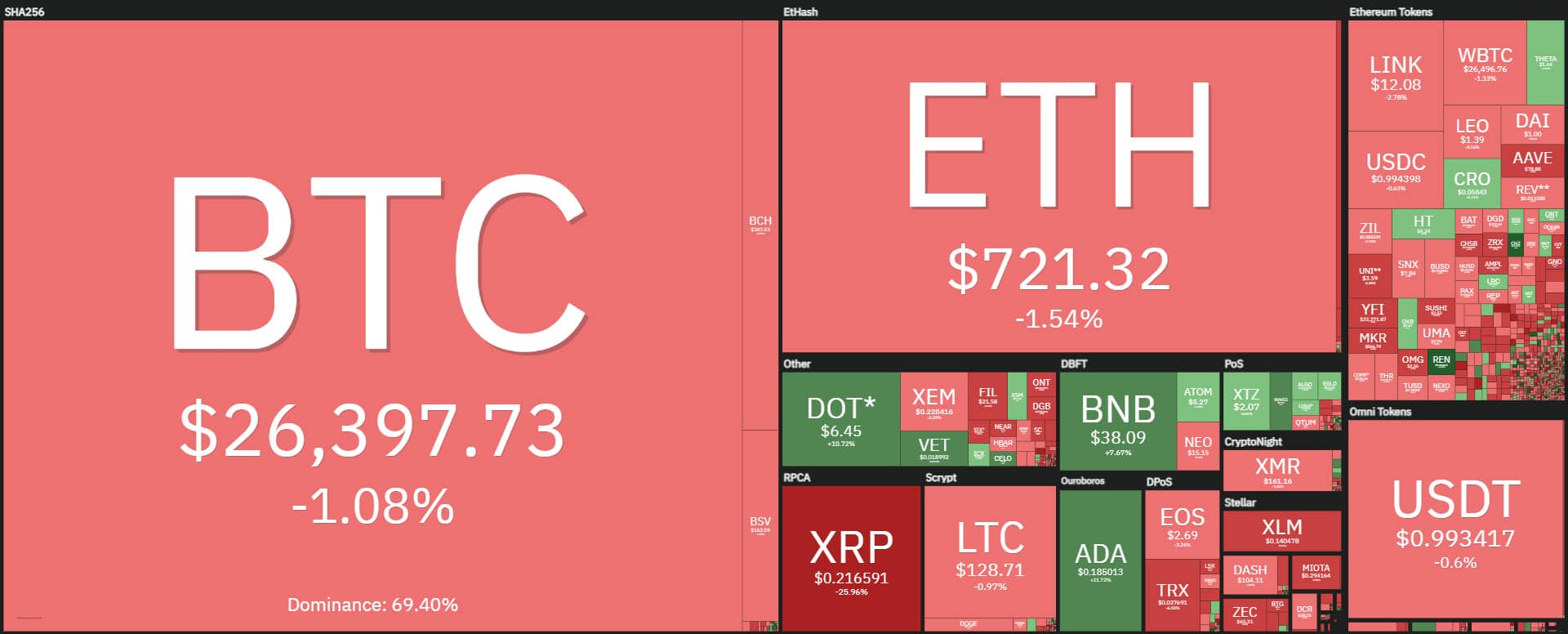

This day sees a market that after the glories of the last few days partly pulls the brakes, with XRP crashing. But it is also distinguished by two opposing forces among the top 20 capitalized. On the one hand, there are full-bodied double-digit rises as in the case of Cardano (ADA), Polkadot (DOT) and Binance Coin (BNB), in 7th, 8th and 9th position, with Polkadot rising by 15%.

In the middle are Bitcoin and Ethereum with controlled declines. Both have the negative sign but it is a contained descent.

XRP crashing decisively

On the other hand, the strong decline of XRP emerges after the latest news that sees Coinbase being added to the list of exchanges that will limit and then stop the trading of Ripple’s cryptocurrency. Coinbase joins OkCoin and Bitstamp, other US-based exchanges that have decided they don’t want to be caught in a legal dispute that could arise given the legal actions the SEC is set to take against Ripple.

This is causing the crashing of XRP, which today drops a further -20%. Ripple’s performance since the beginning of the month sees a 67% loss in value. Considering the record high of November 24th, the loss is 70%, with prices falling just short of 21 cents, the lowest level not seen since last July and undoing all the rally that Ripple had recorded in the second part of November.

Looking at the sector, today unlike yesterday there are just over 70% crypto assets in negative territory. As mentioned though, these are largely controlled declines.

Among today’s top risers, Chillz (CHZ) rises to the podium with +20% followed by Ren, +17% and then ADA,+13%. On the opposite side Ripple is performing the worst followed at a distance by Verge (XVG), the other only one among the top 100 with a double-digit decline, -10%.

Despite the slowdown of the last few hours, the market cap remains below $720 billion, last Sunday’s record, but above $710 billion.

Bitcoin retreats below 70% of dominance, but remains at the highest levels of the last two years. In fact, the 70% mark, surpassed on Sunday, had been passed in September 2019, and had not been recorded since March 2017. It was an inverse phase to the current one, where there was a descent of prices and dominance, whereas in this case there is a bullish phase. Despite the excellent rises in the last 48 hours, Ethereum remains just above the 11% threshold while Ripple sinks to 1.8%, the lowest level it has not recorded since March 2017.

Volumes in the day yesterday were definitely tonic, in a context that has instead seen a 30% decrease in the last 24 hours with $300 billion of volumes.

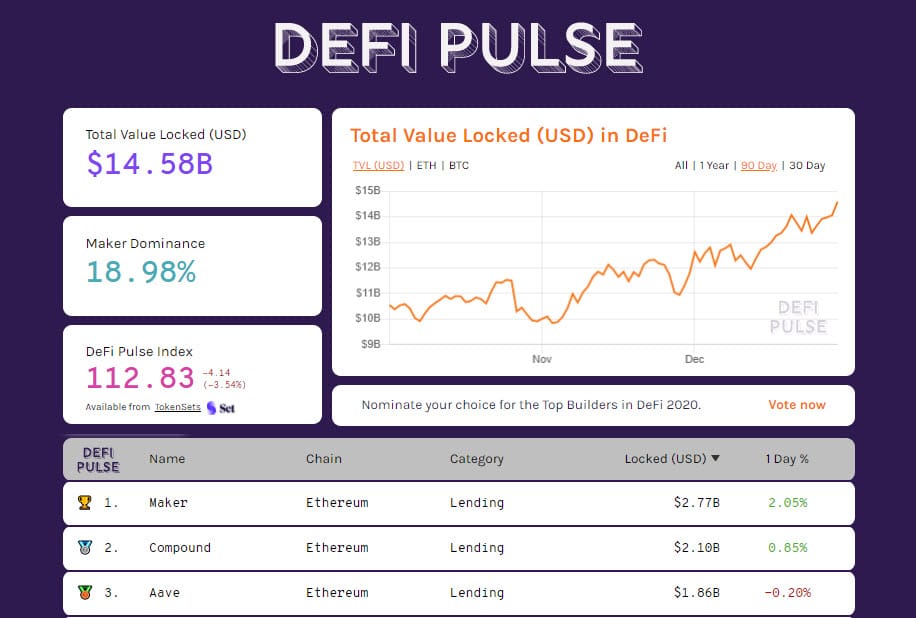

DeFi, new record for TVL.

DeFi sees absolute records rising for the first time above $14.5 billion, an absolute historical peak since DeFi Pulse removed WBTC from the general basket which is now categorized in a basket related only to tokenized BTC.

Therefore today’s TVL sees Maker confirming its leadership with over $2.8 billion, followed by Compound, $2.1 billion and in third position is still Aave, $1.8 billion.

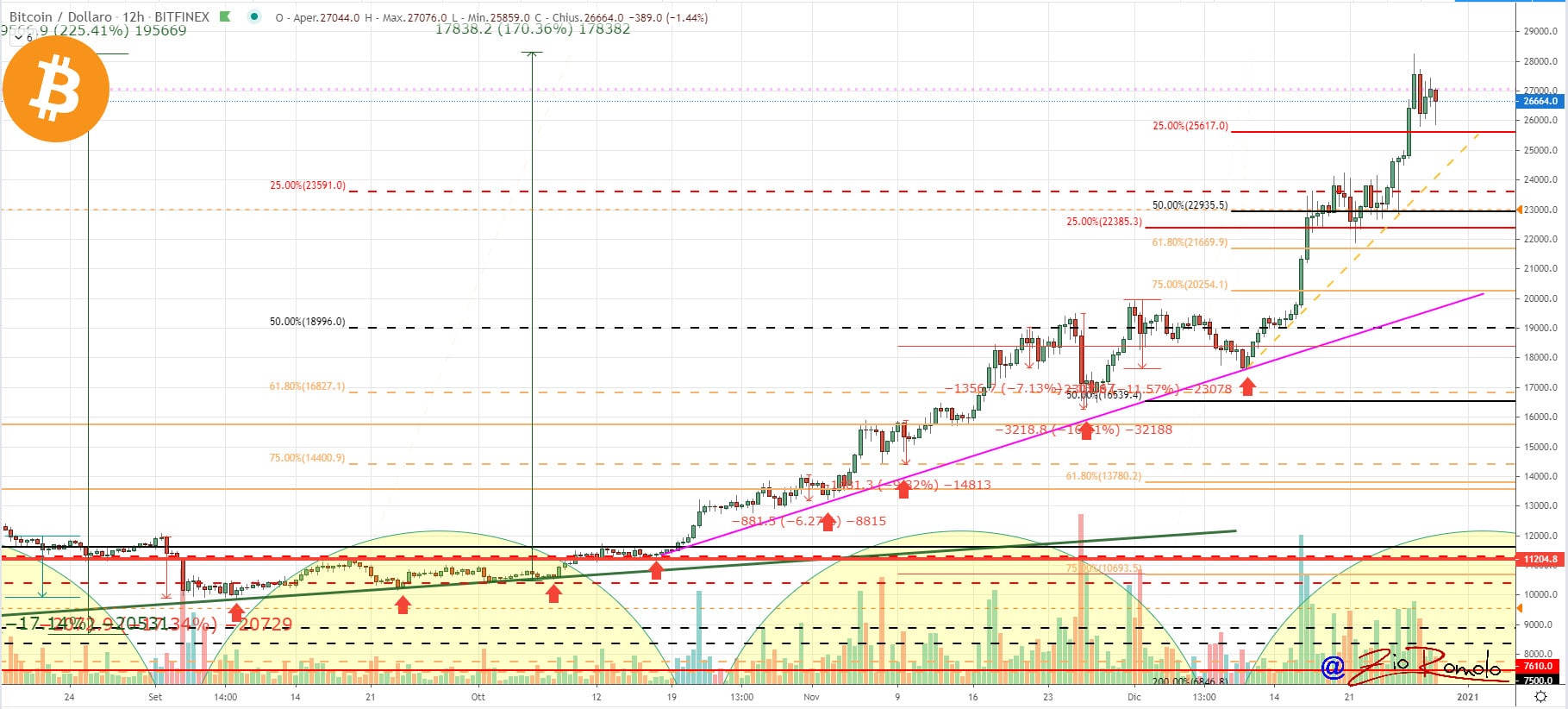

Bitcoin (BTC)

After the glories of the weekend that saw the absolute historical records at $28,370, Bitcoin is seeing profit-taking prevail, which however are not affecting the short-term bullish trend that saw a descent with prices just below the threshold of $26,000, then recovered.

It is a static phase for Bitcoin, which is not a concern for the trend in a decidedly bullish context. The first levels of concern that would begin to give bearish signals in the short term are below the threshold of $24,000, whereas in the medium-term context the support remains at $20,000, which coincides with the previous resistance that acted as a stopper to any rise and that has yielded with the breakthrough of mid-December and generated the recent rally.

Ethereum (ETH)

The spike recorded yesterday with prices touching $750, the highest level that ETH has not recorded since May 2018, sees ETH maintaining a well-set uptrend. The movement of the last few hours removes the dangers of a test of the support of $550, lows of Christmas Eve when prices tested this threshold and then saw the purchases begin that led to the mini-rally of recent days that saw prices fly by more than 35%.

At the moment, profit-taking is not particularly affecting Ethereum. An eventual break of $750 will have to be supported by volumes that are currently growing.