A day with new records for Bitcoin that for the first time in about three years returns above $16,000.

It was January 8th, 2018 when, at the beginning of the most tormented bearish phase of recent years, the prices of Bitcoin rose to $16,300.

This is a solo bullish uptrend, considering that the rest of the altcoins are unable to follow at the same pace.

Scrolling the list from the top, in fact, among the 25 most capitalized Bitcoin is the one to record the best climb, pushing more than 2.5% from yesterday’s levels.

Only Crypto.com Coin (CRO) is able to replicate this performance, highlighting a day where the red sign prevails.

In fact, more than 75% of the top 100 in the rankings today move below par. The best rise of the day is that of Blockstack (STX), a token linked to a decentralized Internet project, up by more than 25% which, added to the rises of the last few days, causes the figure of the last seven days to fly over 70%.

The list of the best ones includes Icon (ICX), Decred (DCR) and OMG Network (OMG), all above 9% from yesterday’s levels. Despite the removal from the Shapeshift exchange, the Dash (DASH) and Zcash (ZEC) privacy coins are also doing well, up 4%, with the latter six days from its first halving.

The total market capitalization continues to rise, now to over $455 billion, the highest level since May 6th, 2018.

With an increase of more than 10% in the last 24 hours, total volumes rise above $140 billion. The rise in the last few hours brings Bitcoin’s market share back up to 65%, to the detriment of Ethereum, which has returned below 12.5% despite reaching $470, and Ripple (XRP), which remains buried at 2.5%.

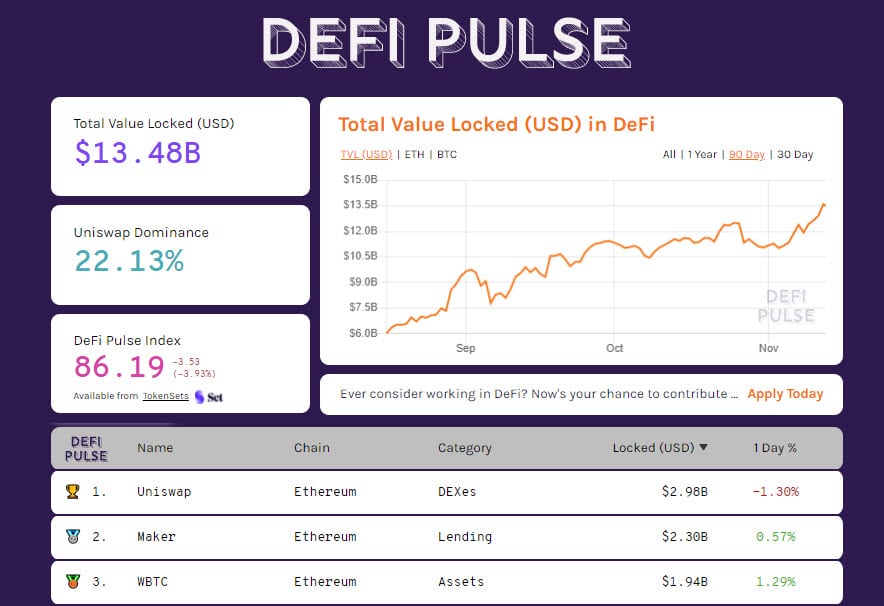

A jump for the total value locked (TVL) on decentralized finance protocols, updating the new record at $13.5 billion. An increase due to the rise in locked collateral on Maker, which for the first time breaks the $2.3 billion threshold.

Investors return to tokenize bitcoin, reaching 174 thousand BTC, an absolute new record.

Record prices for Bitcoin (BTC)

For the second day in a row, the prices of Bitcoin update the records of the last 34 months with prices above $16,150, helping to fuel the mood of investors back to the highest levels of the last year.

The exhilaration is partly dampened by spot volumes which, unlike last week, are not soaring. In contrast, open interest in derivatives rose to $5.9 billion for the futures and $3.5 billion for options, the highest peaks ever. These are the reasons why options traders are opening up positions to protect from possible turnarounds.

In the last 24 hours, the strength of Call options has leapt beyond that of Put options. A signal to follow carefully in the coming days.

Ethereum (ETH) prices

In the last 24 hours, the purchases have attempted to push the quotations above $470, confirming the hypotheses developed in recent days, but without achieving the hoped-for success of regaining the annual highs reached at the beginning of September.

The increase is not supported by the purchasing volumes, and this is the condition that will have to be achieved in order to aspire to a new record. Otherwise, there would be room for a reversal that, at the moment, would not find important obstacles down to $375. A distance of 100 dollars from the current levels.

This is the area of manoeuvre that the prices of Ethereum can grant without affecting the bullish trend that has been growing for over seven months.