Bitcoin returns above 32 thousand dollars today with explosive volumes.

After yesterday’s negative closing that interrupted the positive series of 7 consecutive days on the rise, today the situation is looking better.

Yesterday saw the most volatile bearish movement of the last eight months and in fact in less than six hours Bitcoin lost 15% while the price of Ethereum dropped over 25%.

Loopring: the best price rise of the day

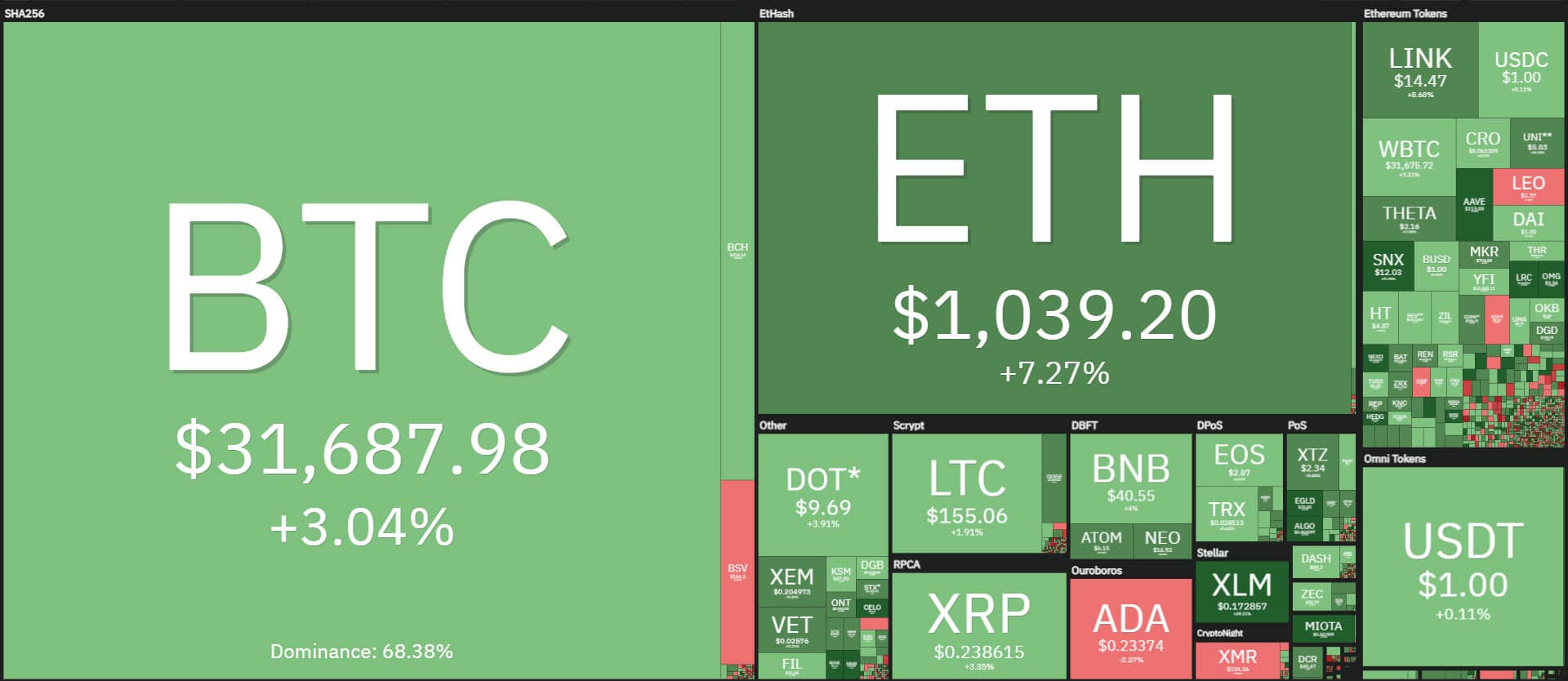

Today, over 80% of the major tokens are hovering above parity. On the podium of the best ones is the Loopring (LRC) token, with a 60% gain in the last 24 hours it recovers $0.50 cents, the highest level in the last 19 months.

With the strong jump of Ethereum, which has now climbed back above $1,100 gaining more than 40% from the quotations of Tuesday, December 29th, the gas fees used to execute smart contracts are back to rise.

In the last few hours, the price of Gwei – the unit of Ether used to calculate gas commissions – to be paid for the transfer of Ethereum between wallets has risen above $10 per transaction, rising above $70 for transfers involving multiple trading pairs, as required for the use of Uniswap’s decentralized exchange.

A condition that makes users of decentralized exchanges (DEX) migrate to open source platforms such as Loopring developed on zkRollup protocol, a technology that transfers transactions over a network superior to that of Ethereum with the advantage of processing thousands of transactions per second at very low costs without using gas fees.

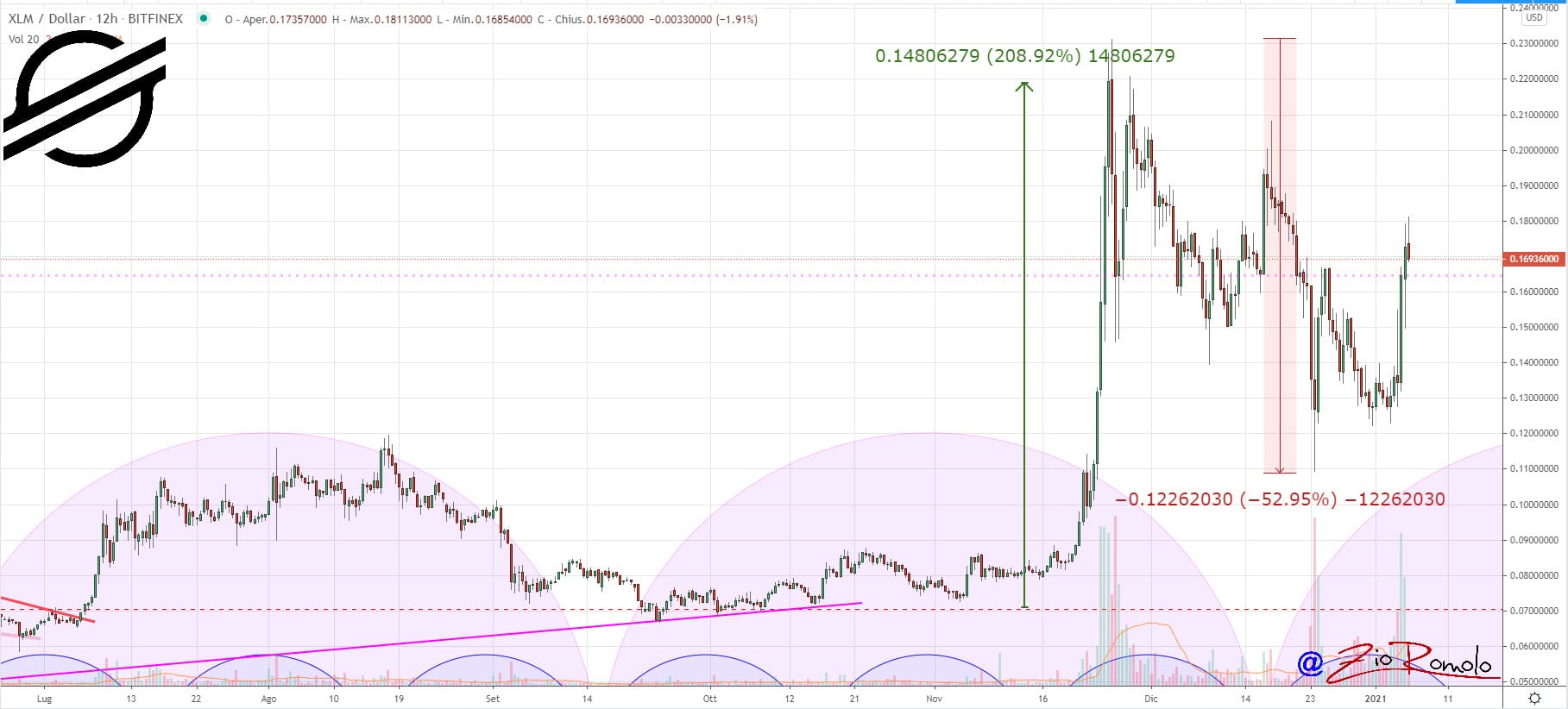

Next up are Stellar (XLM), Synthetix (SNX) and Iota (MIOTA), all up 25% from yesterday’s levels are competing for the second position in the day’s top list. The vicissitudes of Ripple (XRP) have dragged the prices of Stellar (XLM) to the lowest levels of the last two months at $0.11 with a loss of over 50% from the highs of the period reached at the end of November. Stellar in these last hours tries to recover by rising above $0.17.

Explosive Volumes for Bitcoin, Ethereum and DEX

The increase in volatility in the last 48 hours causes the volumes traded on the main platforms to explode as well. Over the past four days Bitcoin, despite the holidays, has recorded three days above $12 billion setting the three record days among the top four in history.

The same for Ethereum that between Sunday 3rd and Monday 4th January records the two days with the highest trades in its history.

Yesterday with over 14 billion in USD was the day with the highest volume calculated in US dollars. With over 4 million ETH exchanged it was the day with the highest number of Ethereum traded since March 20th, 2020. Ethereum was trading below $150 USD that day.

With the market cap above $860 billion, below the absolute highs reached in the early part of the day yesterday but above the previous record high of $830 billion set in January 2018, Bitcoin’s dominance returns just above 69%.

Ethereum’s reconquering of the $1,100 USD mark raises capitalization above $119 billion, surpassing the previous all-time high of $116 billion set on January 9th, 2018. XRP’s market share plummets to below 1.2% the lowest level since March 2017.

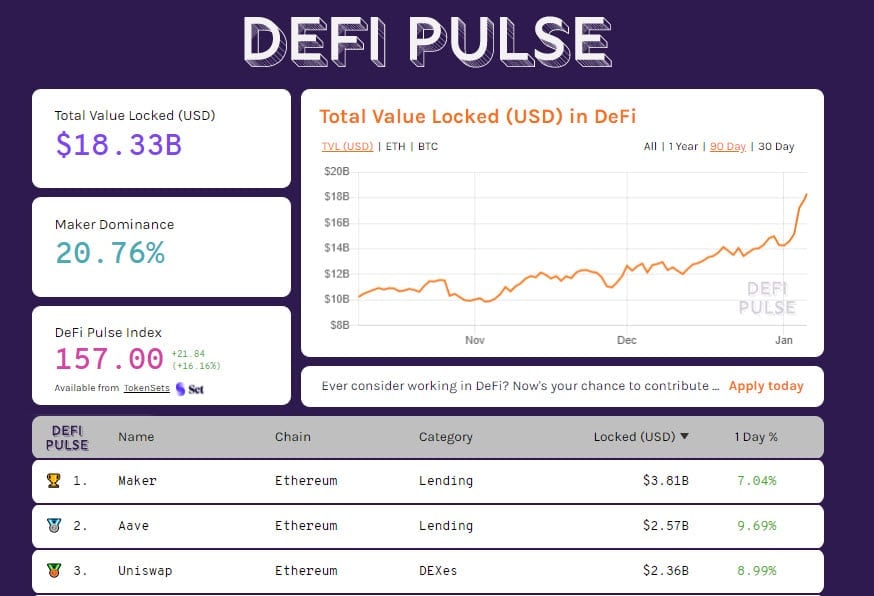

New records also for total value locked (TVL) on decentralized finance platforms over $18.3 billion. This is thanks to the growth in the value of assets used as collateral, while the total number of Ethereum and Bitcoin locked in the various protocols are back down.

Maker remains the market leader with over $2.8 billion. Aave maintains the second position with $2.5 billion, while Uniswap takes the third position for the first time.

Yesterday’s trading explosion also transfers to decentralized platforms with nearly $10 billion traded yesterday alone. About 45% of the total traded yesterday was processed by the Uniswap DEX, surpassing the total transactions processed in the last 24 hours by centralized giants like Coinbase Pro and Bitfinex.

Bitcoin (BTC)

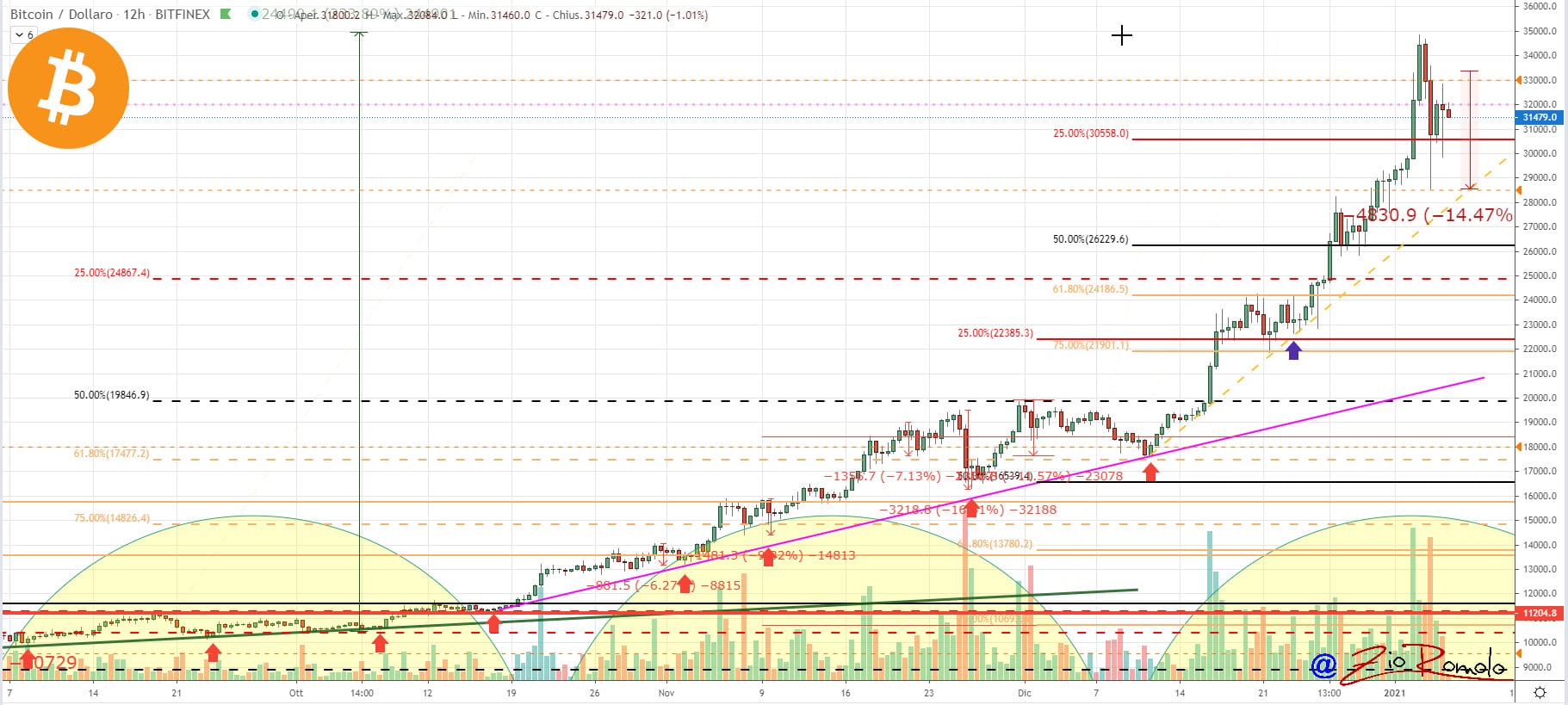

Yesterday’s drop in just a few hours saw Bitcoin’s price gains accumulated in the early days of the year erased. The price plunge down to USD 28,500 saw short buying return, bouncing prices back above USD 32,000 in the following hours.

This movement started to create the first supports that the non-stop climb of the last days had left without useful operational references. These references could once again provide information in the next few hours to start setting up protection strategies even for the most active option traders. Yesterday, with over $10 billion, a record aggregate open interest was recorded.

Ethereum (ETH)

Yesterday’s shock that in less than two hours saw Ethereum prices quickly fall from 1150 to 840 USD, does not affect the strong bullish trend, with Ethereum prices back above 1,000 USD with spikes even above 1,100 in this first part of the day. Yesterday’s strong oscillations confirm the ample room for manoeuvre that the strong rise of the last week grants to speculation, allowing it to move without causing any damage.

Only a fall below 750 USD would begin to show the first signs of weakness for the medium term. In the event of a jump above the recent record of 1,160 USD it will be important to follow the volumes of new purchases, a necessary condition to accompany the new rise.