Yesterday, during Labor Day, which saw financial activities stop for the whole day, price and volumes of bitcoin returned in the spotlight.

It would seem random but it is actually curious what happened in the last hours. Yesterday afternoon, in fact, when the US S&P 500 futures market closed trading activities, the price of bitcoin scored one of the most intense rises of the last month with a movement that, in a matter of hours, from 6 PM to 8 PM, recorded a rise of about $900, going from $9,500 to $10,500.

This highlights how bitcoin is establishing itself as an alternative asset to the banking financial system also in terms of trading.

The volumes of bitcoin have also returned to rise, recording one of the days with the highest trade in the last two months. In the last 24 hours, the volumes see a very high concentration on bitcoin, which, on a daily basis, is now handling about 4 billion dollars, three times the levels of Ethereum.

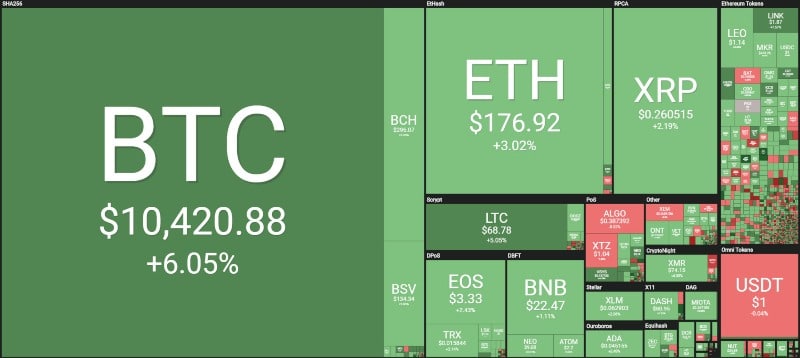

This propels the price of bitcoin upwards by 5% and back to almost 10,500 dollars, placing altcoins in difficulty once again. Despite following the bullish trend, only a few altcoins are able to replicate the BTC movement.

Monero climbed by 5%, winning the 10th position in the standings against Stellar (XLM). The same rise is achieved by Ethereum Classic (ETC).

Chainlink (LINK) also climbed the top 20, after the drop of last week, attempting to conquer the 2 dollars with a rise of 6%.

The best of the top 100 of the day is V Systems (VSYS) who, with a double-digit rise, climbs 12% and continues to ascend positions in the standings reaching the 30th position.

In contrast, ByteCoin (BCN) scores a 10% double-digit decline. Enjin Coin (ENJ) and Ren (REN) also changed pace, showing a downturn of 5%.

The dominance of bitcoin rises to 70%

The rise in the price of bitcoin once again brings back the market cap over 264 billion dollars, recovering several billion compared to yesterday. Bitcoin for the first time in two and a half years breaks through the 70% dominance threshold. It hasn’t happened since March 2017, to the detriment of Ethereum and Ripple that update the year’s lows, reviewing market shares that hadn’t been recorded since 2017. Ethereum is below 7.3%, while Ripple is below 4.2%.

Bitcoin (BTC) price

Bitcoin draws a descending triangle from a technical point of view. It is important not to push below $9,500 in the next few days, otherwise, there would be a risk of validating the technical figure in place with extensions that could go below $9,000.

For a clear countertrend signal for the bitcoin price, it is necessary to go beyond the threshold of 11,000-11,500 dollars, values left during the downturn started in the first part of August.

Ethereum (ETH)

The short term reversal signals of Ethereum are weak. After the low of 165 dollars reached in the last days of August, ETH tries to recover the 185 dollars threshold violated last week and which marked the uptrend in the annual perspective. For Ethereum it is necessary to recover the 185 dollars as soon as possible and to go beyond the psychological threshold of 200 dollars very soon.

Otherwise, the bearish structure remains valid, in line with the first negative bimonthly cycle since the beginning of the year.