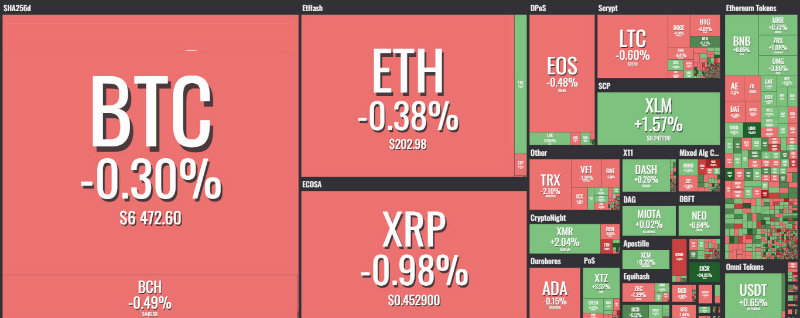

The second day of the week continues with yesterday’s opening trend, with the prevalence of red signs for more than 60% of the tokens listed on Coinmarketcap that, after having surpassed 2000 tokens, has an average of 8-10 new daily entries.

Despite this, capitalisation continues to stand at just over 210 billion dollars, a sign that is not entirely comforting even if we are in a context that cannot be considered negative given the three important announcements made last week: Fidelity, Goldman Sachs and Michael Novogratz‘s fund, Bakkt.

The latter has set the launch date for December 12th. An event that will officially sanction the entry of the old financial world into what many now see as the future of assets.

Over the weekend, Binance exchange CEO, Changpeng Zhao, provocatively posted a Twitter question to his followers asking what would happen if Fidelity decided to invest in the cryptocurrency sector even just 5% (about $350 billion) of managed capital, tripling the current market capitalization.

Right, that little 5% is more than doubling (almost tripple) the entire crypto market cap. And some people are still worried about… pic.twitter.com/EETSyQXjnm

— CZ Binance (@cz_binance) October 21, 2018

Looking a the ranking, with particular focus on the top 20, only one handful is distinguished by the colour green: Stellar Lumens (XLM), Monero (XMR) and Ethereum Classic (ETC) with increases of around 2%. The best one is Tezos (XTZ), which achieves another good increase above 4%.

Current bitcoin value (BTC)

Prices are now in contact with the upper side of the downward triangle and are waiting for a good reason to make the movement explode, either upward or downward. The contraction of volumes in recent days, which in the last 24 hours has recorded just over 3 billion dollars traded, one of the lowest levels since the beginning of the year, indicates the investors’ fear of anticipating the wrong move.

Sooner or later, someone or something will decide to pull the trigger. The phases of contraction, especially those which are so prolonged, usually end with violent shocks. What happened last week may just have been a test.

Ethereum (ETH)

Today as well is a copy-paste from recent days. For over a month, price congestion has forced prices, except for three occasions, into a channel between 200 and 240 dollars. Trading volumes remain interesting even if far from the August records. Uncertainty due to network developments (see Constantinople’s postponement) does not help to bring back purchases.

The thresholds of $190, downwards, and $250, upwards, remain technically crucial.