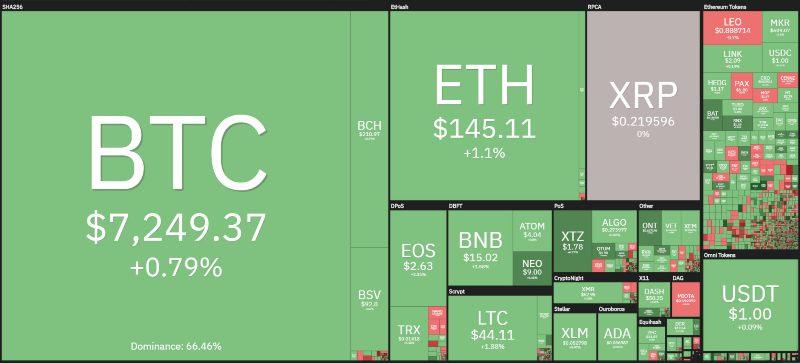

Despite the prevalence of green signs with more than 75% of cryptocurrencies in positive territory, the day is not able to recover the falls that have occurred in the last seven days. On a weekly basis, red signs prevail, with only 4 exceptions among the first 30. Among them, the price of Tezos (XTZ) stands out, which on a weekly basis earns 35%.

The strong upward trend has currently stopped at the highs of yesterday afternoon with levels that for the first time since May, after seven months, review the price of $1.80, a step away from the absolute historical record of last May, at $1.86.

Today, Tezos continues to maintain the upward momentum though decidedly lower than that of the last three days with a rise that in the last 24 hours climbs 5%. Prices slow down and fall by a few decimals of a dollar, without affecting the strong rise that, since the lows at the end of October, has seen the value of Tezos more than double.

To follow, among the best of the week there is Cosmos (ATOM), which gains 11%. The other two are Neo (NEO) and Maker (MKR), both up 3.5%.

Among the best of the day, Mindol (MIN) continues to stand out and returns to climb with a leap of about 20%. Mindol is characterised by strong volatility which is partly due to speculation that sees 90% of trades on a daily basis on two little-known Asian exchanges, Coineal and Coin Tiger. Mindol is a project involving anime, manga, games and music, which particularly dominates the Japanese market.

Among the best of the day, there is also Kyber Network (KNC) which gains +7%, while among the best known there are the 6% rises of Basic Attention Token (BAT) and Waves (WAVES).

In contrast, Enjin Coin (ENJ) and Lisk (LSK) fall by 2%. Performing worse is Bitcoin Diamond (BCD), one of the speculative bitcoin forks that have gone into oblivion, falling into 70th position with more than $76 million of capitalisation.

The market cap remains below 200 billion dollars, volumes continue to remain low with daily exchanges still below 50 billion dollars. The dominance of Bitcoin, Ethereum and Ripple remain unchanged from yesterday’s levels.

Bitcoin (BTC)

Bitcoin oscillates around the $7,200 area, a three-day break-even level with volumes that keep contracting, just like the price. It is a signal that could anticipate an upward or downward directional movement. Structural conditions remain weak.

A possible signal of reversal would consist of a return to 7,500 dollars over the weekend. In the event of a sinking to 7,100-7,000 dollars, speculation could increase downward with the possibility of scoring new lows since the beginning of the month.

Ethereum (ETH)

The situation hasn’t changed for Ethereum. After the sinking in the early hours of yesterday, with a movement that pushed prices to test the threshold of 140 dollars, today ETH tries with a modest reaction to recover the equilibrium area of 145 dollars but the volumes do not help to give the signal of comfort of this bullish movement caused more by a technical reaction than by a real movement characterised by major purchases for the protection of the $145 threshold.

The situation of Ethereum remains unstable, indeed precarious. The first sign of reversal would come with the recovery of 155-160 dollars. If prices were to fall below 140 dollars at the weekend with low volumes, Ethereum would also be in danger of bearish speculation.