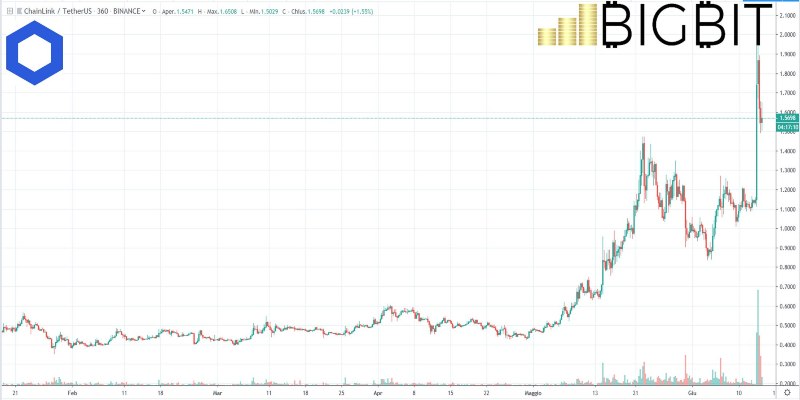

Today Chainlink soars, with a price increase of more than 35%. The credit is obviously due to today’s news that the Chainlink network will be integrated into Google’s cloud project.

The news makes Chainlink fly and it might be the case that the rest of the industry could benefit.

70% of the first 100 cryptocurrencies are in negative territory and, in particular, if we look at the first 25 most capitalised cryptocurrencies, only 4 are characterised by the green sign. A downward trend seems to prevail. But it is not really the case because, if we look at the capitalisation, it is increasing from yesterday’s levels. Among the first 4 cryptocurrencies that are in positive territory, there are bitcoin (BTC) and Bitcoin Cash (BCH) with a rise of just over 2.6%. While ZCash (ZEC) is up 1.7%.

On the negative side, however, there is Aurora (AOA), which after the upward movement of more than 50% yesterday, today cancels almost all the recent gain and is considered to be the worst of the day with a collapse that reaches almost 50%.

Among the other negative signs of the day although not among the worst, there are Binance Coin (BNB), Enjin Coin (ENJ) and BitTorrent (BTT) with a -6%. For BNB the movement is justified: after having updated the absolute historical highs during yesterday, with a rise that pushed it beyond the 36.5 dollars, the profit taking has begun as well as a dangerous technical double maximum that will have to be confirmed in the next hours.

Negative of the day, even if in the past hours the retracement was more contained, is Litecoin (LTC) which today continues to fall by -2%. After hitting $140, the profit taking for a short-term bearish phase began.

The market cap is close to $265 billion, just above yesterday afternoon levels. Bitcoin’s rise leads to an increase in dominance to 56%. Ethereum and Ripple remain unchanged.

Bitcoin (BTC): today’s price

Bitcoin is trying to break through the $8,250. We will have to wait for the development during the weekend. A possible bullish extension and a confirmation of the levels above 8,350 or better still 8,550 dollars would eliminate the hypothesis of a bearish head and shoulders, which, on the other hand, would occur with prices below the $7,600 threshold or with a further sinking below 7,500 dollars.

That is why it is necessary to be very careful, as there are risks of downward speculation.

Ethereum (ETH): today’s price

Ethereum, on the other hand, does not follow the bitcoin setup and corroborates the hypothesis of a bearish head and shoulders with the passing of the hours. For ETH it is necessary to wait for the weekend to push over 265 dollars and then attack the 285 dollars, towards the highs of 2019.

If not, Ethereum will need to keep the $230. In case of violation, in addition to the bearish head and shoulders, a lack of support at the $200 would favour the bears.

A movement that could complicate the current bullish structure, which has been present since the beginning of February, and which took place with the strong and important movement in mid-May, when prices recovered more than 50% of their value.