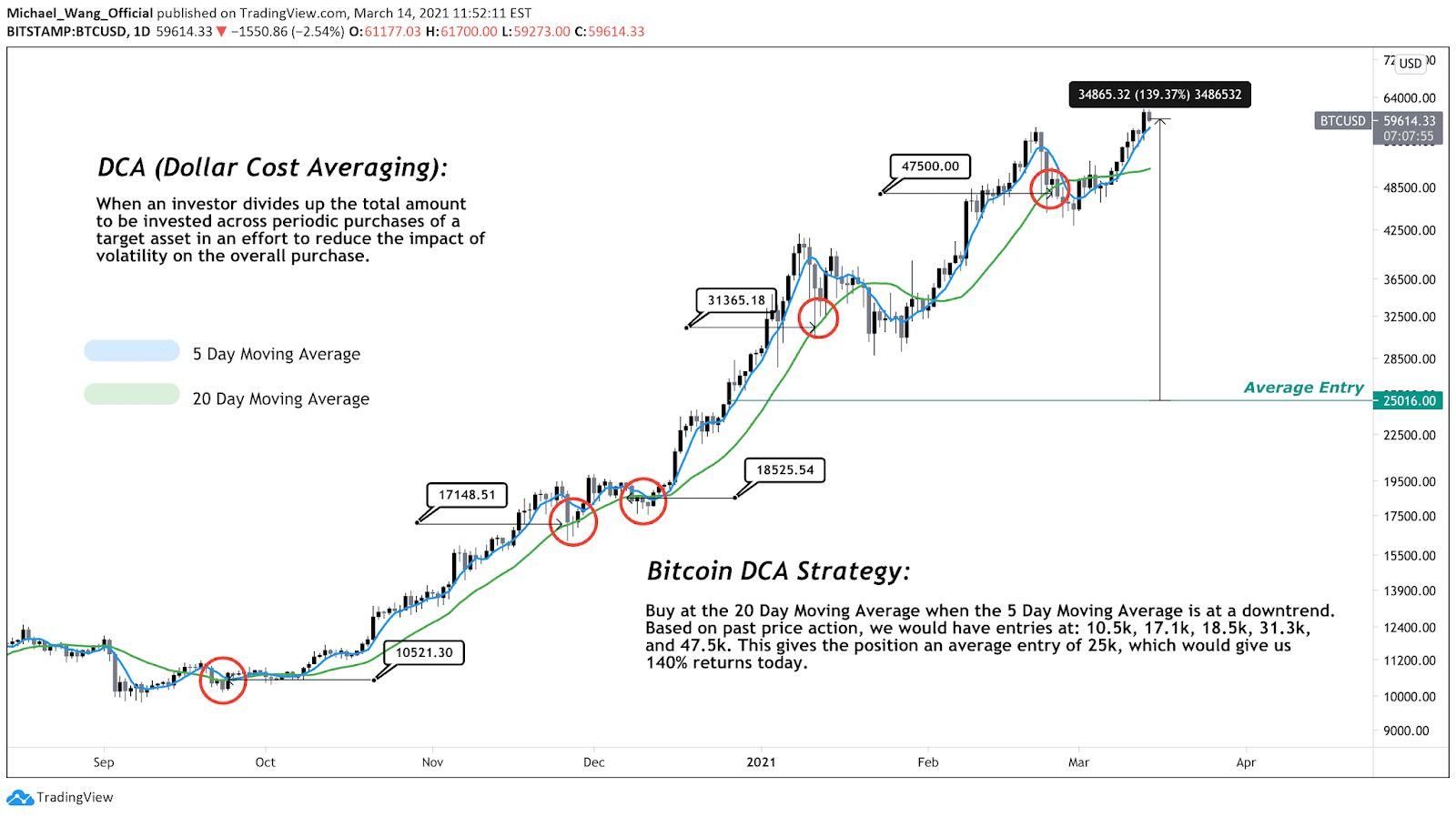

According to an analyst who published his opinion on the famous TradingView platform, the DCA strategy could be easily applied to Bitcoin and can be useful especially for those who are not experienced traders.

Clearly, it is not easy to know when to buy low and then sell high, which is why an operation like DCA could be useful to invest constantly and not all at once.

How does the DCA strategy work on Bitcoin

Basically, this strategy works like a capital accumulation plan: once you have identified the amount of money you want to invest, you divide it into equal parts and invest it on a regular basis.

A similar strategy can be done using a normal crypto exchange.

The trader explains:

“DCA”, or Dollar Cost Averaging, is when investors divide up the total amount of capital they’re willing to invest in, and simply invest a portion of it regularly, regardless of price action and volatility”.

All cryptos are correlated

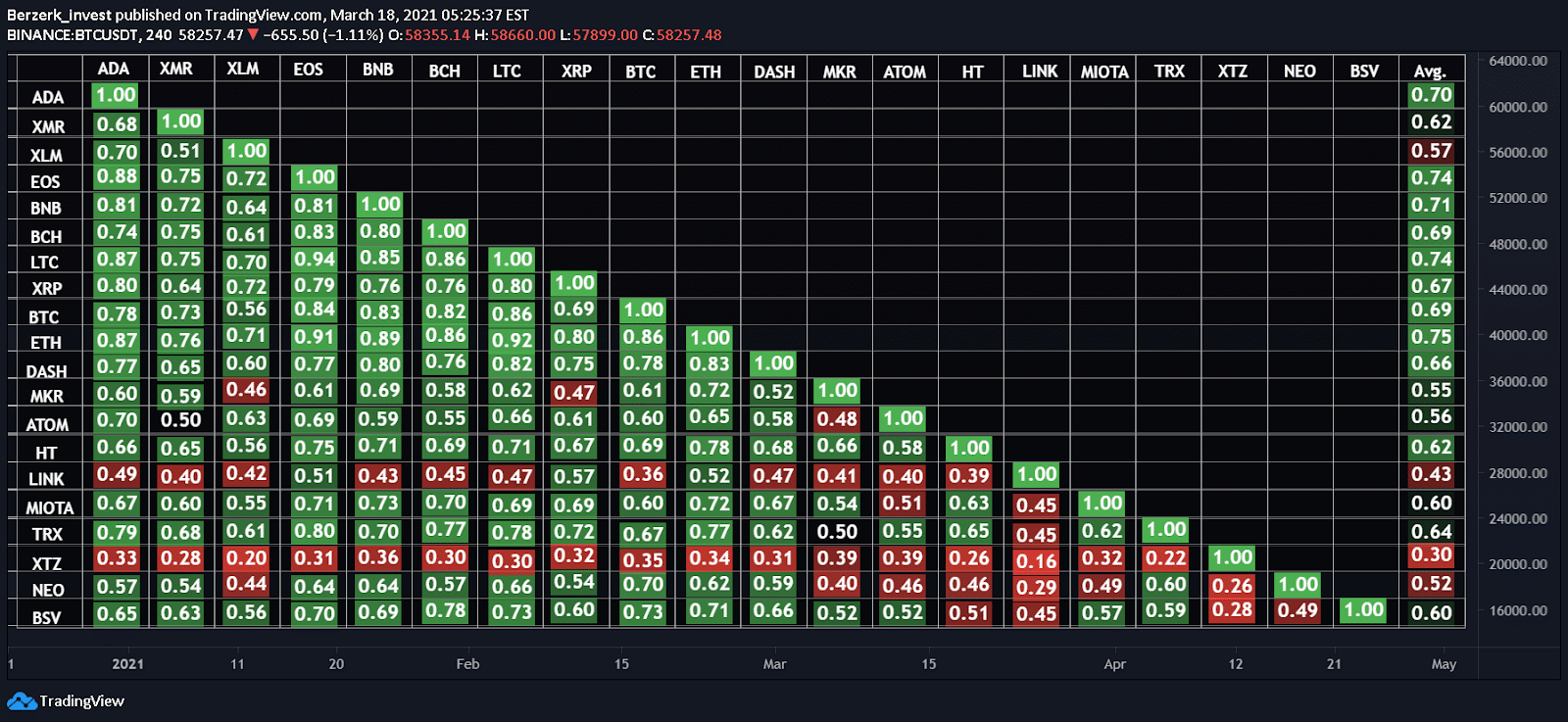

Another trader on the same platform explains how different cryptocurrencies are often correlated in terms of price. This is interesting for those who are just getting into crypto trading.

Indeed, the analyst explains that Bitcoin and altcoins move in a similar way every time, as one goes down, the others go down and vice versa.

The trader analyses:

“Correlations are highest between altcoins and Bitcoin itself (~ average correlation of 0.69), indicating that most of the altcoins move in similar directions as Bitcoin, underscoring Bitcoin’s status as a bellwether for crypto asset markets. While, generally speaking, altcoins are highly correlated with BTC, select crypto assets exhibit materially weaker correlations both with BTC and among one another, which suggests that additional idiosyncratic factors may affect the prices and returns of these assets”.