The weekend, for the second time since the beginning of the year, recorded a Sunday with very high trading volumes, involving Bitcoin above 1.5 billion in dollars, 53 million more than the trades recorded on March 15th, which was the Sunday during the bearish storm of mid-March.

Volatility is at its lowest level for the period: just over 3.7% daily on a monthly basis, which is the highest level in the upper neckline range that had characterized the low volatility last fall.

Volatility collapsed after peaking at 11% between the end of March and the beginning of April. This is an indication that, at this moment, is inversely proportional to the positive sentiment as shown by the fear and greed indicator, which goes to the levels of late February, levels reached when Bitcoin reached almost $9,600, the same price at the end of February.

Another uptrend week is behind us: it’s the seventh consecutive week on the rise, which parallels the record set between April and May of last year. This record comes at exactly the same time and, as a consequence of the upsurge, it is better than the end of 2017 when it only stopped at 6 consecutive weeks of upsurge.

This is a very good performance before Bitcoin’s halving, which is getting closer and closer (it is expected in a week: Monday, May 11th).

Not only in terms of the upward price, but also in terms of sharing, the sentiment on social networks is growing strongly from the messages exchanged in particular on Twitter.

In the past few days, the search record for the keyword Bitcoin halving has also surpassed that of 2016.

However, today a prevalence of red signals is emerging.

Among the first 100 cryptocurrencies, there are only 4 signs above parity. The two best ones show double-digit increases: they are Holo Chain (HOT), which rises by 24%, and Zilliqa (ZIL), which rises by more than 10%, in 60th and 70th position respectively.

Among the big ones, today the most sustained declines are those of EOS, which is close to -10%, Ethereum (ETH), Bitcoin SV (BSV) and Monero (XMR) -8%. This is a generalized decline. To find the first green sign it is necessary to go down to the 49th position where there is Hyperion (HYN) which goes up by more than 4%.

With the declines of the last few hours, the capitalization has fallen by 15 billion dollars, returning to just over 241 billion dollars, after having pushed the last few days just over 260 billion dollars, which are levels that had not been recorded since the beginning of March.

Bitcoin’s market capitalization exceeds 160 billion dollars, conquering and maintaining 66% of the total capitalization, while Ethereum’s market share drops back below 10%, regained in the last days of April, while Ripple is now below 4%, the lowest levels apparently abandoned at the end of 2017.

Trading volumes increase on Bitcoin (BTC)

After pushing to $9,500, profit-taking prevailed for Bitcoin, with prices now seeing them lose from those highs by about 10% and go to the $8,500 area test.

It is a reversal that pulls the brakes after the strong rises that had characterized the last days of April and this does not cause concern if prices continue to stabilize above $8,000 to $8,200.

A possible push under these prices should not go below $ 7-600-7,700, this is the area of alarm if the decline continues in the coming days.

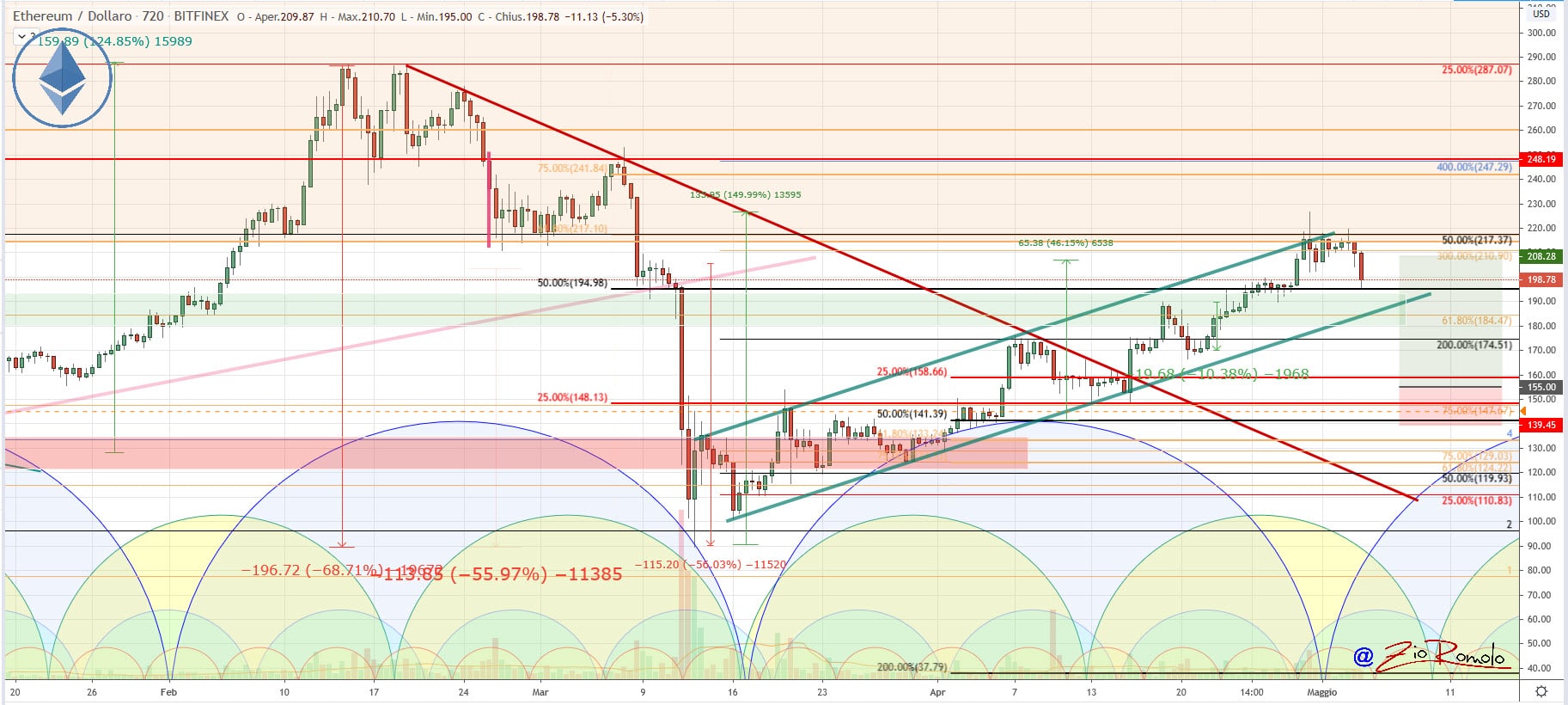

Ethereum (ETH)

Ethereum remains within the bullish channel that characterizes the upward price movement since last mid-March’s lows. Prices return to test the psychological area of $200.

For Ethereum it is necessary not to extend the decline below $175. Alarms would be triggered under this level. A recovery of $215, an affordable area in the next few days, would restore confidence.

An increase in purchasing volumes is necessary in the case of a pullback to the $200 area.