For the second consecutive time, the sum of volumes on Ethereum during the weekend exceeds those of Bitcoin.

In general, today the volumes are stable at the average of the last few days even if they are decreasing from the records set last weekend.

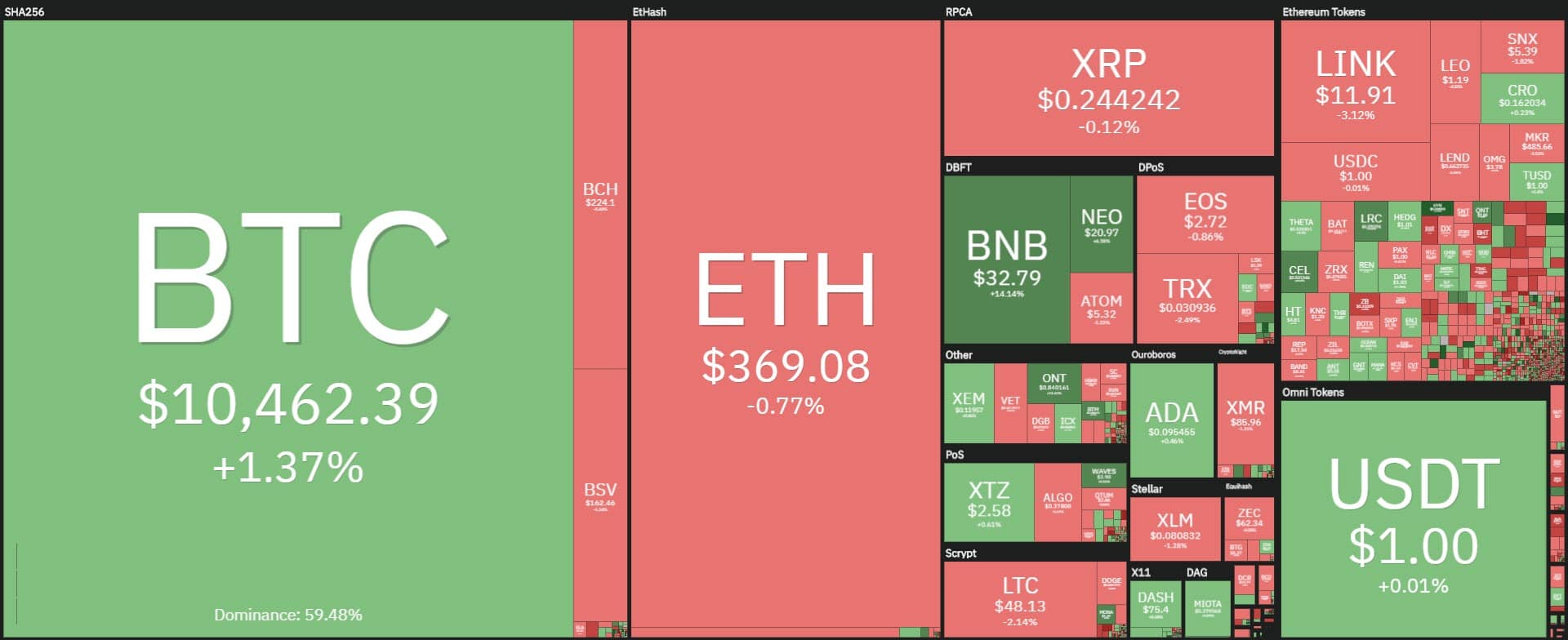

The dominance of Bitcoin hardly remains above 56%, while Ethereum’s market share is stabilizing close to last year’s highs at 12.2%. XRP’s dominance is now below 3.2%, once again falling close to the lowest levels.

The weekly candle draws a pattern (technical figure) of substantial stability of the market with a body smaller than the two shadows: it is a sign that the high volatility of the prices of the last days, tripled from the historical lows of end July, is more contracted on a weekly basis.

In the Top 20, there is a modest prevalence of positive signs. Among the Top is Polkadot (DOT) the best of the week with a gain of over 40%. This is followed by NEO, up 25% since last Monday’s prices.

Yearn.Finance (YFI) is one step away from entering the top 20 capitalized and has jumped more than 80% in a week to over $40,000, doubling its value in less than 10 days.

The new week starts showing weakness with more than 75% of the first 100 cryptocurrencies below par.

Looking at the list of the major capitalized currencies, only Binance Coin (BNB) is in green, gaining more than +2.7%. To find bigger rises, we need to go beyond the 70th position with Hyperion (HYN) in the sprint over 80%, after the recent fall below $0.20, the lowest level in the last year. It follows at a distance from Ampleforth (AMPL) over 10% from Sunday morning levels.

Bitcoin (BTC)

Over the weekend, the price attempt to go over $11,600 failed. The rise was repelled by the short-term resistance that coincides with the peak of this period set on September 4th.

Fluctuations in BTC prices within the channel between $10,000 and $10,500 continue. Options traders remain cautious while keeping the strength of the protections stable below $10,000.

While upwards, the first resistance in the 10,620 area is strengthening, a level that in the last few hours has repelled the bullish attack. The return above $11,650 continues to be decisive to trigger the first bearish coverages and attract new purchases.

Ethereum (ETH): volumes falling

Between Saturday and Sunday night, ETH prices exceeded 390 USD for a few minutes and for the first time since September 5th.

The effort to show strength has not found the support of the purchasing volumes with prices again rejected at the levels of the second part of last week in the 365 USD area.

The former resistance at the beginning of the month in the 355 USD area now proves to be an important support. It is a level to be maintained in the coming hours to reinforce the hypothesis of consolidation.

Options traders prefer to reinforce this level of support by moving positions to protect against a possible downturn.

On the other hand, the strength of the hedges is increased by positioning just above the weekend highs ($390). It remains crucial that the $415 is exceeded to trigger stop losses and bearish positions.