After a period of ups and downs, here comes what is the first real drop of the last weeks, characterized by a retracement phase for Bitcoin.

The week, unless there are positive surprises during the weekend, is about to end with the deepest backward step that hadn’t been recorded since the first week of March, which subsequently characterized the bearish movement that pushed the entire sector to touch the lows of the period from which began the initially hesitant and then cheerful rise that last week led to a full recovery of the entire movement.

Yesterday, the bearish trend that continues to be driven by Bitcoin’s movements saw the second consecutive day downward, bringing the prices back to the levels of 10 days ago. However, Bitcoin remains at levels even higher than those that had characterized the pre-halving.

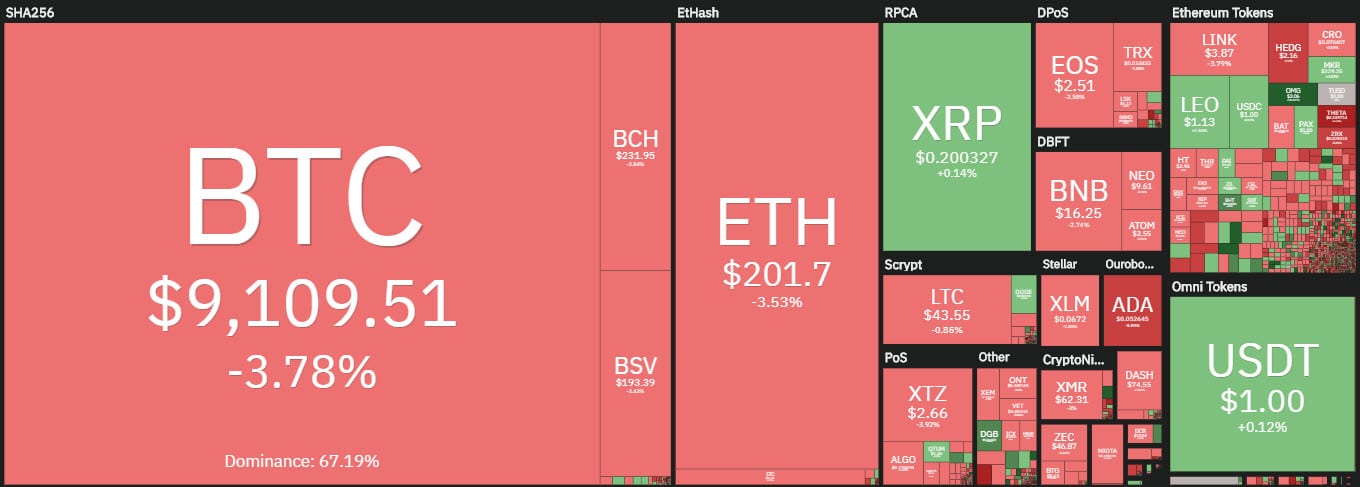

The day follows in the wake of what has been happening in the last 48 hours and sees a clear prevalence of negative signs with over 80% of cryptocurrency in red.

For the big ones, the average decline is more than 4%. Among the top 15, the deepest declines are Cardano (ADA) -7%, followed by Chainlink (LINK), -6%, and Tezos (XTZ), -5%.

These are the crypto assets that together with Stellar (XLM), which today drops by -5%, compete for positions ranging from 10 to 13, although Tezos seems to have consolidated the 10th position.

Bitcoin today drops 4.5%. Ethereum abandons the psychological threshold of 200 dollars slipping by 5%.

Ripple abandons the 3rd position. The signals that were already arriving in recent days see in fact Tether, first among the stablecoins, gain the third position in the standings, with a major leap that at the moment surpasses XRP in terms capitalization by about $300 million. Ripple drops 3.5% of its value.

There are a few green signs, the first is OmiseGo (OMG), which goes against the trend compared to the rest of the sector and is up more than 40%. OmiseGo is a Thai project launched in 2017 that was characterized by an ICO collection that achieved its objectives even before the launch.

It is a platform that offers access to financial services with the possibility of an immediate peer to peer transactions and an exchange of cross-border activities and applications, with access to a suite of wallets that allows users to interact and create digital transactions.

On a weekly basis, OmiseGo flies and performs even better with an increase of almost 70%, reaching the highest in the last 10 months in the $1.75 area.

It’s a week that’s coming to an end with Bitcoin dropping about 5% since both the beginning of the week and last Friday’s levels. It’s a decline that cannot be considered a crash since the previous rises seem more likely to be affected by profit-taking rather than driven by panic selling.

The volumes of the last 24 hours, over 3.5 billion in dollars, remain the highest since last Friday. This highlights how there are tensions due to the fight between Bears and Bulls, even if it seems to be more of a bear rebellion than a real bearish attack.

The bearish movement has brought the market cap back to 250 billion dollars. Bitcoin dominance remains unchanged at 66.5%. Ethereum gains a decimal fraction and goes back to 8.8% while Ripple doesn’t go down and remains at 3.4%, lowest levels in the last three years.

Bitcoin (BTC): retracement phase

Bitcoin breaks the bullish trendline for a short time while remaining inside the bullish channel and moves close to the lower neckline of the same channel. A neckline that currently passes in the area 8,650-8,700.

These are the levels that would show a change of pace after more than two months of uninterrupted climbing. Considering the March lows and May highs in the $10,000 area, which continues to confirm the importance of this psychological level, the movement of the last few hours sees a retracement of about 25%. It is a significant movement in the short term but at the moment not so worrying in view of the medium and long term.

It is important for BTC to pass the weekend without sinking below $8,650. In case of a violation of this level, it is important to hold the pre-halving lows in the $8,100 area.

Upwards, the levels to be reached in this particular phase and in the middle of a movement that has been characterized downwards for 48 hours, remains the 9,900-10,000 dollars, psychological resistance now also become technical in the short term.

Ethereum (ETH)

The decline does not spare Ethereum that returns under the neckline of the bullish channel. With the breaking of the psychological threshold of 200 dollars, the prices are brought back in these hours to test the technical support area of $190.

It is important for ETH to keep the prices above this level, otherwise, the support is at $170-175.

On the rise, Ethereum draws a triple maximum in the $215 area that shows strong protection from the Bears: every time the prices in this last month have tried to break the $215, they have been rejected three times.

It is necessary for ETH to consolidate the movement at these levels, without going below 175 dollars, because consolidation of the 190 dollars could strengthen a possible next attack of the 215 dollars.