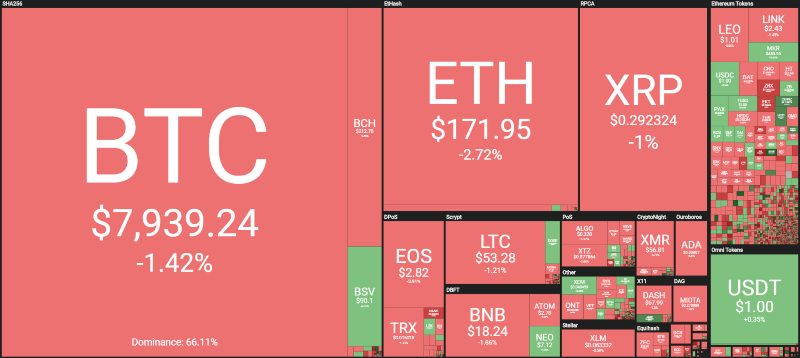

During the day that opens its doors to the weekend, bitcoin is once again below 8000 dollars. Just like last Friday, the red signs are once again prevailing among more than 80% of the top 100 of the most capitalised cryptocurrencies.

A percentage that increases when looking at the big ones. Of the top 20, only Bitcoin Satoshi Vision is in positive territory, scoring one of the top 5 increases of the day with a +2.5%.

The two biggest rises of today in clear countertrend are Solve (SOLVE) which climbs the 96th position with just over 35 million of capitalisation, scoring a +32% on the day, and Centrality (CENNZ), following at a distance and rising by more than 16%.

On the opposite side, 0x (ZRX) is down 6%, as is Monero (XMR), who is paying the price for yesterday’s strong jump. Same bearish intensity for Enjin Coin (ENJ) and Zilliqa (ZIL).

Among the first three, Ethereum shows a sign of nervousness, returning to almost 170 dollars. Bitcoin also continues to be characterised by low volumes, with an average daily exchange rate well below the already low level of the last two weeks. In these hours, bitcoin falls below 8000 dollars and returns to 7,900 dollars, dangerously touching the lows of the last three weeks at 7,800 dollars.

Today Ripple retreats, a reversal followed by the strong rises of recent days that make XRP among the best of the big ones on a weekly basis, with a gain of 7%. From the lows reached on September 24th, with the leap confirmed this week, Ripple recovers more than 40% of its value.

Binance Coin‘s weekly performance was also good, recovering between 7 and 8%, but BNB is still in a bearish channel that just three weeks ago saw prices fall close to 14.33 cents, the lowest levels since the end of last March.

Market capitalisation fell by $3 billion to almost $216 billion, the lowest level in the last week. The dominance of bitcoin also suffers from the decline of the last hours, which comes back to touch 66%. The dominance of Ethereum also continues to fall further, reaching just over 8.6%, the lowest levels since the end of September. Despite the difficulties, Ripple benefited from the excellent weekly performance and managed to consolidate its market share just over 5.8%.

Bitcoin (BTC) below 8000 dollars

Bitcoin remains within the lateral band that by now has been characterising its oscillations since the last week of September.

The movement of these hours that has brought the prices of bitcoin below 8000 dollars, sees the prices close to the lower band of congestion. Over the weekend, it is necessary for bitcoin not to push below $7,750 because with the volumes that are characterising these last weekends it is not excluded that a possible break could be a golden opportunity for downward speculation.

The resistance is far from the levels that could bring vigour: an increase is needed up to $8,600, a level that is very far for now.

Ethereum (ETH)

Ethereum returns to dangerously test the dynamic bearish trendline that has been supporting the positive trend since the lows of mid-December. It’s a very delicate phase. ETH prices are within a long-term triangle with the support base at $175, where prices are now fluctuating. The upward price is falling further, with values close to 185 dollars.

A narrow band of 10 dollars where the trend will be determined for the next days of the week.