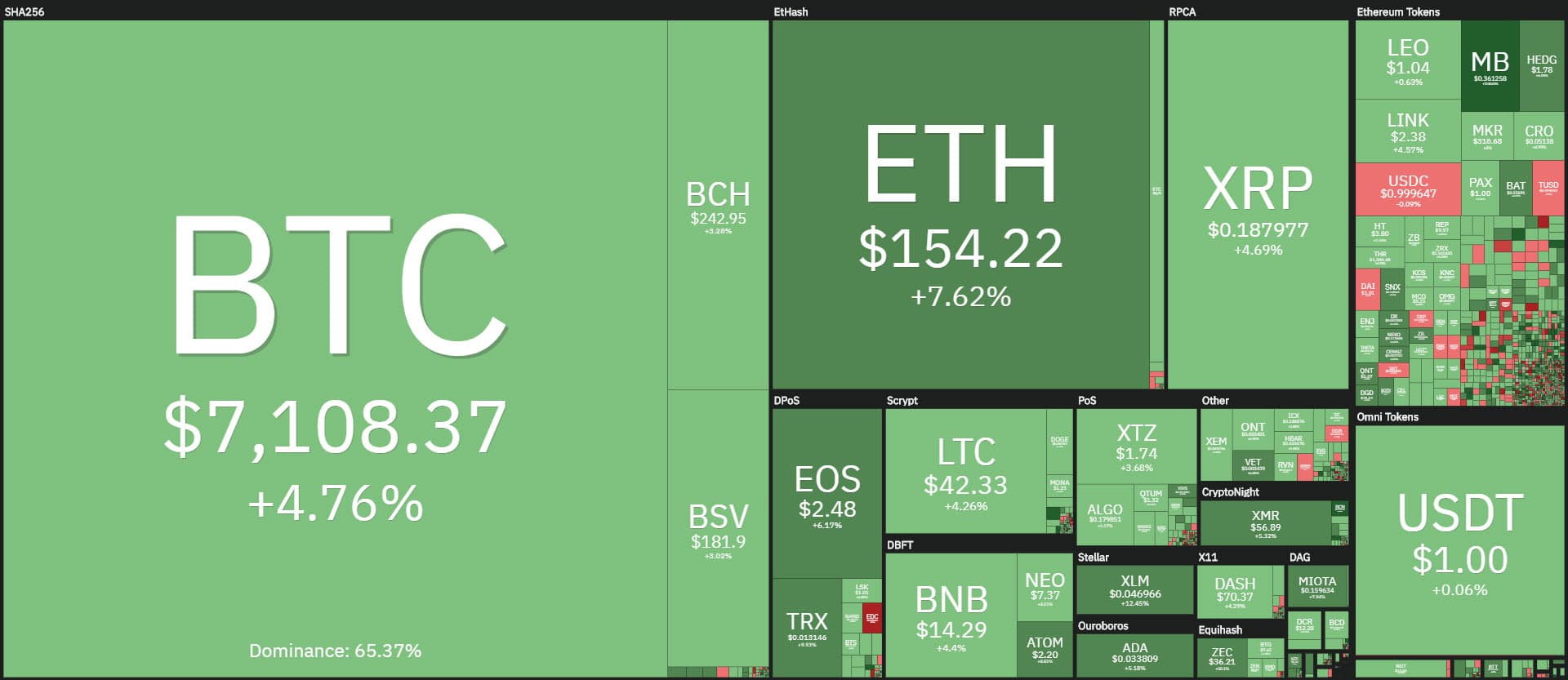

The green sign prevails today for more than 90% of the cryptocurrencies, even with double-digit increases that emerge among the big names, such as the price of Stellar (XLM) and TRON (TRX), both rising by more than 10%.

Stellar stands out for the rise and climbs on the podium with prices that, with today’s high jump, totally cancel out the decline that had developed in mid-March. Stellar returns to a step from 0.05 dollars despite not being able to drag the rise of Ripple (XRP) which today rises by 4%. Since these two projects have similar objectives in terms of development, XRP does not benefit from the indirect effects of Stellar’s bullish movement.

Meanwhile, Bitcoin rises by about 5%, but among the top 3 cryptocurrencies per market cap, it is Ethereum’s rise that pushes it beyond the highs of March 20th. It’s a break that Bitcoin experienced last week and that in these hours is finding further confirmations: it’s technically important because it gives a signal of bullish continuation in a medium-term perspective.

Today’s rises push the market cap to review the 200 billion dollars, a level that it had abandoned during the very beginning of the downturn on March 12th. These comforting signals will have to be confirmed in the coming hours and days.

Bitcoin’s dominance remains stable above 65%. Ethereum gains ground, returning to 8.5%, levels that it had not seen since last March 20th, while Ripple’s dominance remains stable at 4.1%.

Bitcoin (BTC) price

Bitcoin confirms conclusively that it is on a new biweekly cycle. The lows recorded last weekend will be the reference point for the bullish confirmations of the current bi-weekly cycle started from last weekend’s lows.

For Bitcoin, it will be necessary to confirm the rise above $7,200 as soon as possible to go back to the $7,800.

On the contrary, only a return below $6,600 would trigger a first warning signal that would expand only with extensions below $5,800, the lows recorded last weekend.

Ethereum (ETH)

Ethereum is showing a good bullish signal with attempts to extend beyond $154, the previous mid-term highs. A confirmation of the break of the current day’s highs would project Ethereum’s prices to 190 dollars in the coming days, this is the level that ETH will have to recover as soon as possible to return to review a bullish approach in the medium term.

The only concern for ETH would be a return below $125. Below this level, downward speculation and the danger of sinking below $115 would prevail again.