The week just ended saw a hesitant recovery from the altcoins with respect to bitcoin that, having experienced a pullback, slowed down the bullish momentum that had characterised the previous week. In fact, over the weekend the positive signs of the altcoins prevailed, a trend that could bring hope for the next few days.

Of the altcoins that have stood out the most, Cosmos (ATOM) emerges and with a decisive leap recovers the $2.5 after having sunk, last week, to $1.90. This represents an increase of more than 60%.

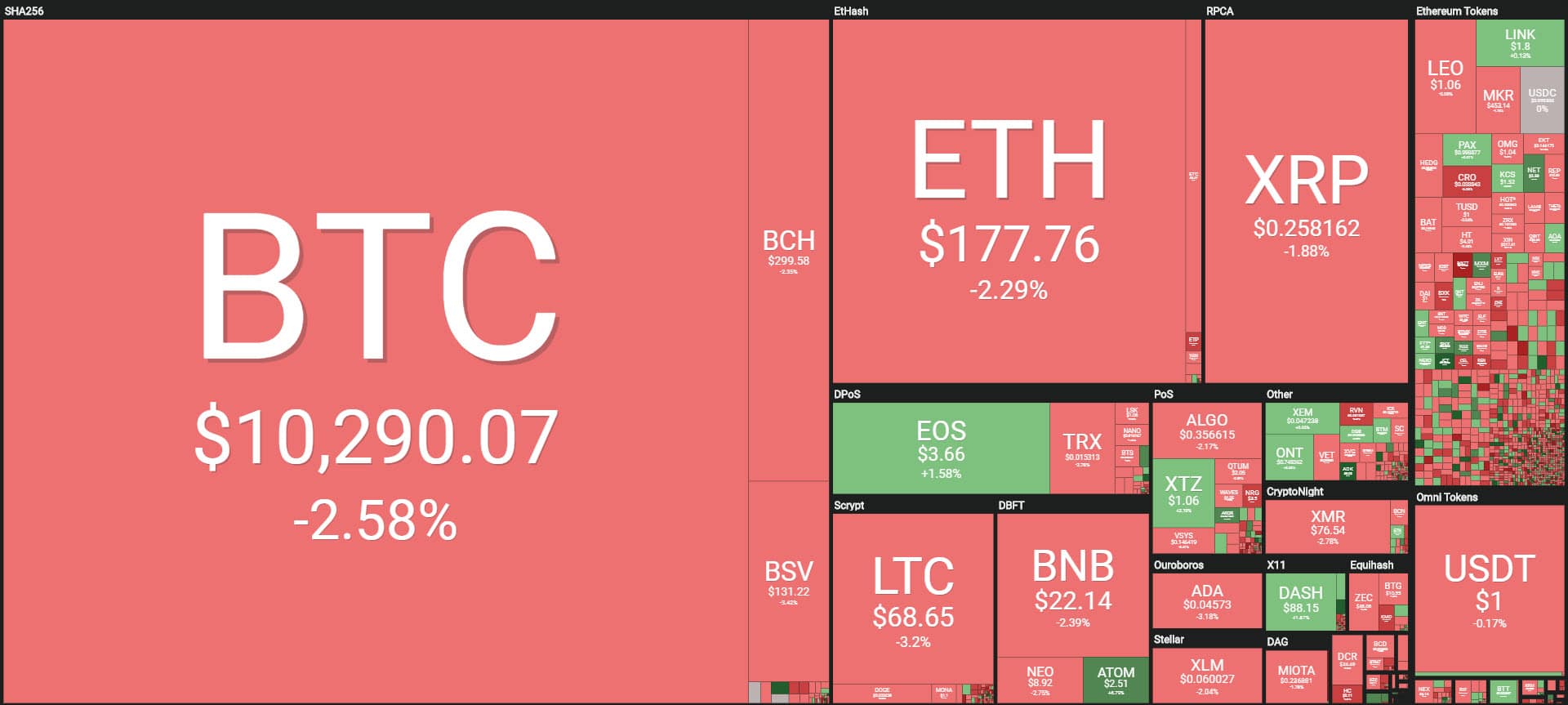

The weekend saw most of the major altcoins moving, however, Ethereum continued to show difficulties in recovering important levels in a monthly perspective. ETH continues to swing close to the summer lows, at 170-165 dollars, while Ripple fails to stabilise above 25 cents. The weekend saw a sharp drop in volumes that dropped to $50 billion daily.

The snapshot of what happened over the weekend reflects on the dominance of bitcoin that slips below 70% after having pushed over 71% last Friday, levels that have not been recorded since the first quarter of 2017. Bitcoin’s pullback has a negative impact on the market cap, which is back below $265 billion after last Friday’s $270 billion.

Today the day opens with a clear prevalence of red signs, mainly due to the positive performance of all the altcoins yesterday morning.

As for the weekly balance, green signs prevail among the top 20, apart those of Stellar (XLM), Leo (LEO) and Iota (IOTA), which fall below parity. The worst is Leo who loses 5% on a weekly basis and returns to approach the levels of the launch at 1 dollar.

The best on a weekly basis as a result of the weekend rise is EOS with a double-digit gain of over 13%. EOS in the last 72 hours scored an increase of more than 20%, recovering 3.80 dollars, a level abandoned with the fall of mid-August.

Bitcoin’s pullback (BTC)

Bitcoin fails the break of the 11,000 dollars, level it had approached last Friday and returns to test the 10,300 dollars. With this last pullback, bitcoin technically returns to score the fifth-highest high, validating more and more the structure of the bearish triangle. It is necessary for bitcoin to give confirmations over 11,000 dollars in the next few days otherwise it will increase the validity of this technical figure.

A break of the 9,500 dollars could push bitcoin to review the levels of last June, whereas a rise above 11,000-11,500 dollars would invalidate this technical structure by increasing the possibility of reviewing the annual maximums in the following phases.

Ethereum (ETH)

Ethereum’s technical structure remains on a downward trend. Ethereum cannot catalyse large volumes to support any upward swings. It is, therefore, necessary to decisively recover and consolidate the 185 dollars, otherwise, the movements that have characterised the last 10 days would continue to highlight a continuation of the bearish trend.

A possible break of the 165 dollars, a low tested last Saturday with a sinking lasting a few hours that led to the test of the lows of mid-August, would drive prices towards the bottom to review the 155 dollar price, a level abandoned last April.