Summary

Bitcoin Analysis

Bullish BTC market participants defended the $19k level for the 36th consecutive day on Wednesday and when traders settled-up to close the day, BTC’s price was -$204.4.

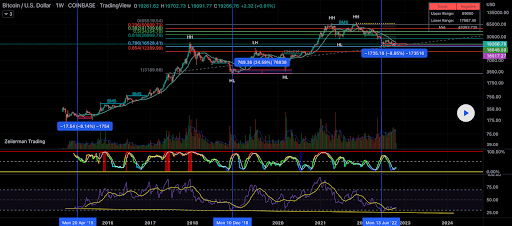

Today’s first chart of emphasis is the BTC/USD 1W chart below by smies1992. BTC’s price is trading between the fibonacci level [$16,528.41] and 0.618 [$26,999.79], at the time of writing.

Bullish BTC traders have a primary target overhead of the 0.618 fib level followed by 0.5 [$34,354.7], 0.382 [$41,709.6], 0.236 [$50,809.73], and 0 [$65,519.54].

Traders that believe there’s another push to the downside yet want to send BTC’s price below its 12-month low of $17,611 followed by targets of 0.786, and 0.854 [$12,289.99].

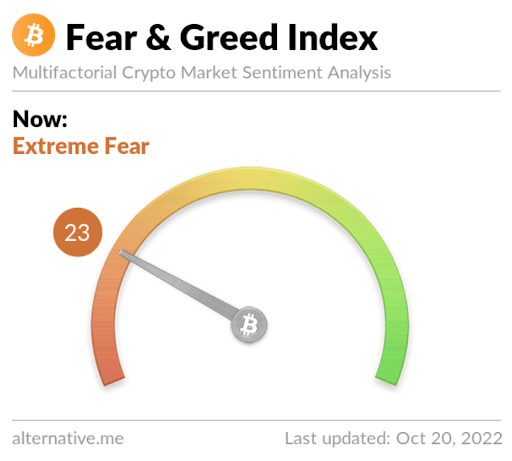

The Fear and Greed Index is 23 Extreme Fear and is equal to Wednesday’s reading.

Bitcoin’s Moving Averages: 5-Day [$19,336.91], 20-Day [$19,421.99], 50-Day [$20,368.52], 100-Day [$21,604.96], 200-Day [$30,262.63], Year to Date [$30,777.15].

BTC’s 24 hour price range is $19,066-$19,360.2 and its 7 day price range is $18,372.47-$19,872.75. Bitcoin’s 52 week price range is $17,611-$69,044.

The price of bitcoin on this date last year was $65,961.

The average price of BTC for the last 30 days is $19,333.7 and its -4.3% over the same span.

Bitcoin’s price [-1.06%] closed its daily candle worth $19,123.7 on Wednesday. It was the second consecutive close in negative figures for BTC.

Ethereum Analysis

Ether’s price lost nearly 2% of its value during its trading session on Wednesday and when the day’s candle was painted, ETH’s price was -$25.47.

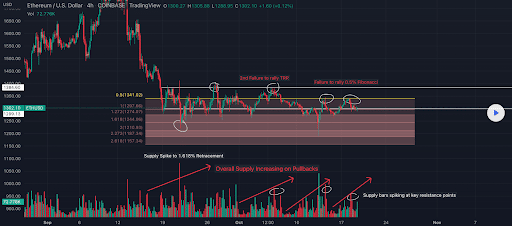

The ETH/USD 4HR chart below by jalapablo is the second chart we’re analyzing for Thursday. ETH’s price is trading between the 1 fib level [$1,297.66] and 0.5 [$1,341.02], at the time of writing.

From the perspective of bullish traders, they need to regain the 0.5 fib level before trying to reclaim territory above the $1,400 level to again show some resolve against the recent and incessant selling pressure of bears.

Conversely, bearish traders of the Ether market have targets below of the 1 fib level, 1.272 [$1,274.07], 1.618 [$1,244.07], 2 [$1,210.93], 2.272 [$1,187.34], and 2.618 [$1,157.34].

Ether’s Moving Averages: 5-Day [$1,307.86], 20-Day [$1,322.49], 50-Day [$1,511.44], 100-Day [$1,459.47], 200-Day [$2,106.32], Year to Date [$2,157.19].

ETH’s 24 hour price range is $1,280.31-$1,310.89 and its 7 day price range is $1,216.50-$1,337.15. Ether’s 52 week price range is $883.62-$4,878.

The price of ETH on this date in 2021 was $4,160.21.

The average price of ETH for the last 30 days is $1,316.72 and its -11.31% over the same interval.

Ether’s price [-1.94%] closed its daily candle on Wednesday worth $1,285.34 and in red digits for a second straight day.

Cardano Analysis

Cardano’s price reached its lowest level of the entire bear market on Wednesday and concluded its daily session -$0.0126.

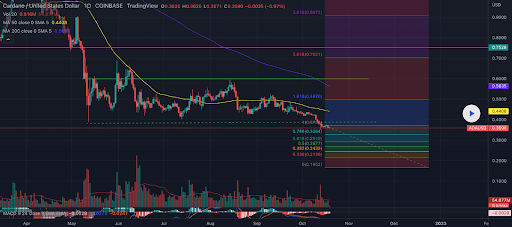

The final chart for analysis this Thursday is the ADA/USD 1D chart below from Cryptoslothx. ADA’s price has lost support at the 1 fib level [$0.370] and is trading between that level and the 0.786 [$0.3264], at the time of writing.

For bullish ADA traders to reverse the current downtrend on ADA’s price they need to first retake the 1 fib level followed by targets of 1.618 [$0.4970], 2.618 [$0.7021], and 3.618 [$0.9072].

Bearish ADA traders are in the driver’s seat of Cardano’s market and they want next to send ADA’s price below the 0.786 to another new 12-month low. Below that level the next targets for bears are 0.618 [$0.2919], 0.5 [$0.2677], 0.382 [$0.2435], 0.236 [$0.2136], and 0 [$0.1652].

ADA’s Moving Averages: 5-Day [$0.363177], 20-Day [$0.409176], 50-Day [$0.451226], 100-Day [$0.475271], 200-Day [$0.694940], Year to Date [$0.718908].

Cardano’s 24 hour price range is $0.347-$0.3624 and its 7 day price range is $0.347-$0.387. ADA’s 52 week price range is $0.3502-$2.37.

Cardano’s price on this date last year was $2.18.

The average price of ADA over the last 30 days is $0.4181 and its -26.73 over the same interval.

Cardano’s price [-3.48%] closed its daily session on Wednesday valued at $0.3498 and in red figures for a second day in a row.