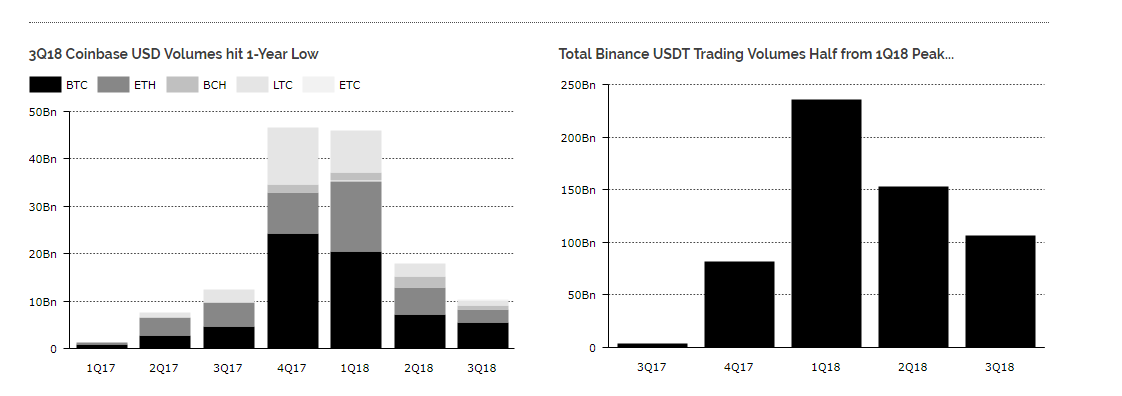

The two-year period 2017-2018 was the year of great growth for exchanges, both in terms of profits and business, but the current moment of stagnation of the market risks putting an end to this moment of general euphoria, as can be seen from an analysis published by the Diar on two of the main exchanges, Coinbase and Binance.

According to several analysts, including Diar, the problem of falling volumes is due to two factors:

- The explosion of the bitcoin bubble;

- The fact that many utility tokens have not managed to have the expected evolution.

The first factor is difficult to contain by the exchanges and is part of a natural boom-bust cycle, given the impressive growth of BTC in the first part of the year.

The second factor is very relevant and is related to the fact that many ICOs have not been able to have the operational evolution that was expected. Too many promises in the whitepapers have not been kept for various reasons, ranging from poor identification of target markets and overly bold business ideas to inadequate teams.

Moreover, ICOs have very often been based on the legal uncertainty that underlies their nature. This has prompted exchanges to look for different forms of investment than their typical brokerage business, investing directly in numerous startups and paving the way for the so-called security tokens.

Basically, some exchanges are investing in startups that, once developed, will be put back on the market in the form of security tokens representing shares. Coinbase, for example, has made numerous venture investments, as we see in the following table:

These are instead the companies in which Binance and its related fund, Binance Lab, has invested:

These forms of participation are long-term investments by the exchanges: they buy a stake in an interesting startup or ICO, they provide the necessary financial and managerial resources and then they put the security token on the market.

This is an apparently excellent idea, but it clashes with the absence of regulations on the subject.

For now, there is not yet a clear space on the treatment of a security token, especially with US investors, but sooner or later this problem will have to be solved and, when that occurs, these large exchanges will be in the front line with an interesting selection of tokens ready.