By now it has become virtually impossible not to know and talk about the Yearn Finance (YFI) protocol which is grinding record after record. The last one is precisely due to the price of the YFI token which has exceeded 15 thousand dollars. Even higher than bitcoin.

For those who do not know this protocol, it is a system that allows aggregating various underlying lending protocols, such as Aave, Compound, dYdX and Fulcrum, similar to what happens on idle.finance.

Once the various assets are deposited, they are converted into their respective tokens such as yDAI, yUSDT, and are moved to the underlying protocols and periodically placed on Curve.fi to create AMMs (Automated Market Makers) whereby, besides earning the fees from lending, users also earn the fees from Curve.

The reasons that move the price of the YFI token

Yearn Finance has its own governance token, YFI, distributed to users who provide liquidity only to certain ytoken pools.

It is this token that has surpassed incredible levels. With a total supply of just 30,000 YFI, 29962 of which are in circulation, it is understandable that the race for the token has started with investors willing to pay out incredible amounts. This shows once again how the scarcity of a commodity increases the price out of all proportion.

It is the same principle that will occur with bitcoin as soon as there is a shortage of BTC on the market.

Yearn Finance and competitors

Its operation is quite simple, just like its interface since it has different components such as earn, zap, apr and vaults depending on what the user wants to accomplish.

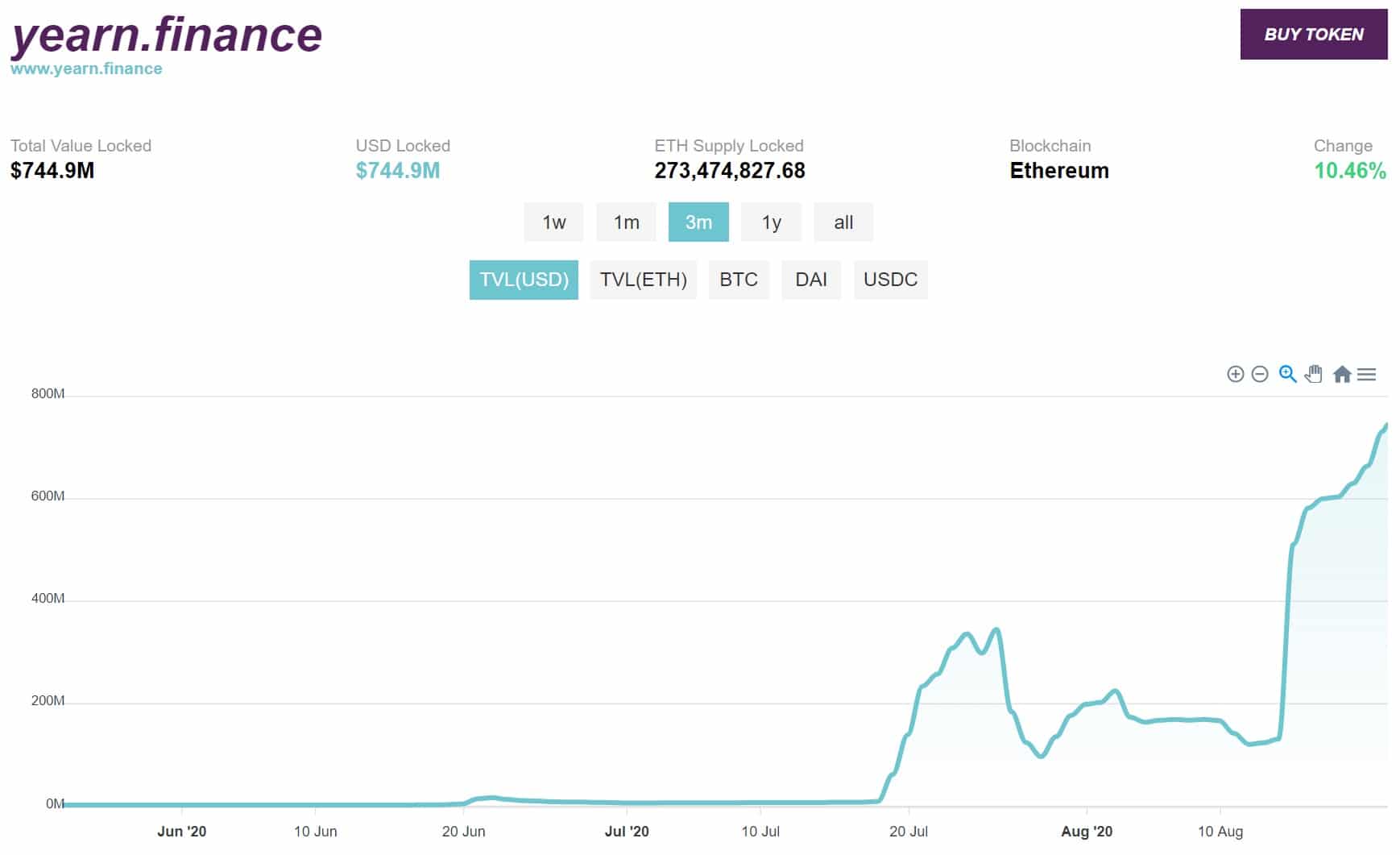

As can be seen from the previous graph, there are more than 700 million dollars locked via this protocol and at this rate, it will reach as much as 1 billion dollars.

The game is now open because other similar systems that have been on the market for some time have not stood by and watched.

Idle.finance itself will launch its governance token that could reach the same figures. It shouldn’t be overlooked that these tokens are distributed free of charge, without any effort to all those who provide liquidity to the various pools, and let’s not forget that with the latest update of idle.finance, it is possible to recover the governance tokens of the underlying protocols: this means that by providing liquidity to a pool, users get:

- The interest on the asset provided, for example DAI;

- The token of the different protocols into which the pool is divided, so if DAI are divided partly into Aave and partly into Fulcrum, then we will get both LEND and BZX tokens;

- The token from idle.finance that will be announced soon.