Takahiro Hattori and Ryo Ishida conducted an in-depth scientific study on the behaviour of crypto investors and their arbitrage trading habits, focusing on the presence of these practices between ordinary exchanges and futures markets.

This is a very interesting study due to the fact that prices of cryptocurrency derivatives have always been mentioned among the reference price indicators of ETF projects because they derive from an official regulated market.

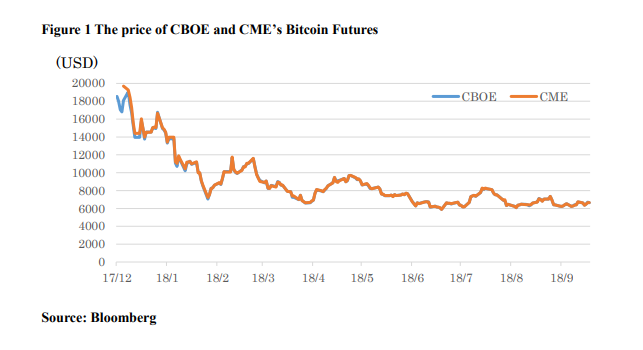

The researchers’ analysis focused on the CBOE and the Gemini exchange, which is widely used in the USA by professional operators.

Arbitrage is mainly linked to the purchase of short positions at the closing of the CBOE market and therefore to their hedging with operations on the spot market of Gemini, selling practically short and then covering the position elsewhere at lower prices.

In this way, the open positions on the futures market also influence the spot market through an arbitrage activity.

The study is very recent and started in March 2018.

The results of the study reveal that there is no opportunity for arbitrage between the futures market and the spot market.

Futures traders do not cover themselves on normal exchanges. On the contrary, traders use the ordinary market information to predict future derivative contract prices.

In short, the futures market does not provide significant opportunities or arbitrage, but follows the prices of the exchanges, resulting in a very low forecast value.