The interest in Bitcoin by institutional investors remains high, as evidenced by the open interest on Bitcoin futures on the CME that closed over $256 million yesterday, the highest level that had not been recorded since before the collapse in mid-March.

This confirms how the interest at the institutional level is high, to the extent that also the open interest on Bakkt futures has recorded a peak on April 24th, closing at $7.6 million, while yesterday it closed at $7.4 million, thus remaining close to the highs.

Two tops in a few days: the open interest, which measures the net overnight open positions, yesterday reached the tops of mid-March on CME and Friday the tops on Bakkt.

The day, for the first time after seven consecutive days on the rise, a trend that had not been recorded since July 2019, today sees the red sign prevailing, albeit slightly. More than 60% of the main cryptocurrencies are moving in negative territory.

Among the declines that are particularly evident today, we find Bitcoin Cash (BCH) and Bitcoin SV (BSV), both losing 1.2%.

After the halving at the beginning of April, both Bitcoin forks born in 2017 and 2018 continue to show a loss of value. Another pronounced decline is that of (Eos) EOS, which fell by 1.4%.

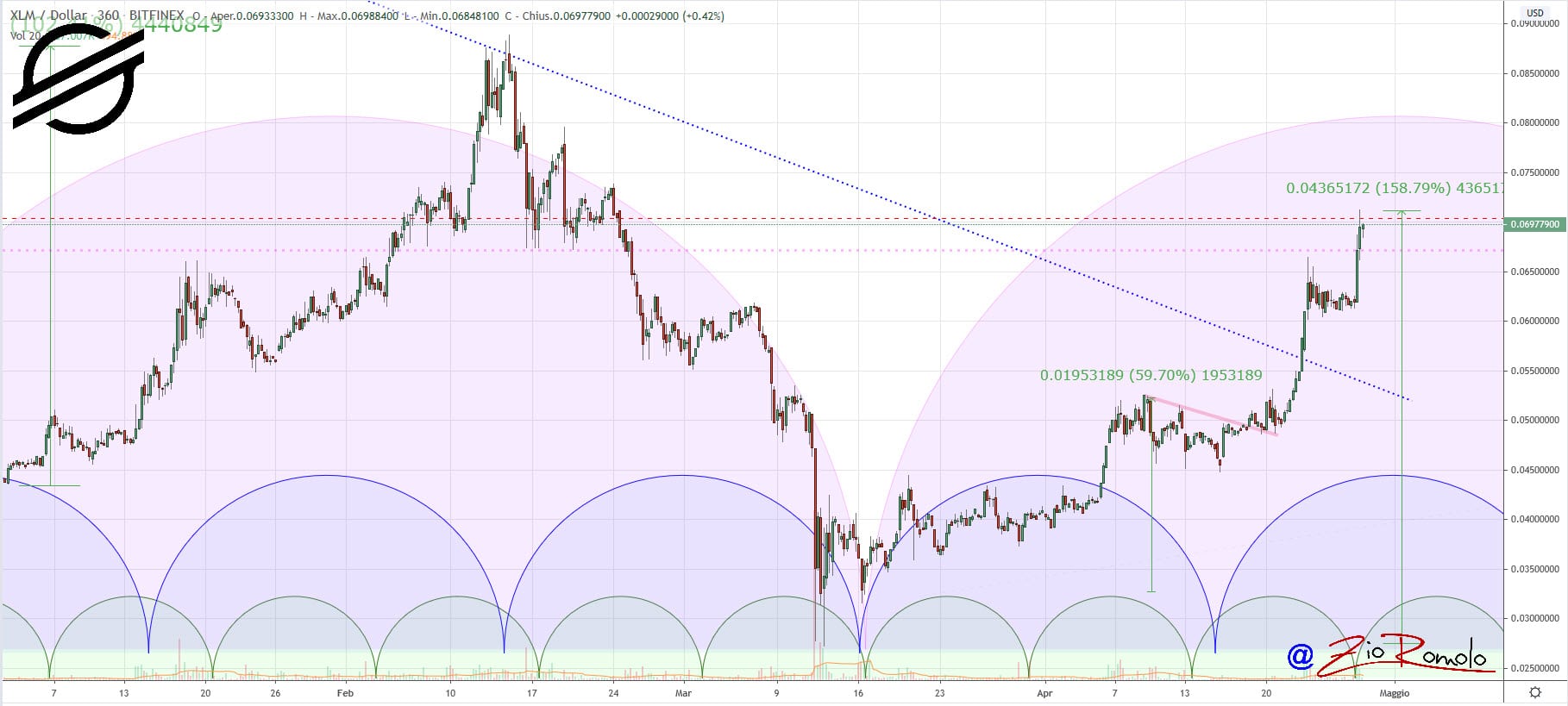

On the opposite side, in positive territory, Stellar (XLM) continues to fly with a double-digit increase over 11%. Stellar records one of the best recoveries after the lows of mid-March with a total gain that goes over 150% in less than 50 days. Stellar, with the rises of these last hours, returns to review area 0.071 dollars, levels that it had not seen since late February 2020. Today, Stellar is on the podium of the best of the top 100 and replaces Chainlink (LINK) in 11th position, regaining a level abandoned for months.

Tezos (XTZ) continues to distinguish itself among the top altcoin rises. Tezos also tried to recover the period highs recorded during the weekend with a rise of almost 4%.

Another rise is that of Cardano (ADA), which continues to support the movement of the last few days going to threaten the 12th position occupied by Chainlink with an increase of 3.5%. Chainlink, on the other hand, is falling back by 0.2% and this puts the 12th position at risk. Between the two, in fact, there is a difference of just over $35 million.

The privacy coin trio sees Monero (XMR) climb, updating the highs of the last period to a step from $63, levels before the March crash. Monero is the one which is doing the best.

Dash (DASH) retreats, confirming the current trend of the weekend and today is unable to replicate the trend of Monero, losing 1.4% without compromising the uptrend in the medium-long term started from the March lows. The other privacy coin ZCash (ZEC) also falls by just over 1%.

Yesterday’s volumes recorded highs with an average higher than last week, with Bitcoin trading at a billion dollars again.

The price trend remains consolidated but finds no support from new purchases. This is a somewhat controversial signal, but at the moment it doesn’t seem to jeopardize what’s happening on Bitcoin and the altcoins that are at the levels of April’s highs and beyond.

In the last 24 hours, trading volumes across the entire sector have fallen back slightly below $100 billion.

The market cap is back above the $220 billion, which it hadn’t seen since early March.

Dominance remains unchanged for the first three with Bitcoin at 63.9%, Ethereum just under 10% and Ripple that continues to fluctuate around the critical threshold of 4%.

Bitcoin (BTC)

Bitcoin remains hooked on the period highs recovered in yesterday’s day just under $7,800, oscillating around 7,700 points and going to almost totally cancel out the decline that had characterized the two days of terrors of March 11th and 12th. The upward trend remains solid.

At the moment there are no particular concerns, but it is necessary for BTC to give a cue supported by the purchasing volumes higher than those of yesterday, which would boost confidence in the few days before the halving that is estimated to take place between May 10th and 11th. An alarm signal for Bitcoin would only come with drops below 7,150 points.

Ethereum (ETH)

Ethereum continues to move within the bullish channel that confirms the trend which has been characterizing it since mid-March. For Ethereum, after touching the psychological threshold of 200 dollars, a waiting period has begun that could open a new upward trend if within the next few days it will break the $200 threshold.

For ETH, a retracement is also acceptable, which would not cause concern as long as it doesn’t go below the $170 support.