After yesterday’s sharp declines, weakness continues to prevail with Bitcoin still at a loss, while many of the altcoins are attempting to bounce back.

All the big names are trading below par except for Ripple (XRP), which is up more than 8% and is back above 50 cents for the first time since February 23rd. Ravencoin (RVN) and Terra (LUNA) both rose more than 25%. In third place, Icon (ICX) took the last step on the podium, climbing 15% to near $2.

Yesterday saw an overall drop in volume but not for Bitcoin which traded over $16 billion on the major exchanges for the first time yesterday. This is the highest counter value in over four weeks.

Despite the weakness of the last 48 hours, the total market cap remains above $1.7 trillion with Bitcoin once again giving up some of the ground gained in recent days, falling back below 61% dominance. Ethereum managed to stem some of the decline by climbing back above 12% market share.

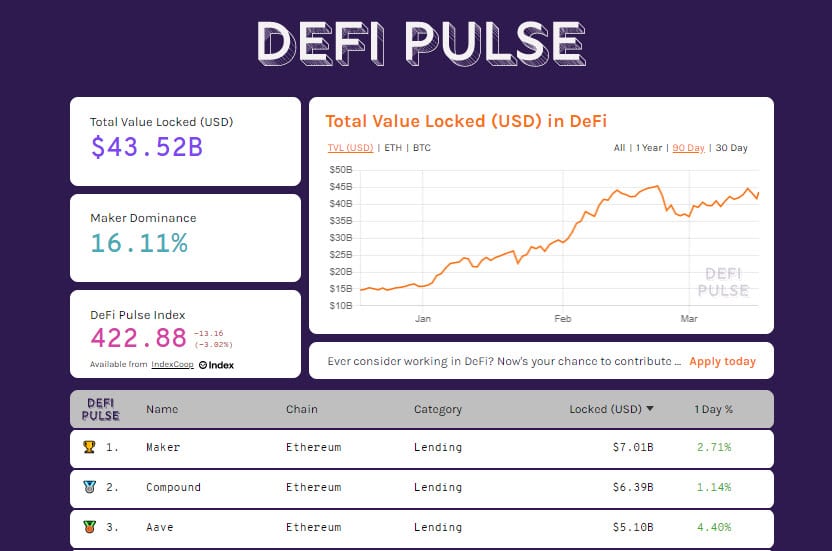

DeFi recovered to $43.5 billion. This is due to the return of users who choose to lock tokens on decentralized finance projects. For the first time since November, the number of locked ETH exceeds 9 million units. Bitcoin is also rising, with more than 34,000 tokenized BTC.

Bitcoin (BTC), a 15% loss from records

The drop of the last few hours sees the price of Bitcoin return close to $53,000, marking a loss of about 15% from the absolute record of last Sunday, but without affecting the upward trend that began from the lows of late January.

Despite the volatility that has returned in recent days, there are no worrying signs. In fact, only a break below 50,000 dollars would give the first bearish signal in the medium term.

Ethereum (ETH)

Ethereum, on the other hand, has been able to better counter the bearish push, stopping its descent at about 10% from the top of Saturday, March 13th. Ethereum’s long-term trend is also upward. Unlike Bitcoin, Ethereum’s bullish structure is better set in the long term, although the recent rise has failed to make new highs.

For the price of Ethereum, the first sign of weakness would only come with a drop below 1,600 dollars.