The assessment of the actual value of BTC against market trends is a topic that fascinates all investors and traders.

Are we too high or too low compared to an assumed intrinsic value?

A research by Hans Hauge, published on SeekingAlpha, tries to give an answer to this question. According to the researcher, we are very close to the bottom, because a period of low price has corresponded to an improvement in the value indicators of the virtual currency.

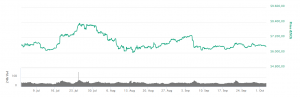

First of all, let’s analyze the trend of the cryptocurrency in recent months (data Coinmarketcap):

As we can see from the graph, the values have decreased significantly compared to July, with a drop in prices of more than 20%.

In the face of this not so brilliant market the basic indicators of the crypto move in a positive way. According to Hauge, the base value of BTC can be evaluated according to three parameters:

- unique” wallet addresses;

- hash power installed;

- transactions.

The first indicator provides a basis for evaluation according to Metcalfe’s law, while the other two essentially allow an evaluation of the expansion and operational success of the network. In the face of a significant increase in hash power and transactions, we have also seen a recovery in the rate of unique addresses (data Bitcoin.com):

As we can see, we have gone from the bursting of the bubble to a situation of consolidation and then of slow growth.

The combination of low prices and network growth makes us optimistic about the possibility of being close to the bottom, so the worst should be behind us and we may face the possibility of growth.