Cryptocurrency trading has brought a real revolution in the field of online trading, opening even more possibilities to any retail investor. This new virtual currency market experienced a real boom a few years ago, when the value of its most illustrious currency, bitcoin, skyrocketed and caught the regulators completely unprepared.

To be precise, the main difference between this market and the traditional one is that it is not controlled by any official institution.

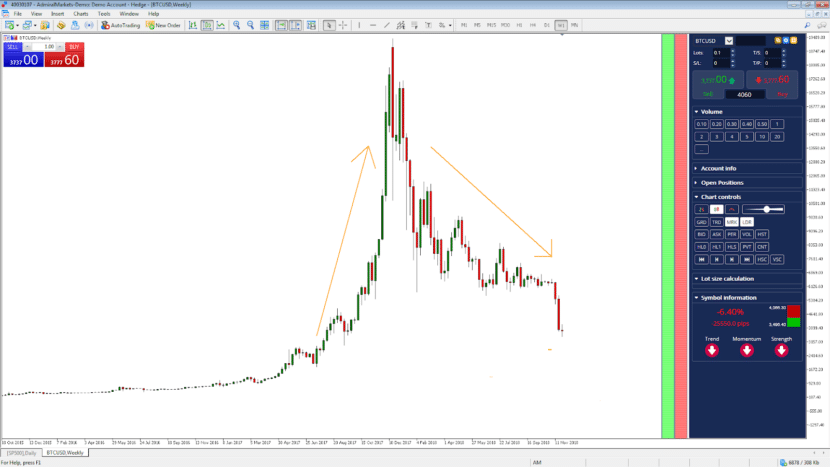

However, it is still far from competing with traditional markets, such as gold, Forex or shares. In fact, the collapse in the value of cryptocurrencies last year and the pronounced volatility with which they are traded has generated a certain climate of distrust in this market.

Alternatively, some brokers have begun to offer their clients the opportunity to trade cryptocurrencies through CFDs (or Contracts For Difference), so that it does not matter whether the price rises or falls because the trader can enter any trading position with respect to the product, either short or long, without officially holding the financial asset. Moreover, it is an option that reduces costs compared to digital trading platforms.

But what is CFD trading? The first thing to understand is that when investing through contracts for difference in any asset, be it shares, commodities, currencies, the user does not physically own the financial product, but creates an agreement with the seller speculating on the price increase or decrease of the underlying asset over a certain period of time. If the trend coincides with the one the trader has chosen in the contract, they will make a profit, while if the market goes in the opposite direction, they will incur losses.

In the specific case of cryptocurrencies, CFD contracts allow them to be paired with other currencies, as is the case in the foreign exchange market, for example. Traders can speculate on the rise or fall of these assets without having to own them. After all, it is a contract between two parties, the trader and the broker, who on the expiration date exchange the difference between the initial cryptocurrency price and the final one.

Cryptocurrency trading through CFDs offers the advantage of being able to apply leverage to the funds invested, which can be either big or small depending on whether the trader is a professional or a retail trader. This means that the trader does not need very high capital to start trading, and can only do so with a percentage of the total value of the position.

In this sense, last summer the ESMA (European Securities and Markets Authority) approved a new regulation on leverage applied to CFDs that sets maximum levels in order to ensure that retail clients do not lose more than they invest.

Another point in favour of this derivative is that it can be traded 24 hours a day, seven days a week. It also provides greater security than direct trading with cryptocurrencies when using a regulated and professional broker.

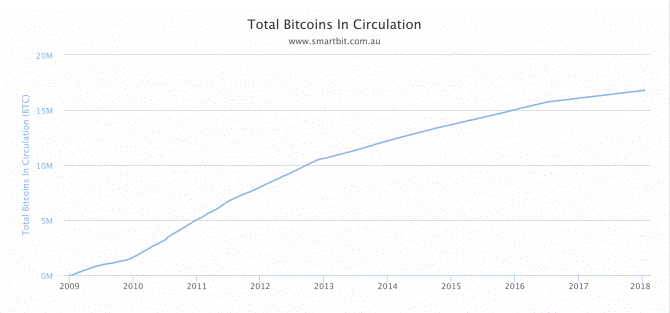

There are currently at least a hundred cryptocurrencies with a total capitalisation of more than $140 billion, according to CoinMarketCap.com. The most valuable are: Bitcoin, which exceeds 70 billion dollars, Ethereum and Ripple, both exceeding 10 billion dollars in value.

According to the Report on Cryptomarkets and Blockchain of the Observatory of Financial Digitalization (ODF), the number of cryptocurrencies increased by 55% last year, although the total value decreased significantly, up to 80% after suffering the hard crash.