The technology company Line Corporation has published an interesting report on the development of fintech and its accessibility.

The research focused on the Far East, Southeast Asia and part of the Western world. The focus was on the trade-off between interest and real knowledge of the fintech sector and modern cashless payment methods.

The research had as its reference sample 5000 smartphone owners in seven markets including Thailand, Japan, Taiwan, Indonesia, South Korea, USA and UK.

The sample was drawn up taking into account the realities most interested in the development of fintech.

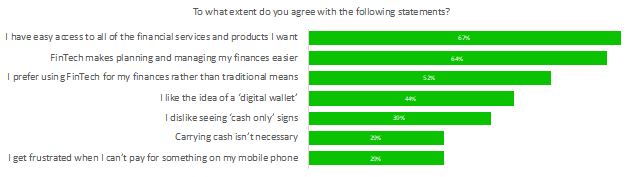

In these markets, 64% of respondents said that fintech has simplified the management of their financial resources. In general, confidence in these technologies is quite high, with 63% of respondents saying they believe in the tools they use, while another 30% show an ambivalent attitude.

Confidence is higher in young people than in older ones, with only 55% of the respondents over 55 trusting modern tools, compared to 69% of the ones aged 28-34.

Knowledge is much lower, with an average of 44% saying that they consider themselves informed in this area, a percentage that rises to 52% if you consider the under 34.

Among the most desirable services to use on smartphones are savings accounts (65%), bank transfers (57%), current accounts (48%), insurance (65%) and travel insurance (58%).

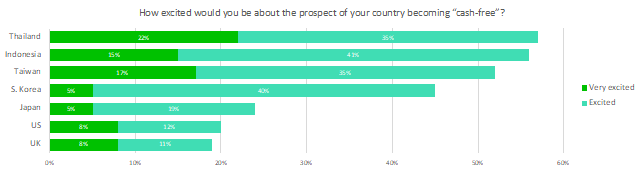

If we consider instead the spatial distribution, it appears that users from Southeast Asia: Thailand, Taiwan and Indonesia, are much more ready to enter the fintech sector, with 57% of Thai people who say they are excited to join a cashless company, followed by Indonesia at 56% and Taiwan at 52%. South Korea follows at 45%.

These markets are also more ready to purchase financial products online using smartphones.

While the average percentage is 65%, in Thailand it is 83%, in Indonesia 77% and 75% in South Korea.

Western countries and Japan are much more conservative, with only 24% of the Japanese ready to leave cash, followed by 20% of the Americans and 19% of the British.

In particular, the Japanese appear very conservative on the subject of cashless payments.

This makes the role of Line very important, as it is trying to make fintech payments simpler and more instantaneous, offering solutions for payments through its own application as well as insurance solutions.