A balanced day, with a perfect balance between positive and negative signs, marked by the collapse of Bitcoin volatility, at an absolute historical low.

Scrolling through the list of the first 20 cryptocurrencies, the best increase comes from Monero (XMR), which rises by more than 7%. The privacy coin continues to show signs of an upturn, taking the other two privacy coins with it. ZCash (ZEC) rises 7%, followed remotely by Dash, +2%, influenced by cross attacks from a firm which revealed that the protocol does not guarantee total anonymity. These rises put Monero and ZCash on the podium, the best two of the day.

At a distance we see Ripple (XRP), which continues to give positive signals with a rise of 3%. The prices of XRP are reported just under 26 cents. This is the highest peak since September 4th.

The days continue to record decidedly low and shrinking volumes. Yesterday, the counter-value trading on Bitcoin was again above 1 billion dollars. Those on Ethereum remain below 500 million dollars for the third consecutive day.

The total volumes of the last 24 hours are just over 80 billion dollars, over 70% less than the peaks recorded exactly one month ago.

Bitcoin Volatility at historic lows

This highlights an expectation on the part of operators, which continues to force price fluctuations. It is a picture that brings down Bitcoin’s daily volatility on a monthly basis to absolute historical lows.

Today, in fact, the volatility index records a value of 0.61%, an absolute historical low, below the previous records of 0.80% recorded in January 2013 and April – October 2016.

Volatility drops below these previous lows, marking a new historical record of daily volatility index on a monthly basis for Bitcoin.

DeFi, record for WBTC

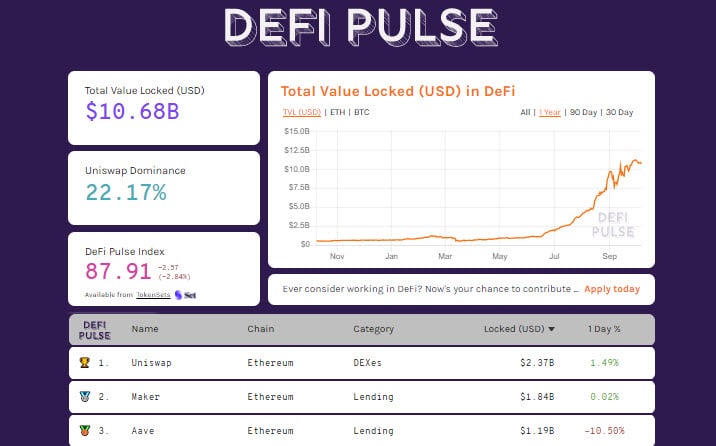

DeFi, despite the low fluctuations of the last few days, still remains just under 11 billion dollars, below the peaks recorded last week, at the end of September when the TVL index rose for the first time to 11.2 billion dollars.

The number of Bitcoin tokenized on ERC20 protocol continues to rise, reaching 141,000 BTC, an absolute historical record. WBTC confirms its leadership in the sector, which climbs to 5th position and maintains a total of more than one billion in fixed assets in dollars.

The first three in the ranking are:

- Uniswap, 2.4 billion dollars

- Maker, 1.8 billion dollars

- Aave, 1.2 billion dollars

Market capitalization remains as it was yesterday just over 342 billion dollars. The dominance of Bitcoin is above 58%, while Ethereum drops slightly to 11.3%. XRP remains above 3.3%.

Bitcoin (BTC)

Bitcoin’s movements remain restricted, with prices below the $11,000 threshold, more psychological resistance that in the last 10 days has rejected attempts to increase. Technical resistance remains at $11,200, the first level higher by option hedges for derivatives traders.

Option traders in the last 24 hours must decrease the strength of hedging by the Call, a possible change of analysis for the next few days with traders who are beginning to see the possibility of next rises. In fact the Put hedges increase, downwards, and this indicates the possibility of a trend change in the coming days.

Ethereum (ETH)

The prices of Ethereum are even tighter in the grip of the fluctuations that see in the last 24 hours differences within 5 dollars, between 359 and 355 dollars. This also indicates for Ethereum a wait on the part of the traders to break up or down to start taking positions.

A break that with the passage of time, as often happens in these days, could cause a strong upward directional movement, with a push over $370 or downward under $315-320. These are the levels of Ethereum to follow carefully.