Chainlink and Polkadot saw record price rises in the top 10 today.

This is the end of a rollercoaster week, which began with a difficult start with declines that ended on Tuesday and that in the last two days have seen a recovery in prices, but that at the moment are still to be contextualized in a technical rebound. In fact, the recovery of important resistances occurred yesterday has not been confirmed in these hours, in which there is a prevalence of red signs.

Chainlink: the price flies and sets a new record

Among the most capitalized coins, there is a slight prevalence of negative signs. Among the blue chips of crypto (the top 10), Chainlink (LINK) has risen more than 25% and is at the top of the podium. It was preceded by Curve Dao Token (CRV), while the best of the day was IOSToken (IOST). IOSToken (IOST) has performed 290% since the start of the year, the best year-to-date increase among the top 100.

Chainlink‘s rise today takes it to $21, an all-time high for the token in the smart contract oracle project. This allows Chainlink to climb to 9th position with over $7.7 billion in capitalization.

Another noteworthy rise among the top 10 is that of Polkadot (DOT), which continues to fly, today +13%, with prices close to $15. Again, this is a record for the price.

Polkadot consolidates its 5th position in the ranking, keeping its market cap above $12 billion, ever closer to overtaking XRP, which continues to hover below 30 cents,

Total capitalization remains above $1 trillion. Bitcoin’s market share falls back a few decimal points to 68%. Ethereum’s rise in the last few hours has seen it regain 13.5% of dominance. XRP continues to hover at three-year lows at 1.2% market share.

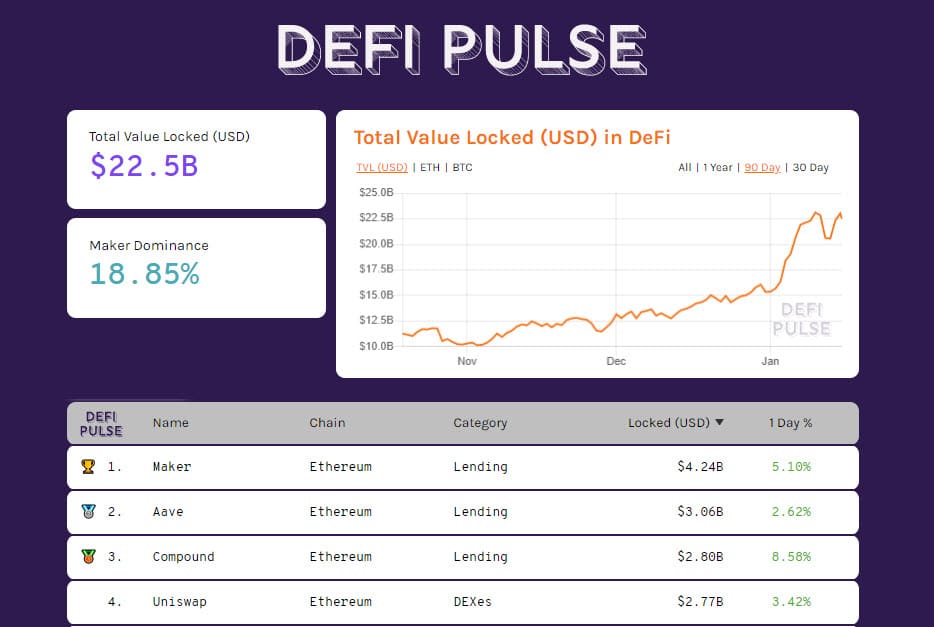

DeFi climbs back above $22.3 billion, its highest level ever. Both ETH and BTC collateralized and locked in decentralized finance protocols are also increasing, albeit timidly.

Maker with $4.2 billion confirms itself as the leader of the sector, followed by Aave, with Uniswap and Compound going head to head for third place.

Bitcoin (BTC) price

After two days of upward reaction, Bitcoin is falling again. Yesterday’s rise above $39,000 is not confirmed by purchases, leading to selling in the short term, with prices revisiting $37,000.

If prices fail to climb back above $38,000 in the next two days, it would mark the first bearish week after a series of four consecutive weeks that saw one of the best rallies in Bitcoin’s history.

Over the weekend, the $40,000 mark should be monitored on the upside and the $30,500 low from earlier in the week on the downside.

Ethereum (ETH) price

Ethereum today goes against the trend and rises 4%, returning to above $1,200, a key level that indicates the exit of the technical rebound by getting Ethereum prices back into the uptrend.

Unlike Bitcoin, Ethereum’s technical structure is more solid, although it is necessary for prices to push above $1,300 to aspire to new highs. If not, there is room for Ethereum to fall back below $1,000 without ruining the bullish structure in both the short and medium-term.