The week begins with altcoins doing very well. First and foremost, it’s the prices of Ethereum and Ripple, which achieve a double-digit increase in just a few hours.

The movement started during the weekend and saw the euphoria of the rise enjoyed by Bitcoin last week, shifting to the altcoins.

The prices of Ethereum and Ripple drive the altcoins

In the last few hours, Ethereum has been back above $600, a level that has not been recorded since May 26th, 2018. Ripple also returns to the levels of November 2018 and regains the $0.55. These rises drive the entire altcoin sector.

It’s a moment of glory for the whole sector that returns above $550 billion of capitalization, the highest level since January 2018.

Unlike what was happening last week, this additional total market cap gain in the last 48 hours also benefits from the rise in altcoin capitalization.

Excluding Bitcoin’s capitalization, at $343 billion, altcoins alone capitalize over $207 billion, the highest level not seen since the end of May 2018.

The strong bullish movement of the last few hours has also led to a rise in the dominance of Ethereum, which is now more than 12.2%, a market share that ETH has not recorded since the beginning of September.

Ripple, on the other hand, returned to over 4.5%, the highest level since December 2019.

Today, ETH and XRP are the best among the big names, with Stellar (XLM) earning as much as ETH, +12%, whereas Ripple achieved 20% over the last 24 hours. XRP doubles its share from last Monday’s levels.

Overall, only Horizen (ZEN) does better, earning 44% on a daily basis, this is an ecosystem of an alternative blockchain that scales down the sidechain protocol to make it decentralized and customizable.

The euphoria of altcoins does not influence DeFi

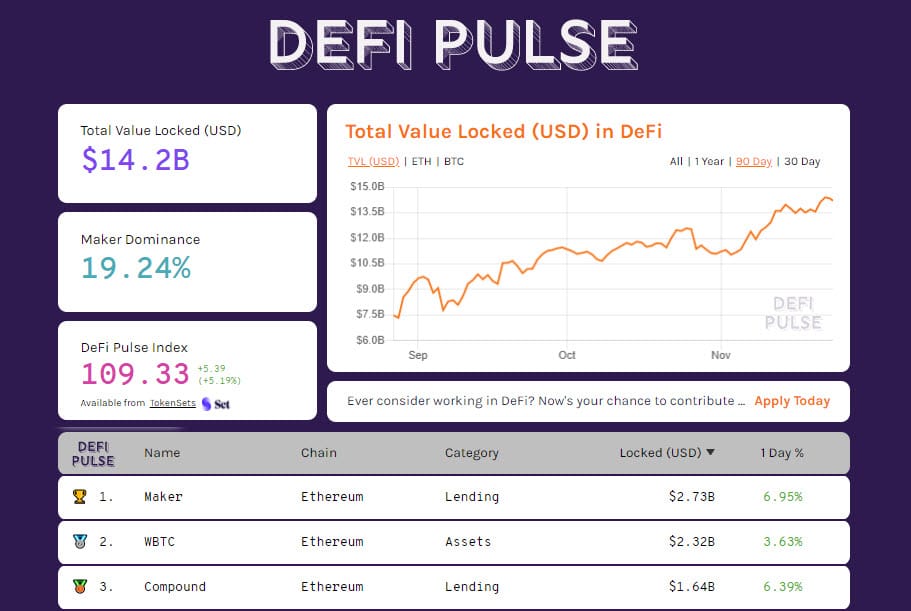

This movement featuring a strong strengthening of Ethereum, the most used token as collateral in DeFi, does not show a particular recovery by DeFi with the TVL which remains over $14 billion but without any particular upward trend.

This is due to the situation of Uniswap which sees users continue to remove ETH from collateral positions. The number of ETH in the various protocols is falling, below 7 million units, the lowest level since early September.

The number of bitcoin locked in the DeFi sector remains stable, at just over 170,000.

Bitcoin (BTC)

Bitcoin made it through the weekend staying close to the record levels of the last 3 years, recorded at the end between Friday and Saturday, with the price of Bitcoin that for the first time since December 2017 reached almost $18,950. For Bitcoin, it is the highest level since mid-December 2017.

It is a trend at the moment supported more by the technical aspect rather than by the volumes: in fact, during the weekend volumes decreased and remained above 3 billion dollars, below the record set last week at $6.5 billion on one of the most traded days of the year.

It’s a delicate week for BTC, which will have to find confirmation of the $17,500, a real level of support in the medium term.

Ethereum (ETH)

The strong bullish movement makes Ethereum gain about 30% from Friday’s levels. It is an impulsive movement that makes quotations fly to the highest levels of the last two years, abandoned at the end of May 2018.

ETH remains healthy despite the period of uncertainty that lasted throughout October. November is proving to be a month worthy of recovery with this strong jump upwards.

The continuation of the week is now important for Ethereum. In contrast to BTC, ETH has created a more solid structure and this is confirmed by the trend of these hours that see Ethereum leap above $600 for the first time since May 2018.