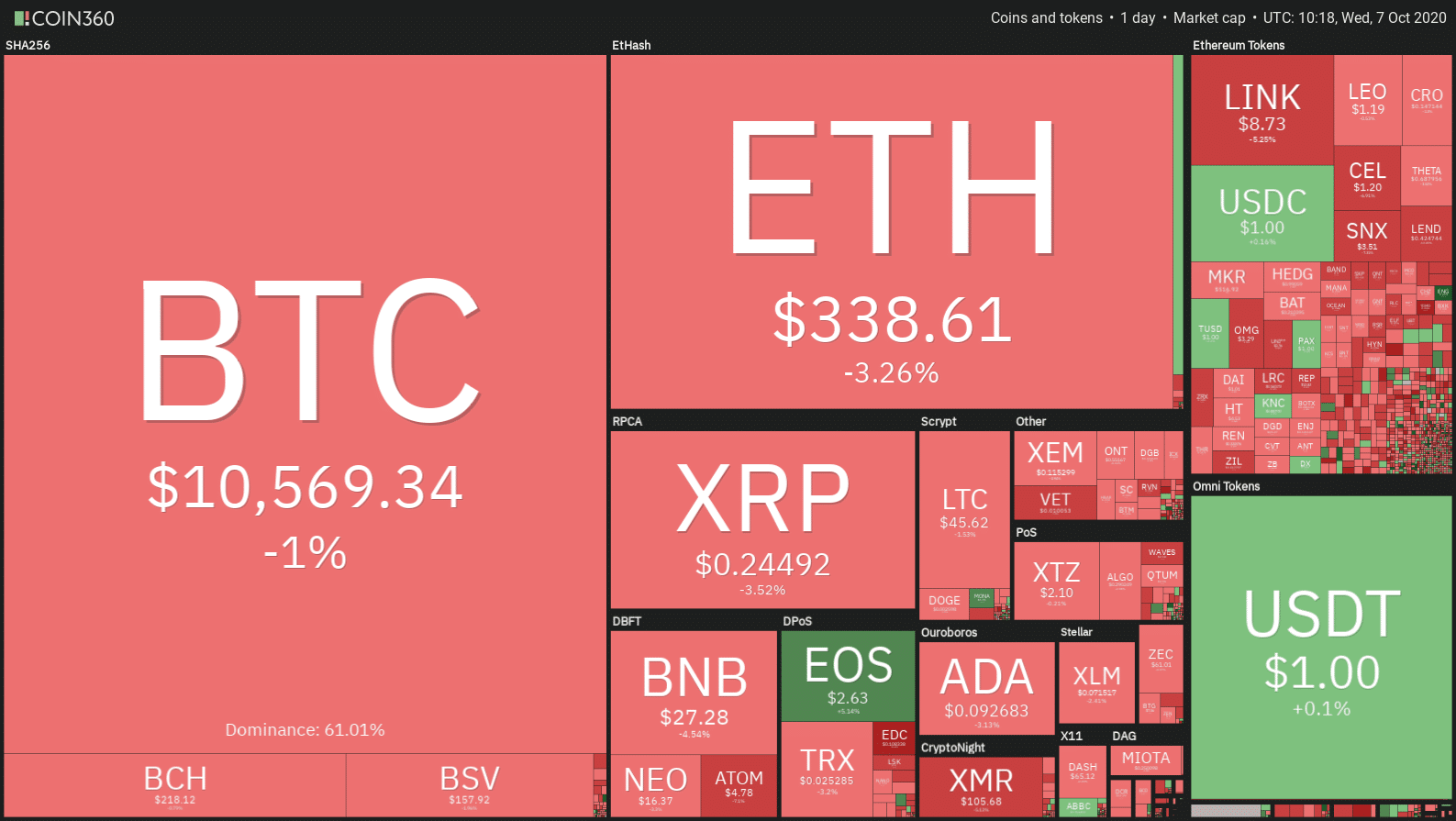

Today there is another day of uncertainty, in which the price of EOS stands out. Scrolling through the ranking of the top 100 we see only 4 positive signs, but there are no worrying collapses.

The week is not able to give a clear sign of a turning point. In fact it remains caged in the uncertainty that forces the traders to wait for a directional movement.

This can be seen from the volumes which, although increased in the last 24 hours (+20%), remain below 110 billion dollars, much lower than the last quarter and September averages of 150 billion dollars.

The price of EOS rising; it is the best of the day

Scrolling through the ranking from the top of the most capitalized, you can see the positive signal of EOS, which rises by 5%, one of the few green signs of today, along with PumaPay (PMA, 82nd position) which registers a +6%.

The other most well-known increase of the day comes from Ethereum Classic (ETC) which rises by 3.5%.

EOS has signed an agreement with Google, and this brings it to be in decidedly counter trend today. The partnership leads to a price increase of +5%, which at another time could have been a much more important increase. But the agreement is bound to affect in the coming weeks.

The worst are the bearish movements around 15%, as in the case of Elrond (EGD), followed by Aave (LEND) and Ocean Protocol (OCEAN). These are the deepest falls of the day.

The market cap goes down again to 335 billion dollars. As it happens in times of difficulty in the whole sector, the traders take refuge in BTC, for this the dominance reaches 59%, levels that indicate a recovery of market share.

The loss of value on the part of Ethereum leads to a drop in TVL that brings it just over $10 billion total, last abandoned on September 23rd. DeFi goes back 15 days.

Some Ethereum goes out and this affects the TVL while tokenized Bitcoins remain above 140,000 BTC, and this is an interesting signal.

Bitcoin price (BTC)

With the decline of the last few hours, Bitcoin’s quotations go to test the short term support of $10,500. The congestion that has been going on for 15 days forces prices between $10,400 and $10,900. It is a range that affects volatility, which has plummeted to absolute historical lows.

The analysis remains unchanged compared to the last days.

Price Ethereum (ETH)

Yesterday Ethereum, taking the minimum and maximum of the day and despite the turbulence in the afternoon, moved by 17 dollars, a derisory movement. Ethereum prices are now fluctuating below the threshold that in recent days has been at an equilibrium threshold of $345-355, to be precise at $340.

These are movements that in a long term perspective lead to a contact with the bullish trendline that combines the rising lows of mid March. The test that will probably take place within the next few days will be due to the elapse of time and not to a real downward movement.

For Ethereum the indications of the past days remain unchanged. The levels to follow are 315 dollars downwards and 365 dollars upwards in the short term. The crucial level remains at $390, tested in September.