The International Monetary Fund (IMF) has issued an interesting report on the prospects of the evolution of digital money issued by central banks, CBDCs (Central Bank Digital Currencies).

The report was then analyzed by Diar, a well-known information service that has been dealing with crypto for some time.

While the private sector has long since begun to provide solutions for the crypto world that can meet the needs of security and compliance with anti-money laundering regulations, the situation is much more uncertain in the public sector.

Should central banks issue regulated cryptocurrencies?

Although the IMF states that this is possible in the near future, at the same time it would be a solution that would not replace normal cash, if only for political reasons, because its imposition would be experienced as a loss of privacy and freedom.

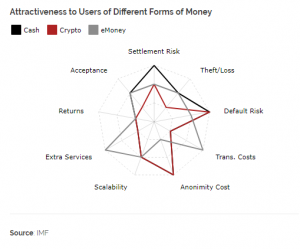

At the same time, the use of blockchain technology may not be the only possible solution for an electronic currency issued by a public body: an ordinary electronic currency, not based on the blockchain, could also provide efficient solutions in the management of the money supply and be more pleasing to the private sector.

As the chart shows, each solution has its advantages and disadvantages:

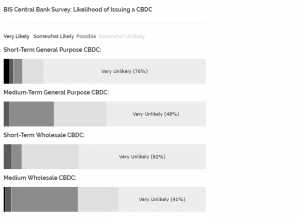

CBDCs could be a solution in certain situations, presenting advantages for specific economic systems and this could make their adoption possible.

Thus, the IMF assesses the probability of application in different situations:

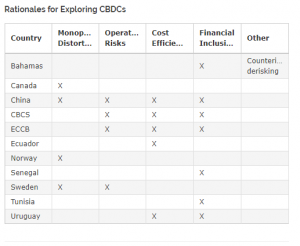

Electronic currencies can bring different advantages depending on the national economies in which the central banks operate.

So electronic currencies can be a solution, but they might not be based on DLT due to the problems of scalability and application simplicity. Centralised alternative solutions may be more useful in this case.

So what will happen to private cryptocurrencies?

For this type of coin, the problem remains the great volatility and it will be necessary to study a form of legislation that can allow its adoption on a large scale.