Here are the latest trading crypto updates: the market resumes after reassurances from the US authorities. Bitcoin faces the 6000 support.

Trading crypto updates: the SEC awakens the Bulls: leggil’articolo in Italiano

Yesterday’s verdict of the US Securities and Exchange Commission (SEC) on the criteria for regulating Ether tokens interests the bulls. The first to benefit is Ethereum (ETH) followed, for obvious reasons, by Tron (TRX) and Eos (EOS).

As a result, the entire sector is trying to rise after the decreases of recent days by scoring double-digit rises from the lows reached Wednesday afternoon.

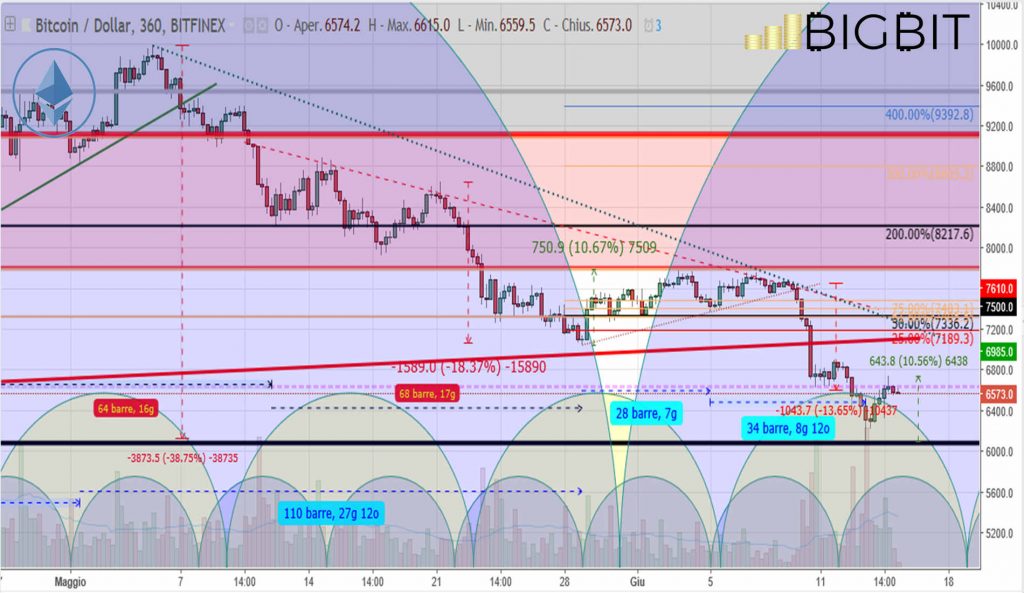

Bitcoin (BTC)

The 6000 area once again scares the bulls. For the third time since the beginning of February, this area sees the return of purchases. A triple low that technically augurs well for the future. However, a return above 6900 dollars is needed in the coming days.

Operating levels

UPWARD TREND: The short rebound in progress will have to go beyond the 6900-7000 area to find the first confirmations of a return of purchases.

A return below 6200, or worse 6000, will indicate yet another false rebound.

Ethereum (ETH)

A rise of more than 13% in just over 24 hours pushed prices above $500, boosting hopes for a trend change. The traded volume recorded yesterday was only lower than the peak at the end of May. This time the barrier is the low of the end of May, in 520-500 area. A consolidation and a push over the 520-530 area is needed to start repelling the attacks of a still present bear.

Operating levels

UPWARD TREND: The push beyond the highs of yesterday afternoon, in the 525 dollars area, will be a first bullish signal of short to medium term. Over 550 dollars we’ll have a confirmation.

DOWNWARD TREND: A return under $450 would be negative, it’s the weekly support as well as the basis for a possible monthly cycle start confirmed by volumes.