Reuters today published an article on VISA and Mastercard that will increase their fees in April, at least for the American market. This could be an excellent opportunity for bitcoin.

The so-called “Interchange fees”, i.e. those for processing transactions between credit cards, banks and customers, will be increased.

The problem will hit the merchant banks: they manage the accounts of the big e-commerce giants, carry out millions of credit card transactions per month, and manage the contacts of the big commercial distribution chains.

Technically traders are not affected, but it is clear that in some way the increase in service will be somehow passed on to traders and consumers.

The increase in the cost of credit card use would make electronic payment with virtual currencies more convenient.

Currently, the average fee for a BTC transaction is 0.42 US$, while the average fee for a LTC payment is just over 3 cents, both very low values considering the possible size of the transactions that can be made.

To date, there are 48 thousand points of sale in the USA that accept bitcoins as payment through Coinbase, while Square is preparing to launch support for the Lightning Network.

The latter, very promising both from the point of view of costs and efficiency, is still embryonic, but already exceeds 2.8 million dollars in capacity and 3000 knots of active channels.

There are therefore all the technical prerequisites for the adoption of virtual currencies as payment instruments in the real world.

The problem lays in the mass adoption by both consumers and traders.

The rising costs of Visa and Mastercard in the US can be an important factor in pushing towards this direction.

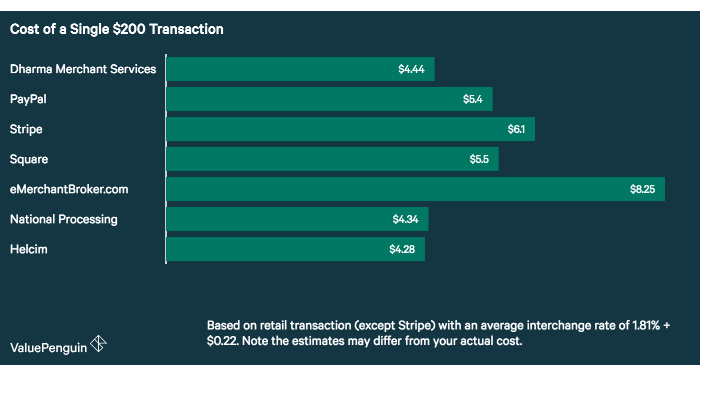

As Valuepenguin indicates, one can already pay up to $8 for a credit card transaction, and these costs are increasingly being added to customers.

Faced with the few cents paid for a transaction with LN, BTC and LTC these figures appear huge and will be a strong push for retailers to accept crypto.

Faced with the few cents paid for a transaction with LN, BTC and LTC these figures appear huge and will be a strong push for retailers to accept crypto.