Following last week’s sharp rises, the sector is seeing a return of prudence accompanied by a sharp drop in cryptocurrency daily trading volumes, ranging between $75 and $80 billion.

In fact, yesterday closed with some of the lowest trading volumes since last October, highlighting how after the strong euphoria that caused daily exchanges to skyrocket, these last few days a certain degree of caution has prevailed for the entire sector.

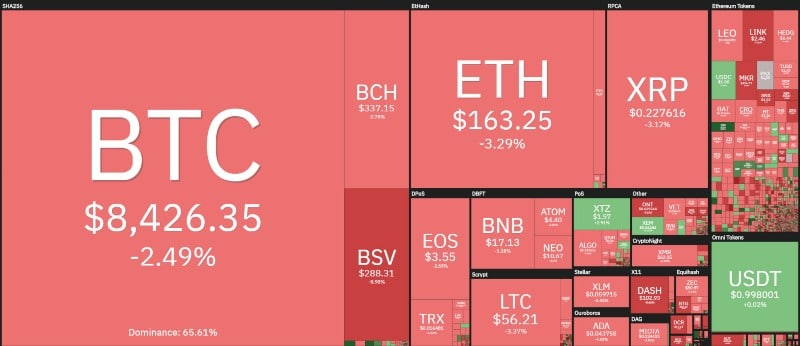

Today shows a prevalence of declines for 85% of the first 100 cryptocurrencies. If we narrow the analysis to the first 25, only Tezos (XTZ) is above parity, with an increase of almost 3%. Tezos benefits from being the token that will be used by San Francisco-based venture capital Andra Capital, which has officially announced the launch of an STO based on the Tezos token.

This further raises the XTZ prices, which in recent hours are back above $1.60, trying to recover the highs reached in mid-December at $1.84, the highest level in the last two years.

Tezos is back over 1.1 billion capitalization in 12th position, still lagging behind December, when it had reached 10th position, held only for a few hours. Anyway, Tezos overtakes Tron and Monero, who drop to 13th and 14th position.

The best of the day is Swype (SXP), a token of a smart wallet launched in summer 2019, which gains 18%. Among the best known today is Enjin Coin (ENJ), which gains 5%.

By contrast, the worst performance is that of Komodo (KMD, 60th position), which loses 12%. KMD is a multichain platform with open source development, which is used to design and build blockchain superstructures. It is also one of the first developments, dating back to 2014.

Bitcoin Satoshi Vision continues to be subject to strong speculation and volatility linked to the figure of Craig Wright, losing 8% today. Bitcoin Diamond (BCD) also loses 8%, as does Chainlink (LINK) and the other Bitcoin fork, Bitcoin Gold (BCG). After the strong rises of the past few days, Dash is also losing 7% today.

The generalized decline in daily trading volumes makes the market cap slip above $230 billion, respectable levels, not too far from last week’s highs of almost $250 billion, and far from the lows of mid-December at $185 billion.

Bitcoin dominance slips below 66%. Altcoins benefit, like Ethereum, which earns decimal fractions and falls back to 7.7%. XRP remains stable and maintains 4.3% of the market share.

Bitcoin (BTC) trading volumes decreasing

Bitcoin experienced the bearish dynamic resistance that combines last June’s decreasing highs, which passes through the $9,200 touched between Saturday and Sunday. After that movement, sales have prevailed and in the last few hours, BTC’s prices have returned to test the $8,400.

Nothing compromising in a medium-term perspective: the rise that characterized the first 20 days of January now sees prices lose 30%, a physiological retracement movement that at the moment does not affect the rise shown in the first 20 days of 2020. Bitcoin still remains in the safety zone with the holding of $8,300.

Possible signs of reversal will come with falls below $8,000, which coincide with 50% of the retracement of the rise just indicated. A return above $8,800 in the next few hours would signal a return of strength that must be accompanied by a return of volumes and purchases.

Ethereum (ETH)

Even Ethereum, in line with the decline of Bitcoin, loses 2.5% on a daily basis and sees prices test the $160. For ETH it is important not to go back below $155, former resistance level broken with the mid-January rise. The $155 is now a level of support to hold in order to aspire to an upward return.

Like for Bitcoin, Ethereum also needs to recover the $175 as soon as possible, in order to aspire to the breaking of the January 18th high (the highest of the last three months) which coincides with the dynamic downward trendline that joins last August’s decreasing highs at $178.