Yesterday, the quotations of bitcoin and Ethereum have scored a strong upward movement. Bitcoin strongly recovers the 10,000 points, pushing in the late evening close to the 10,500 points, a difficult area of resistance that throughout the month of September has proved to be a level well defended by the Bears.

After having fallen again below 10,000 dollars for the umpteenth time and for the second time since the beginning of the month, the short leap sees the prices of bitcoin above this level once again.

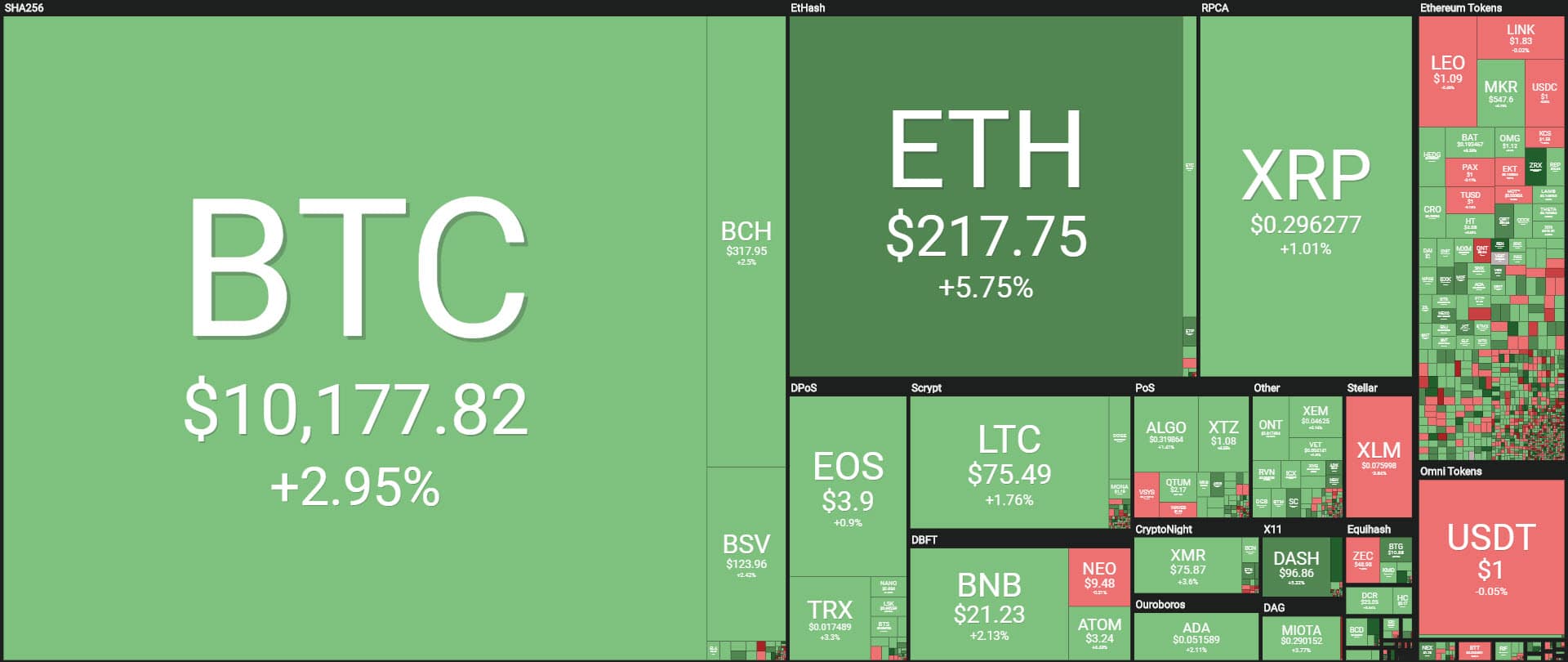

Ethereum performs even better, recovering $225, a level abandoned last July. This leads to the emergence of the green sign for more than 80% of cryptocurrencies.

Among the first 20, Stellar is the only red sign. After the rise of the past few days with the recovery of the value of more than 50% in a few hours, Stellar now takes a break and loses about 2% with prices at 0.075 dollars.

Among the top 100, the best upward movement is that of ABBC Coin (ABBC), which rises by more than 40%. Among the best known of the day is Dash rising 6%, followed by Ethereum which is close to the 6% rise in the day.

Bitcoin quotations today rise by more than 3% and, with Ethereum, is among the best of the first 15.

The market cap rises above $270 billion, a level that in September is proving to be a cap for the total capitalisation of the entire sector. The dominance of bitcoin rises a few decimals from yesterday’s levels, reaching over 67.5%, respectable levels despite losing the 70% of market share, the threshold that had characterised last month.

The rise of Ethereum does not particularly affect the dominance that remains close to 9%. Ripple is slightly down to 4.6%.

Bitcoin (BTC) quotations

Bitcoin continues to swing within the famous descending triangle. The recovery of the psychological threshold of 10,000 dollars is positive, a level that no longer has the same effect as a few weeks ago: the continuous upward and downward breaks are neither worrying nor attractive anymore.

For bitcoin it remains necessary to push over 10,500 dollars, showing how this level in the short term is a resistance to be broken necessarily upward to attract new purchases and then push over 11,000 points, level of resistance increasingly important in the medium term.

With yesterday’s rise, bitcoin attracts volumes again. In the last 24 hours, there was the most intense trading day of the last 10 days.

For bitcoin, in the event of a downturn, it is necessary not to go below $9,800-9,500 over the weekend as bearish speculation could increase.

Ethereum (ETH) quotations

The last few days bring new confidence to the first altcoin that in recent months had raised doubts as to the stability and resilience of support levels, marked between late August and early September in the $165 area, levels that Ethereum had abandoned last May.

The recovery of $225 is an important short-term signal that has brought back the purchasing volumes. Over the weekend it will be necessary for Ethereum to consolidate the rise of the last 7 days, a performance that makes it among the top three of the top 15.

For this reason, it is necessary not to fall below 200 dollars. A very positive signal would be a boost that would bring prices back to 235-240 dollars, putting the turbo and bringing prices back away from the warning thresholds that remained valid until a few days ago.