Yesterday morning’s positive signals have deflated during the day and today the situation is reversed with a prevalence of red signs. To find the first positive balances you have to go beyond the 25th position of Coinmarketcap’s ranking: in 26th place, in fact, we find 0x (ZRX) that marks a rise above 5%.

Going even lower, at 33rd and 42nd position we find Aeternity (AE) and PundiX (NPXS) with double-digit increases over 12% from yesterday afternoon levels.

Among the Top 20, there are no particular movements worthy of note: only Tron (TRX) is suffering a worse decline falling just over 2%.

As highlighted in previous reports of the week, volatility is at the lowest levels of the last year and a half.

Despite this condition or precisely because of it, traders’ confidence is recovering.

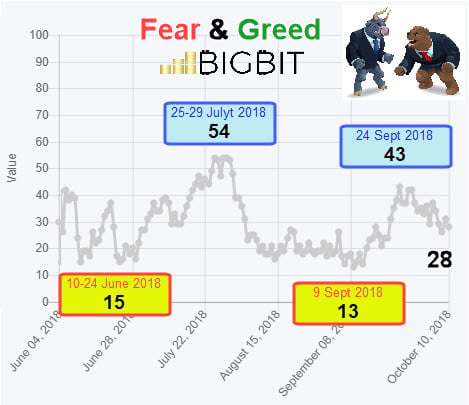

On September 9th, after having touched the low of the last quarter in conjunction with the return of prices to the lows of the year, the indicator that measures the Fear & Greed of the operators reacted positively, reaching the maximum period (43) on September 24th. In those hours, prices regained confidence and reached the levels where we are today.

Bitcoin (BTC)

The attack on the dynamic resistance fails again. Yesterday morning prices touched the 6730 area without inflicting the bullish blow that could have caused the jump upwards of a few dozen points, necessary to get beyond the threshold of 6800 dollars, a level that we continue to consider crucial in the medium term. On the contrary, instead, it will be necessary to pay attention to the return below 6500 dollars.

Ethereum (ETH)

ETH prices continue to oscillate in the $225 area. Yesterday, the exceeding of the technical resistance to 230 dollars, initially accompanied by volumes, was not confirmed. In fact, prices and volumes have again fallen to the levels of the past few days, without giving any indication.

The passage of days begins to draw a flag (red triangle on the chart) that could cause some shock in the coming hours.