Is it possible to earn money with bitcoins that are staked for a payment channel to work on the Lightning Network?

The answer is yes, at least according to a recent BitMEX study, but the earnings are limited.

The research centre of the well-known exchange has collected data on the active Lightning Network channels and has also carried out experiments on the management of a node, achieving results that can be interpreted in a bivalent way.

In order to carry out its activities of sending and receiving payments, Lightning Network needs the presence of funds that allow the “Inbound Capacity”, i.e. the possibility of receiving funds, and the “Outbound Capacity”, i.e. the possibility of sending funds.

In the first case, the financial means are provided by the channels that are connected for payments, while in the second case the funds are made available by the person who opens the channel itself, and who will retrieve them when the channel is closed.

These funds are invested in a totally safe way, in the sense that there is no investment risk and the same bitcoins initially placed are recovered after using the channel.

The operation of Lightning Network involves the payment of a commission, a fee, which may be either proportional to the amount sent or fixed. Unfortunately, there is always discussion about minimum figures, in terms of percentage decimals, rarely reaching 1%.

In this case, there is a conflict of interest: if the channel is expensive it will not be used, whereas if it is inexpensive it will be used, but the yield will obviously be low.

BitMEX has experimented with varying fees on a Lightning channel to see this trade-off between price and demand so as to draw conclusions about the ideal commission.

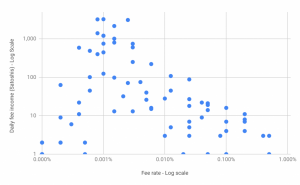

The results regarding the number of transactions and the cost were the following:

The ratio of commission cost to the number of transactions follows the classic trend of a demand curve, but only from a fee of 0.001%.

At a lower level, the inverse price/question correlation falls, however, it is likely that the number of observations has not been sufficient and it seems risky to talk about the Veblen good effect.

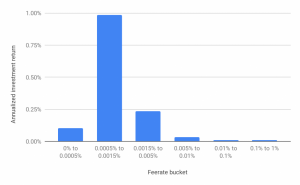

From the point of view of the fees received, the distribution is as follows:

Using a fee between 0.0005% and 0.0015% it is possible to collect a return on the bitcoins invested of almost 1%, making this range the optimal with regard to the fees to be requested.

Now the question might be: is this level of return adequate for the investor? Consider that, in itself, staking within a Lightning channel is a completely risk-free activity, at the level of investing in secure government bonds.

At the same time, however, it involves investing in bitcoin or another virtual currency, and this generates rather high risks/opportunities compared to the dollar or the euro or any other fiat currency.

If it were possible to freeze, or not consider, the exchange risk itself, today the return considered would be little if the alternative was to invest in US government bonds, especially if the alternative was to invest in German Bunds, which yield -0.08% or Japanese bonds with -0.09%.

Even if the alternative could be offered to a European credit institution that pays the rate of 0.4% for overnight deposits at the ECB, it would be a lot. So it is difficult to give an answer if this return is adequate, because it depends, fundamentally, on the performance of BTC compared to other currencies, but we must consider that 1% is still more than zero, which is the yield of bitcoins left unused in a wallet.