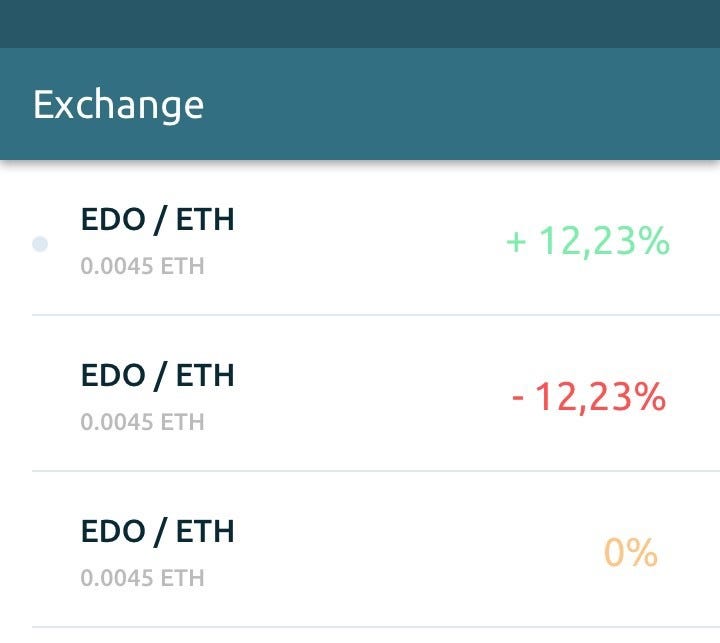

See more images of the hybrid exchange here.

The first pair listed will be EDO/ETH; then we will gradually launch more pairs, including the most popular ERC20 tokens on the market.

As usual, everything will be very user-friendly being the user experience our main goal for the whole Eidoo app.

Code is Law

In the technical paper that follows you will see how the whole architecture works, and why we define it as “hybrid”.

Hybrid platforms leverage both centralized and decentralized system to get the best features out of both. Any transfer of value is executed on the blockchain according to the exchange smart contract and dedicated user wallets, this is to give to the users full control of their funds and to guaranteed a safe management of those.

Eidoo and Oraclize

Thanks to the strategic alliance between Eidoo and Oraclize, we can prove that the centralized order book server is behaving as expected, making front-running impossible and ensuring that a fair matching of the orders always happens.

This is possible thanks to the use of the Oraclize “authenticity proofs” and of their “computation datasource”.

The Eidoo’s hybrid solution

You as a user will maintain total control over your tokens because ETH, ERC20 and ERC223 tokens will be managed on a safe and trustless platform, but with higher speed and scalability than a normal decentralized exchange.

The hybrid Eidoo exchange will overcome current decentralized exchange limitation regarding the management of large amounts of trades while maintaining low fees.

User accounts are based on a smart contract on the Ethereum blockchain, where tokens are placed: the exchange itself won’t have any direct unauthorized access to funds.

Also, in a similar way to what happens in decentralized platforms, exchange transactions between wallets will be based on atomic swaps: this means that the operation will be indivisible and can only terminate with a full exchange; otherwise, nothing happens.

Read more about the hybrid exchange on our Technical Paper here.