The week begins by summarising what happened during the weekend: the crypto market is characterised by low volumes in the wake of the week just ended, during which Coinbase indicated that they had closed the day with the lowest trading volume since last March.

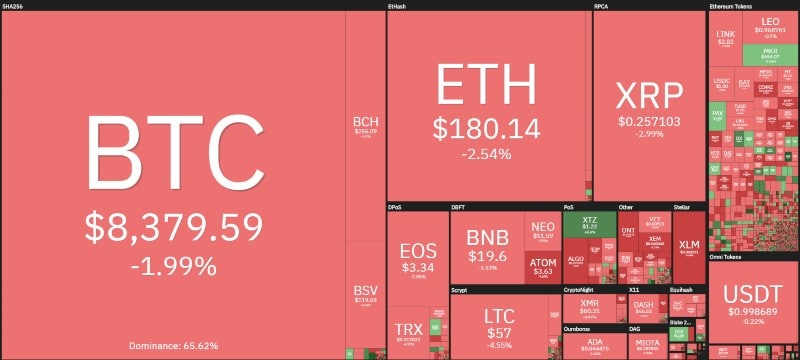

This situation affects the trend of major cryptocurrencies. As Ethereum remains stable, with micro fluctuations between 180 and 185 dollars, BTC and XRP have very low volumes, which is reflected in the price, reaching period lows. Both Bitcoin and XRP, in fact, from the highs of the beginning of the month, begin to slowly lose ground.

DeFi projects riding the wave

Despite a day in which red signs prevail for 80% of cryptocurrencies, positive signals continue to emerge from companies with projects of Chinese nationality or addressing DeFi, all of which are gathering the liquidity that is being poured into them.

The day has seen a good rise in Tezos (XTZ), up 5%, followed by Maker (MKR), up 2.5%. Among the few rises to note is VeChain (VET), which tries to settle above $0.007.

Chilliz (CHZ), a token directly connected to Socios, which groups together many football clubs as well as some world-famous athletes, is also doing well again. Among the negative signs, it is worth noting Bytecoin (BCN) which falls by more than 10% followed by Verge (XVG) which falls by 8%.

For Verge, it’s a retracement due to the profit-taking after the strong leap of last week, which saw Verge climb more than 50% in 5 days.

The market cap remains stable at the levels of last Friday at 230 billion dollars. The dominance of Bitcoin loses a few decimals and falls below 66% of market share, while Ethereum recovers a few decimals to 8.5% and Ripple remains stable at 4.9%.

Bitcoin(BTC)

Bitcoin continues a medium-term downward trend with prices that continue to slide, dropping in these hours to test the $8,400 level already tested between Friday and Sunday. For Bitcoin, after having given up the threshold of 8,600 dollars, it is important not to go below 8,200 dollars, while upwards the level is moving further and further away from the resistance placed in the area 9,000-9,100 dollars.

Ethereum (ETH)

Ethereum is in lateral congestion between $180 and $185. Over the weekend, downward nervousness pushed prices below the $175 threshold and then recovered and moved back between $180 and $185.

The context is not very dynamic and brings interest to the other altcoins.