Today marks a record low for the market cap of stablecoins.

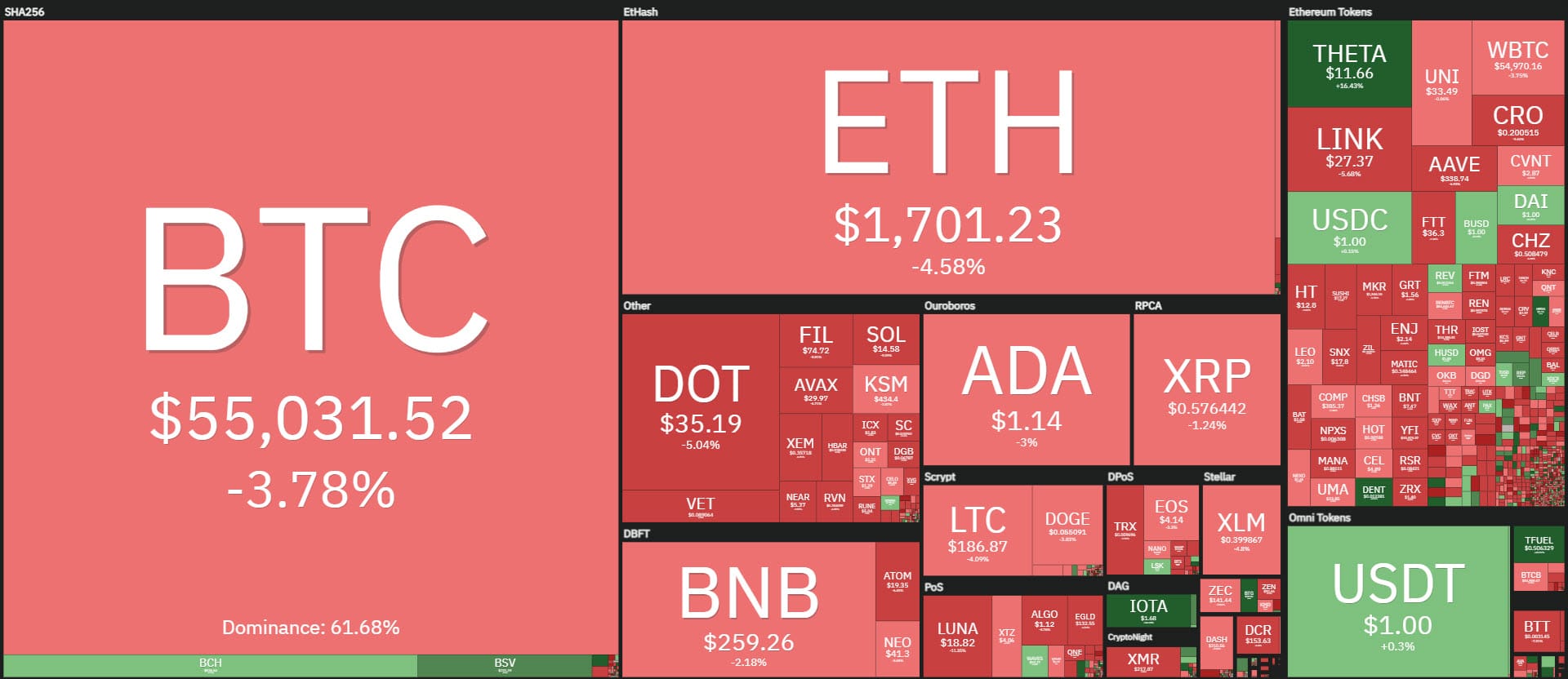

Crypto market in decline

After yesterday’s decent start, a deep bearish reversal in the second half of the day ended the day with a drop of almost 6%, the worst day since the beginning of the month.

The repercussions were felt throughout the day, with over 85% of the top 100 cryptocurrencies below par. Among the big names, the only rises of the day are spearheaded by Theta, which climbs more than 11% to nearly $12, the highest level ever since its launch in spring 2019.

Ripple (XRP) also did well, gaining more than 2% in 24 hours but failing to climb above 60 cents, the highest level since February, where it decelerated during yesterday’s run.

Stablecoins, the market cap close to $58 billion

For the first time ever, USDC‘s market capitalization has risen above $10 billion, accounting for more than 17% of the entire market share. For USDC, this is a 15-fold growth in the last 12 months. At the end of March 2020, USDC had a capitalization of just over $680 million.

Even though Tether continues to lose ground as a result of the growth of USDC and other smaller stablecoins, it is now close to breaking $40 billion in capitalisation. For Tether, this is a doubling of the market cap since the beginning of the year and about 9 times since March 2020. Today, Tether occupies 68% of the entire market, trading more than 90% daily of all stablecoin turnover.

Total stablecoin capitalization is one step away from $58 billion, which is a record for the market driven by the growth of Tether and USDC.

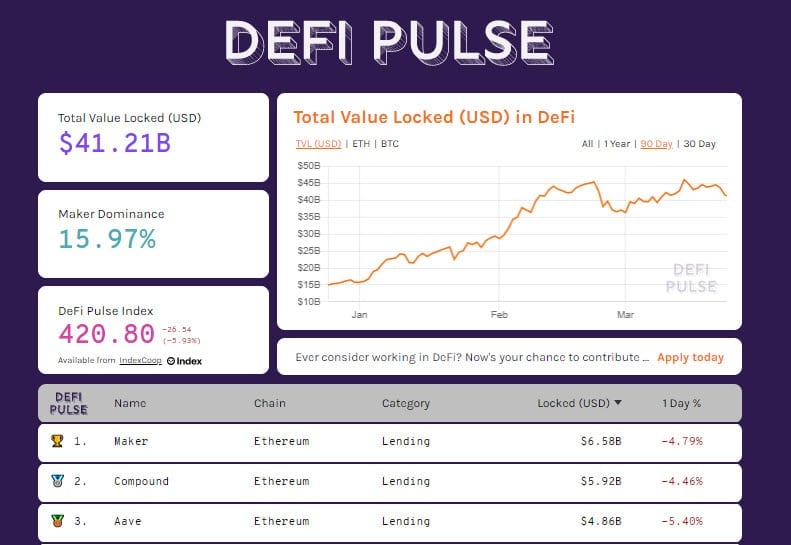

DeFi in decline

Total value locked in DeFi falls to $41.2 billion, a result of the weakness of the last few hours. In fact, the number of Ethereum continues to remain at its highest in 5 months, above 9.3 million ETH. Tokenized bitcoin are back down to 31,000 BTC, the lowest levels since March 12th.

Bitcoin (BTC)

In these hours the price of bitcoin falls below $53,000, testing the dynamic trendline that links the rising lows of late January.

A break of today’s low of $52,810 would reverse the short term trend and trigger the first alarms for a return to the $46,000 area in the coming days.

The declines in the last 24 hours are accompanied by an increase in volumes in the last 24 hours, returning above $10 billion, the highest level in the last 6 days.

Ethereum (ETH)

After more than two weeks, prices broke out of the sideways channel, breaking the lower neckline and testing $1,650, a level that coincides with the relative highs of late February and early March. Despite the decline with a loss of 5.7% yesterday, the medium and long term trend of Ethereum is still set to the upside.

It will be important to understand in the next 48 hours whether the bearish strength is the beginning of a weak short to medium-term movement or is caused by profit-taking.

Over the past week, Ethereum has traded less than $5 billion on the major exchanges, showing low interest from intraday traders.