A DIAR study shows how BTC Lightning Network is just beginning to be a mainnet and still has a long way to go to establish itself as a transaction system.

Diar’s research: “BTC lighting network will grow”. Leggi qui l’articolo in Italiano

Diar‘s research reveals the true situation of BTC’s newborn “Second Layer”, the well-known Lightning Network, which should ensure that the oldest cryptocurrency becomes the best payment system for convenience and speed. LN was applied for the first time at the end of 2017 and saw the first applications on the Mainnet last month.

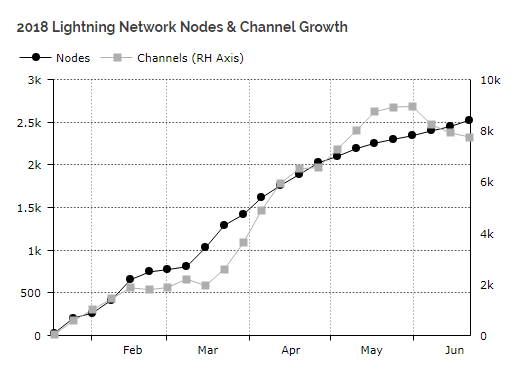

At present, LN has more than 2500 nodes and 8500 channels activated, while the funds available on the network to allow payments are equal to about 150,000 dollars, with a growth of 3600% compared to the beginning.

As the image below shows, on the other hand, the number of channels has seen an adjustment in growth, presumably due to a rationalisation of the network.

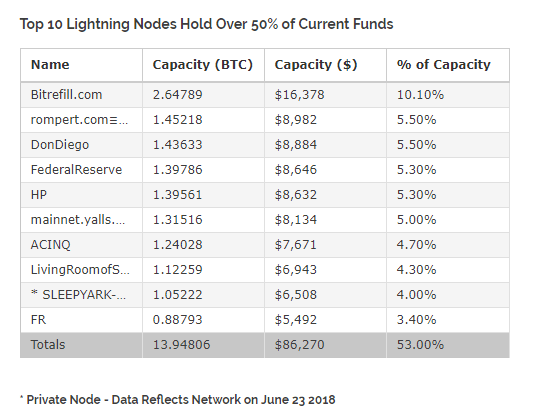

These are the ten largest LN operators from the point of view of the number of nodes activated and it can be seen that these ten entities control 50% of the system funds:

Unfortunately, but not surprisingly, LN also has problems, especially related to “youth”. First of all, the funds available for each channel are very low (less than 20 dollars) and this makes it very difficult to make large transactions.

Unfortunately, but not surprisingly, LN also has problems, especially related to “youth”. First of all, the funds available for each channel are very low (less than 20 dollars) and this makes it very difficult to make large transactions.

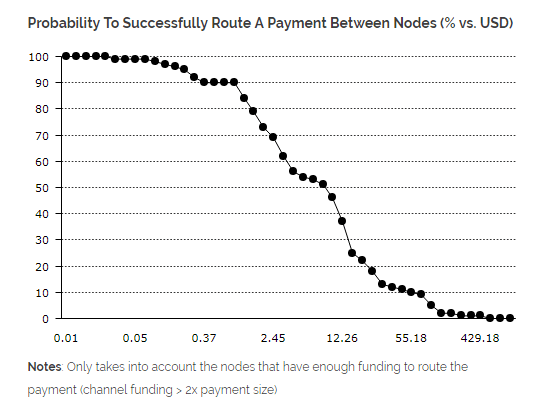

As the research indicates, if you have to pay a few cents of dollar LN is perfect and can transfer funds safely, but if you have to pay a cappuccino the transaction will have 70% chance to go through. If you then decide to buy a smartphone you can be sure that the transaction will not go through.

From the following graph you can understand how the chances of a transaction going through fall dramatically as the size increases:

The problem is that the size of the channels is still too small. Even if they are interconnected, in theory, a few steps are enough to make payments even between nodes not connected to each other, in reality, this does not happen because there aren’t any channels with sufficient funds to support significant amounts: a payment of $ 429 has only 0.01% chance of succeeding.

Another problem that is slowing down LN adoption is the lack of KYC-AML procedures that facilitate adoption by mainstream general payment systems.

These are early problems, which indicate that the Second Layer of BTC is, from the operative point of view, still at a Beta test level, and not completely operative. However, the inflow of funds into cryptocurrency payment systems may allow for rapid growth.