Crypto market prices: Bitcoin breaks the resistance of 8,000 dollars, with a 46% dominance. Ethereum also on the rise.

Bitcoin, at the first light of dawn in the Old Continent, breaks the barrier of two crucial levels: the resistance of 8000 dollars, threshold lost since mid-May, and the share of dominance climbed over 47%.

It was since December 2017, when prices reached the absolute record of all time ($20,000), that Bitcoin didn’t dominate so much of the entire capitalization, today just under 300 billion dollars.

The other Altcoins, which have fallen short of the highs of recent days, are the losers. In the top 10 only Bitcoin Cash (BCH) and Litecoin (LTC) moved into positive territory this morning with increases just under 2%. Others that have to pay the price are Eos (EOS), Cardano (ADA) and Iota (MIOTA), with a drop between 2 and 3 percentage points.

Nothing compromising if we consider that all three maintain a positive weekly balance thanks to the increases achieved in the last two weeks.

In a few days, the general sentiment of the operators seems to have made a somersault. If at the end of June more than 90% of crypto investors though bitcoin would go below 5000 dollars, in recent days the calls are being made for a return to 10 thousand dollars.

Not just from operators. The digital mainstream also seems to be getting back on track.

After the subtle mea culpa of Facebook that since the end of June has been granting its advertising space admitting that it was a little too hasty to ban the advertising of products and services indiscriminately to all the companies in the crypto industry, including those qualified like Coinbase, yesterday afternoon Google also returned to show on its search engine the price of Bitcoin, along with Bitcoin Cash, Litecoin and Ethereum.

A positive mix of news that increases both pressure and expectations on the SEC’s decision to approve the launch of an ETF. Forecast for next August 16, although some rumours indicate a possible postponement to September.

Cryptocurrencies confirm that they do not want to bore investigators, even during summer vacation periods.

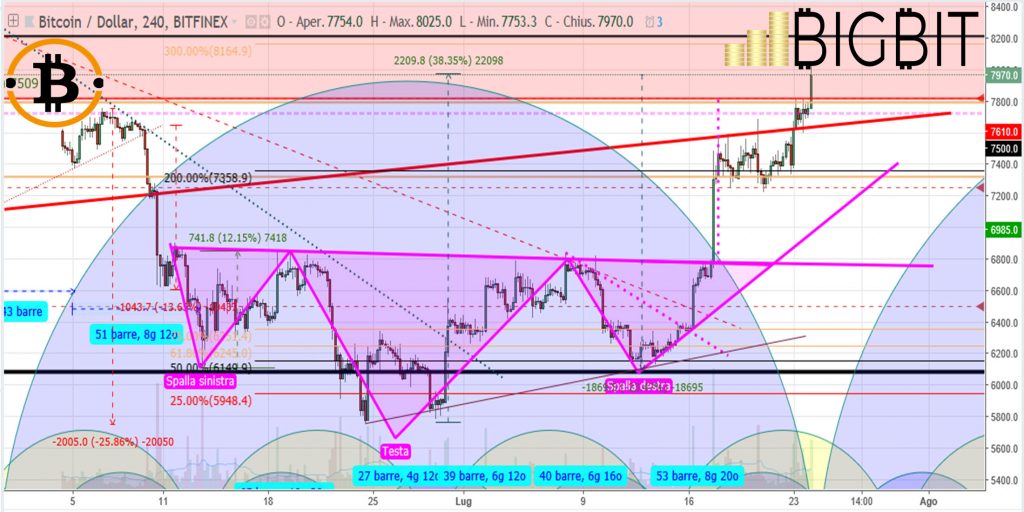

Bitcoin (BTC)

After easily exceeding the $7000 threshold and consolidating between $7200 and $7400 over the weekend, this morning prices return to run and reach the $8000 threshold.

In less than a month, after having dangerously touched 5700 dollars, this morning prices recover about 40% scoring one of the most impulsive rises since the beginning of the year.

Under such conditions and with a prevalence of general euphoria, it is difficult to predict the next stage.

Those who have known this sector for a long time will know very well that getting on a running train is not the right choice.

It is better to regret not seeing the signs of a reversal at the end of June than to regret having listened to the naysayers.

Ethereum (ETH)

Prices return to test the threshold of 440-450 US dollars. The attempt to break the $475 found the defence of the bear.

The rebound in progress brings prices back to test again this important short resistance that proves to be the threshold to protect the resistance of 500 dollars which, as mentioned several times, is the watershed to define the trend in the medium term.

Possible breakage of the static and dynamic support might have prices test the 400 dollars in the next days