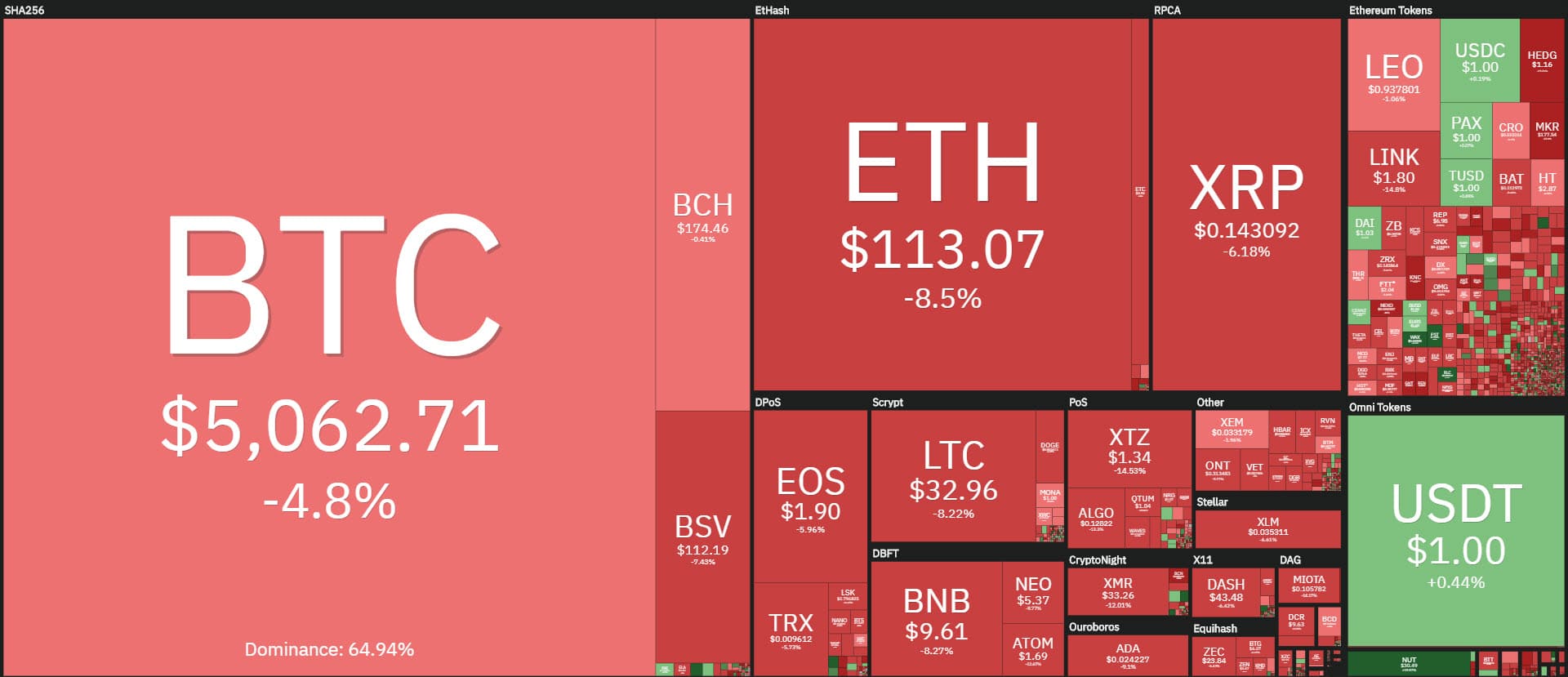

During the first part of the day, the prices of cryptocurrencies reached the lows of the period which were recorded last Thursday and then with the subsequent sinking recorded on Friday the 13th. As a result, the crypto sector continues to show red signs today.

For the second consecutive time, the week opens with a black Monday, or rather a deep red one. During the night of yesterday, one of the most important decisions was made by the U.S. Fed. The stock markets have been negatively affected by these decisions since this morning, further increasing the uncertainty in the markets with negative signs.

In the cryptocurrency sector, there was a sharp decline for Chainlink (LINK), which, together with Tezos (XTZ), has now fallen by 15%. But this weighs heavily on Chainlink which, with the falls of the last few hours, updates the lows of the period and returns to the values of September 2019, totally cancelling the strong rise that it had achieved during the first three months of the year, with the top reached in the first days of March close to 5 dollars.

With the collapse, Chainlink lost 70% from the highs at the beginning of March. It’s a decidedly negative signal that on a weekly basis places Chainlink among the worst of the top 100 as a negative performance with a -50% and a drop to 15th position after reaching 11th position a few days ago.

The prevalence of red signs further decreases the capitalization below 145 billion dollars.

The signal that attracts attention in recent days has been the very high trading volumes, especially during the weekend, flowing over 1 billion dollars on Bitcoin alone. These are very high averages during normal trading days. Such high trading volumes during the weekend show a moment of particular tension.

Bitcoin (BTC)

Bitcoin maintains dominance over 64%. In the coming days, dominance and capitalization will not matter, what will be important is to keep the support levels that remain between 4,500 and 5,000 dollars.

Ethereum (ETH)

Ethereum sees prices fluctuate just above the psychological threshold of $100, levels that it has tested in recent hours.