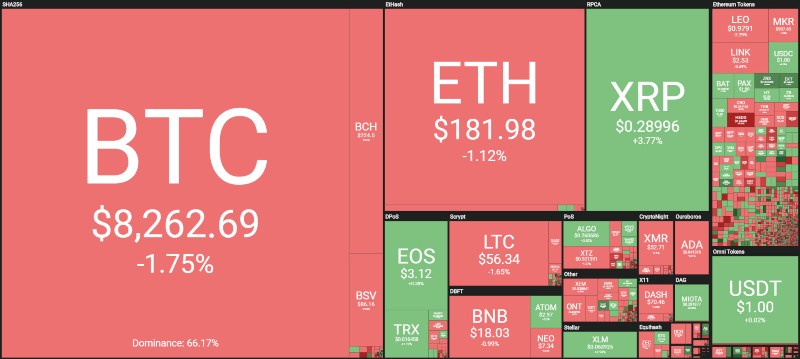

The price of XRP is going up these days. The Ripple token made itself noticed during a weekend with no particular shocks. The new week starts with prices at the levels of last Friday. This is true for bitcoin, which is around $8,300, and Ethereum, which dances around $180-185.

Ripple (XRP) shows a clear sign of redemption. Over the weekend, XRP started to give indications of recovery confirmed today by going up 3.5%, making the price rise over 29 cents and surpass the previous highs of last Wednesday, re-testing again the line of the former support now become resistance.

It will be very important to observe the trend of Ripple in the coming hours. Any increase above 30 cents could attract new purchases.

Among the big ones, the other rise worthy of note today is that of Cosmos (ATOM), which rose by more than 5%. The prices of Cosmos thus return to test the bearish trendline of the medium-term started with the relative highs of the end of June, bringing them back above the psychological threshold of 3 dollars.

However, the best of the day is 0x, which flies over 14% and returns above 33 cents, levels it has not recorded since the end of June. 0x breaks the bearish trend that began last April.

On the other hand, the worst of the day is the pair MaidSafeCoin (MAID) and Crypterium (CRPT), both down 11%.

Total capitalisation remains above $225 billion with trading volumes remaining quite low, under $50 billion, despite a 10% recovery on the contracts traded on Sunday.

Bitcoin (BTC)

Bitcoin continues to oscillate around 8,300 dollars without giving particular operational indications.

For BTC it is important not to return below the threshold of 7,800 dollars in this phase of oscillation that sees the prices caged in a range between 7,800 and 8,700 dollars since last September.

Ethereum (ETH)

After failing to break the bearish trendline that started with the highs at the end of June, Ethereum returns to test again the $180-185 threshold, a level that has attracted prices since the end of August.

For ETH, the indications of the past days remain valid: a break above 190-195 dollars is necessary in order for the price to go up. By contrast, a fall below 165-155 dollars would raise concern.