Today the price of Dash stands out with a rise of 6% thanks to the recent listing on Coinbase Pro. Dash represents the best rise of the day among the top 20 cryptocurrencies, with the price recovering 90 dollars, a level abandoned at the end of August.

Dash benefits from the introduction on Coinbase Pro, albeit in a limited way: the arrival on the platform brings prices up as it usually happens when there are new additions to the cryptocurrencies offered by Coinbase. However, these are much lower increases compared to what happened in 2017, at a time when it was enough to be listed on Coinbase to experience double-digit increases.

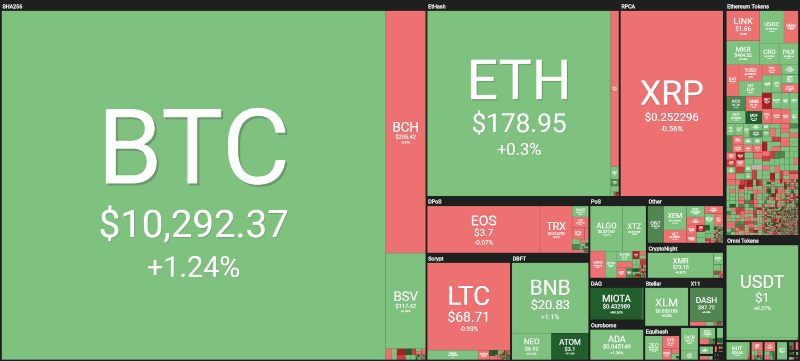

The day that opens the doors to the weekend is beginning to show a prevalence of positive signs. Though more hesitantly than yesterday, bitcoin, alongside Dash, leads the rises among the top 20 capitalised, with a gain of 1.5%.

Below the 20th position, Cosmos (ATOM) continues to perform very well, continuing its upward trend and achieving a 20% increase, consolidating yesterday’s movement, with prices above 3 dollars, and extensions to 3.20 dollars. This rise has made ATOM rank first as the best rise of the day.

In contrast, besides Energi (NRG), which loses 7%, Chainlink (LINK) is another worrying and noteworthy decline. Chainlink lost more than 4%, with prices returning to the levels of mid-June last year, at $1.65. This bearish phase is starting to get a little worrisome. After reaching the top with $4.6 in June, the rumours of recent days have accused the Chainlink team of manipulating prices and volumes.

Trading volumes over the past 24 hours continue to remain below $50 billion, slightly down from yesterday’s levels.

Thanks to these contained rises in the day, capitalisation rises to over $263 billion.

The rise of bitcoin towards the 10,300 dollars confirms the achievement of 70% dominance that took place yesterday. Ethereum falls and returns to 7.3%. Ripple keeps travelling just over the threshold of 4%, the lowest levels since December 2017.

Ripple prices continue to fluctuate at around 25 cents. During a CNN interview with Ripple CEO Brad Garlinghouse, the CEO tried to reassure investors by saying that it’s not the foundation’s intention to keep prices down or adversely affect XRP prices. These sentences come after investors in recent weeks have accused the foundation of massively selling XRP tokens, thus affecting the price. Yesterday, the CEO made an attempt to reassure the investors, although this did not have a positive effect on the value of XRP.

Bitcoin (BTC)

Bitcoin recovers $10,300 and gives reassuring signals with the holding of the $10,000, but will have to find confirmations over the weekend. A possible rise should push prices above last week’s highs, to $10,800, giving a positive signal, while a drop below $10,000, a level abandoned last Wednesday, would bring back the concerns of yet another test of the $9,500 level, a threshold that delimits the base of the descending triangle.

A rise above 10,800-11,000 dollars and an extension to 11,200-11,500 would invalidate the figure of the bearish technical triangle.

Ethereum (ETH)

Ethereum continues not to give signals, staying invariant and with almost imperceptible oscillations in the arc of the same day with prices that are struggling to stay above the 180 dollars, a level where prices have been oscillating for days, with prevalence below this threshold.

For Ethereum it is necessary to recover the 185 dollars, otherwise, it will continue this boring and decidedly not comforting phase that does not attract new purchases, which would allow the climb to 185-200 dollars. It is crucial for Ethereum not to violate the 165 dollars otherwise it would cause the rupture of support with the probability of a sell-off that would push to update the lows of the last five months.