Today Revolut announced the launch of Open Banking for its over 400,000 retail and business customers in Italy.

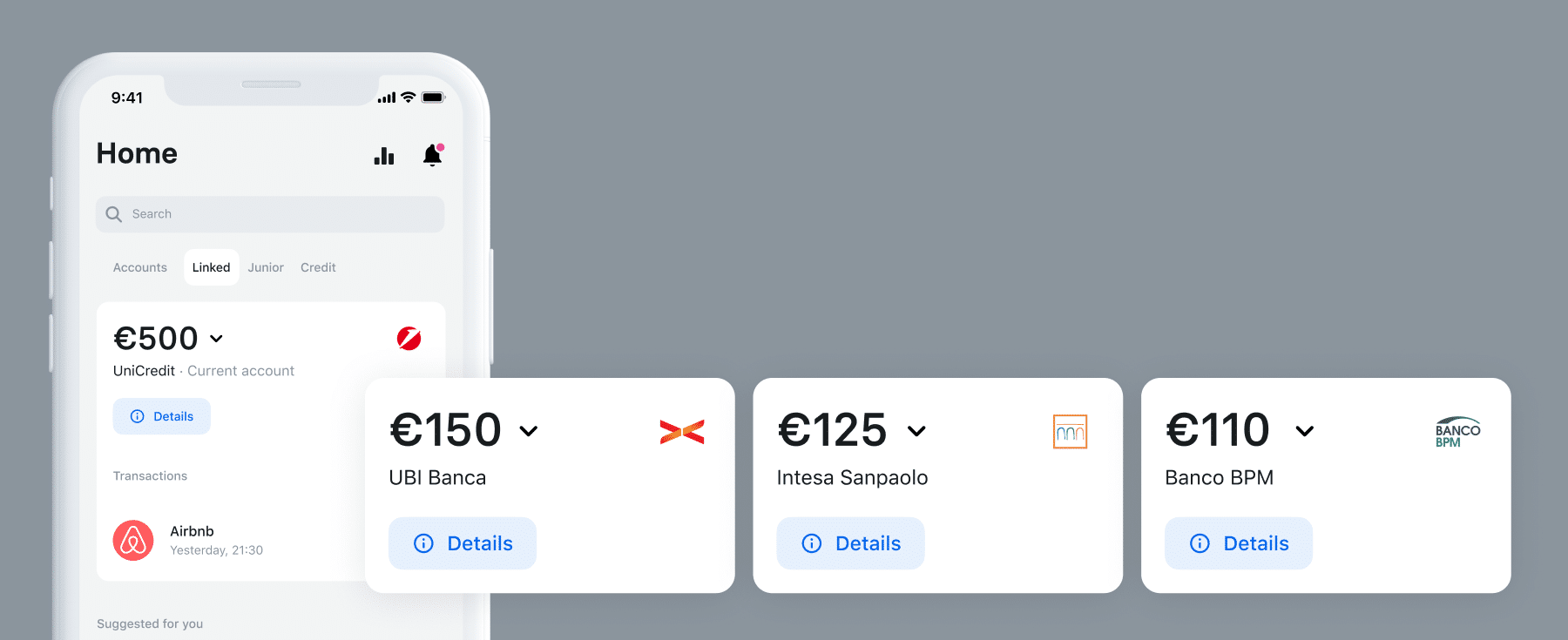

The new Open Banking functionality allows users to connect Intesa Sanpaolo, UniCredit, UBI Banca, Banco BPM and Poste Italiane accounts to Revolut and to access all balances and transactions from a single app.

At the moment most Italian consumers can access information relating to their bank accounts such as data, balance and transaction history only via the website or the app of the individual bank. This translates into limited visibility, as the only way to view them is to access different sites and apps.

Revolut’s Open Banking features

Revolut’s new offering was built in partnership with TrueLayer, one of Europe’s financial API providers.

The goal of Revolut is to help people manage their financial lives in a fast, simple and convenient way. Having to consult multiple apps is not convenient when having multiple companies or more than one account.

Through Open Banking it will be possible to set up budget control and always have a complete overview of all the expenses of non-Revolut accounts.

In the future, Revolut also wants to allow customers to top up their Revolut account via the Open Banking service and include additional banks, including foreign banks.

The Open Banking functionality is free for all customers.

Joshua Fernandes, Revolut’s Open Banking Product Owner, explained:

“With the deployment of our Open Banking product, our customers in France can now consult and manage several bank accounts in the same place, allowing them to have a global view of their daily expenses without having to switch from one banking app to another. We are delighted to see the new regulations facilitating a more open banking world, for the benefit of the greatest number of people. Revolut and TrueLayer are now at the forefront of this experience”.

Francesco Simoneschi, co-Founder and CEO of TrueLayer, added:

“We are delighted that our partnership with Revolut is moving forward rapidly and enabling the implementation of Open Banking in Europe. I was particularly looking forward to the launch in Italy because I know that in our country Open Banking and PSD2 have a great opportunity to bring innovation to the traditional financial sector. I am sure that the Open Banking products that we are developing together with Revolut will be a huge success in Italy”.