Bitcoin is on the rise as more than 90% of cryptocurrency gain over 24 hours. The day thus tries to reverse the weekly trend, which has seen decreases with negative closures.

If Bitcoin confirmed Sunday prices above 10,600 dollars and for Ethereum above 352 dollars the week would put an end to the trend that in the last two times had seen negative signs. Two consecutive negative closures had not occurred since June.

Today’s rises are pushed by Bitcoin’s return to a $11,000 mark, a threshold that in the last month has rejected the upward attacks twice (at the end of September and on the first day of October).

Moreover, an extension started in the second part of yesterday’s day, supported by volumes, which returned above 1.8 billion dollars. It is the highest peak since October 2nd.

Ethereum, even if with a slight increase in the last week, trades just over 800 million dollars, remaining below the billion dollar threshold.

The end of the week is therefore starting in the sign of general positivity that will have to be confirmed at the weekend.

Total capitalisation is back below $344 billion. Bitcoin maintains just under 58.5%. Slight recovery by Ethereum, at 11.6%. Ripple’s dominance is also stable at 3.3%.

Five tokens see rises above 20%. They are: UMA flying 28%, Yearn Finance (YFI) +22%, same jump for Uniswap (UNI) and Sushiswap (SUSHI).

The first three are up: Bitcoin rises 2.3%, Ethereum +3%, and Ripple 1.9%.

The weekly balance from last Friday’s levels shows only two signs below par: Tezos (XTZ), just below -0.5% and Polkadot (DOT) which had a more pronounced drop, losing more than 2%.

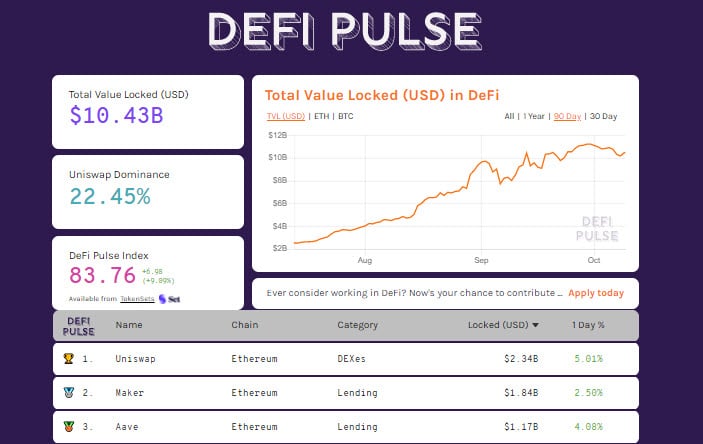

The Total Value Locked of the last 24 hours consolidates the total value over $10.4 billion.

Ethereum pieces rise, over 8.2 million locked. The tokenized Bitcoins also continue to rise, with more than 141,130 pieces.

Uniswap keeps its leadership stable with $2.3 billion, Maker and Aave keep just under $2 billion of collateral blocked.

Bitcoin (BTC) on the rise

Bitcoin remains caged between $11,000 and $10,200, levels that have been fluctuating since mid-September.

With the bullish movement of the last 24 hours BTC comes out over the neckline of the triangle that was characterizing the price fluctuations since the first days of September. This is a signal that will have to be confirmed over the weekend with the $10,800 hold.

In the last 48 hours, option position hedges have increased. The strength of the Put positions rises above the strength of the Call positions, just as it has not happened for over a month. 10,250 and 10,150 are the two highest levels of downward protection indicating the level of support protected by option professionals. Upwardly, breaking $11,050-11,100 remains crucial.

Ethereum (ETH)

Despite the busiest day, the fluctuations in Ethereum saw a gap of $19 between the absolute minimum and maximum, with prices remaining caged between $340 and $361.

For Ethereum, holding the dynamic support of $325, in case of a new return of strength, will be an excellent signal of consolidation for this last month that does not record particular tensions both upward and downward.

For Ethereum, the operating structures of the option professionals are not changing compared to the week’s picture. The strength of the Calls emerges, where the highest level to be broken down to restore confidence and attract volumes is $375-390, levels tested exactly at the end of September and the first days of October.

Downwards, it is necessary to maintain the threshold where the dynamic bullish trendline of $325 passes.