A double-sided day for the cryptocurrency sector, well represented by the daily volatility of Bitcoin, which is on the rise.

After a series of bearish indications for the whole first part of Wednesday, suffering the uncertainty due to the news about the hacking of the Upbit exchange, in the afternoon the market’s course reversed, with a clear prevalence of positive signs for more than 70% of cryptocurrencies.

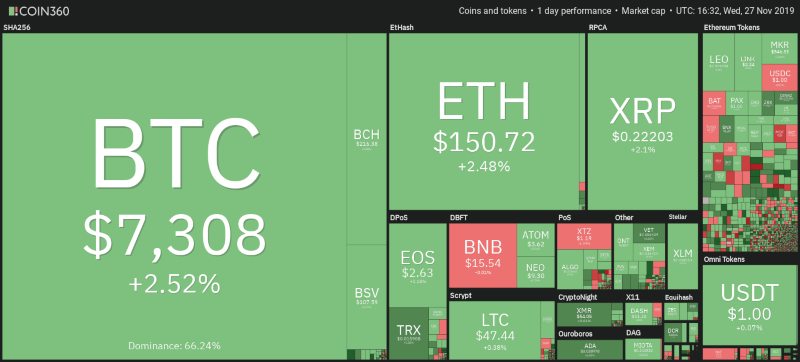

Focusing the attention on the first 30 cryptocurrencies, there are only 4 signs under parity: Leo (LEO), Chainlink (LINK), Tezos (XTZ) and Basic Attention Token (BAT). Tezos and BAT are among the worst of the day with descents of over 2%.

The day is characterised by a particular concern for the case of Upbit, although the trades that CoinMaketCap attributes to Ethereum are also worth noting. In fact, Upbit has suffered a hack attack on the exchange account resulting in a theft of 300,000 ETH, whereas Coinmarketcap shows a trading volume for Ethereum of about 8 billion dollars in the last 24 hours, which is exactly 50% of the marketcap of the crypto.

This is a very high value for ETH, which has a total capitalisation of 16 billion dollars. Looking at the exchange data, Binance, the world’s largest exchange, is only in 32nd position and this may indicate that the data of these hours may be distorted.

As a result, Ethereum is particularly susceptible to high speculation during these hours. By restricting Ethereum’s trades of the last 24 hours to the first 10 exchanges by importance, the volumes remain at the levels of the past days, as does the number of transactions outside the exchanges that have been carried out on the Ethereum blockchain.

The total volumes of the last 24 hours fall further and return below the threshold of 77 billion dollars. The market cap is back on the brink of $200 billion, levels abandoned last weekend. The dominance of the Bitcoin is stable at 66%, while Ethereum continues to give signs of slowing back to below 8.2%, and Ripple remains stable below 5%.

Bitcoin (BTC) volatility

A tense day for Bitcoin which has experienced wide fluctuations, with daily volatility that in the last 24 hours has gone over 7%, compared to an average of just under 3%. From 11 AM to 1 PM (CEST), Bitcoin saw prices oscillate by as much as $500. It is a signal not to be overlooked, which indicates nervousness.

Bitcoin tries again to go beyond the threshold of 7,300 dollars, a level that in the last 5 days is proving to be a difficult short-term resistance. Since November 22nd, several times prices have tried to return above this threshold, but there has been a strong reaction in contrast to sales that have rejected any bullish attempt. If this level were violated, the doors would be opened to review the short-term resistance of $7,500.

Ethereum (ETH)

Ethereum does not suffer particularly from the vicissitudes of the last few hours, although it remains close to the levels of the last six months touched between Sunday night and Monday. For ETH, this particular sign of keeping the lows despite the news from Asia is a positive signal that will have to be confirmed in the coming hours and days.

For ETH, it is necessary to recover as soon as possible the 155 dollars, level abandoned with the sinking of last Friday.

Ripple (XRP)

For Ripple the situation does not change, with ups and downs the fluctuations are around 22 cents of a dollar, where XRP tries to consolidate to restore confidence following the sinking that saw it reach the lows of the last two years in the night between Sunday and Monday.