After retracing and touching the $17,500 mark between Friday and Saturday, Bitcoin has been rising again and in the last few hours is back to $19,500, close to the record reached on December 1st, just a step away from $20,000, the all-time record.

Bitcoin, rising suspiciously

All eyes are on Bitcoin because of this recovery, which on the one hand is suspicious, but on the other is bringing sentiment back to the highest levels in days.

The fear and greed index has been hovering above 90 points for more than a month, since the beginning of November, except in rare instances when it has dropped just below this threshold and then immediately recovered. This is the first time that such long-lasting fluctuations have been recorded, and this is one of the reasons for the current rise.

The majority of tokens are now following this upward trend. In fact, just over 60% of crypto assets are in positive territory today. Bitcoin Cash (BCH) is up 2.6% and Binance Coin (BNB) is up 3.6%.

Among the top 100, Aave and Algorand (ALGO) are the best performers, both rising 7% from yesterday’s levels.

Volumes are suspicious, although not at the record levels of the beginning of the month, with average daily trading levels at $145 billion.

This is suspicious because Bitcoin rising is resulting in trading volumes reaching $2.3 billion, which is below the average since the start of the month. This is the second day out of three in a row that BTC trades are below $2.5 billion. This is an indication not seen since the early days of December, after the explosion seen with the records at the beginning of the month. Ethereum too, despite a decidedly buoyant Sunday for volumes, fell below $1 billion traded yesterday.

The market cap is back above $560 billion, down from the $590 recorded on December 1st, but despite the difficulties it is stabilizing at the highs of the last 2 years.

Bitcoin remains above a 63% market share, with Ethereum stable at 11.8%, while Ripple fell to 4%, its lowest level since the last week of November after a strong late November-early December rally that brought its market share back above 5%.

Ripple is still under attack from profit-taking after a strong rally on November 24th that saw prices multiply 2.5 times in less than a week. After touching 80 cents, Ripple began its descent, with the price struggling in the 50 cents area. At the moment, Ripple is below the psychological level of $0.5, at 48 cents.

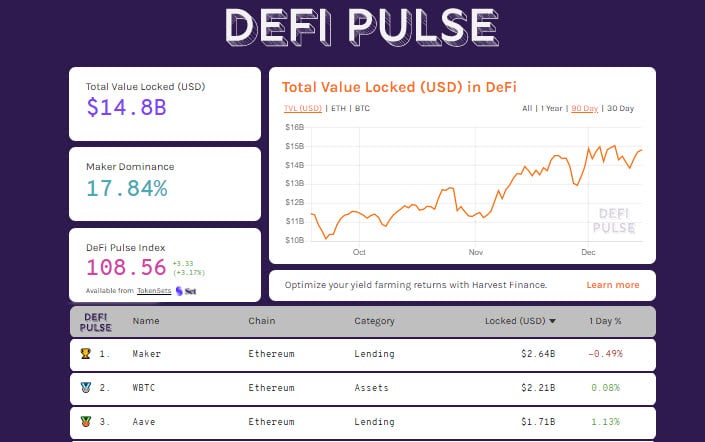

DeFi TVL rising

DeFi is once again close to the 15 billion dollar mark set exactly a week ago. This is due to a slight increase in the price of Ethereum, but also to the number of ETH that continue to grow, albeit at a slower pace than in October and November. The number of ETH traded on DeFi has risen again to over 7 million, a level not seen since the last week of November.

The market leader is Maker with 2.6 billion, followed by WBTC and then Aave which climbs to 3rd position over Compound, 5th is Uniswap.

Bitcoin (BTC)

Bitcoin is reacting after hitting lows between Friday and Saturday, touching $17,500, returning to a step away from the historic highs of December 1st.

The signal in the short term is strong, but in the medium term and based on the current quarterly cycle that began in late September and early October, it is a delicate phase that will give clearer indications in the coming days if the price manages to easily exceed $20,000, setting a new record for the Christmas holidays.

This is something that has been lacking in the cryptocurrency sector, which has always seen the second half of December as a difficult month.

On the upside, the break of the 20,000 dollar mark is important, which must be supported by larger volumes than those of the last few days. On the downside, the lows of last week in the $17,500 area should be monitored, an area where hedging by options strategies is increasing.

Ethereum (ETH)

Ethereum is back close to $600, a psychological rather than technical threshold. The one to monitor is $615-620. Before this level, every swing is in an upward context even if after the highs reached on December 1st, there are slightly lower lows. This is a signal that in the short indicates uncertainty while in the medium does not undermine the trend that remains decidedly set to the upside.

The threshold of the dynamic support that remains after the static support of 480 dollars is 420 dollars, the trendline that has accompanied the upward movement since the March lows and that unites the rising lows of these eight months.