The strong downturn that is developing today – BTC on the front line – cancels out the China effect that at the end of October had caused prices to jump sharply with double-digit increases.

After the peaks reached on October 26th, a slow decline led by Bitcoin began, which in three weeks has not recorded a real bullish reaction and which is ending in these minutes with falls that this morning had already announced the weakness by breaking the psychological support of the 8,000 dollars.

Then came the break of the technical support of 7,800 dollars with a lunge that in these hours sees BTC going to test the 7,500 dollars, the area that had characterised the days before the rise pushed by the statements of the Chinese president who had strongly stirred up the whole sector, starting with Bitcoin.

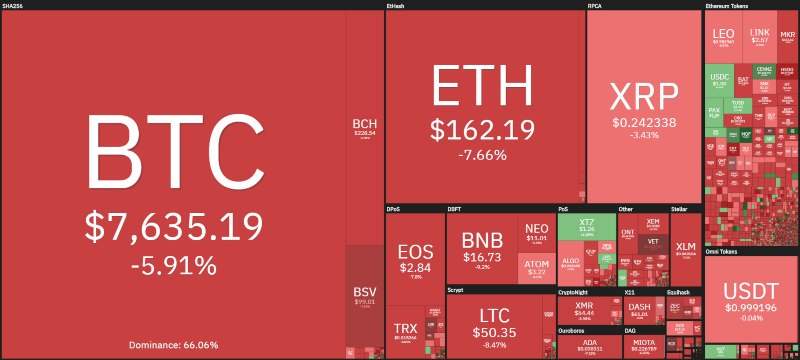

Bitcoin today extends its downward movement by 5% and, as is usually the case, drags all major altcoins. Ethereum loses 8% with prices going to test support levels that coincide with the lows of the last six months, 155 dollars, already tested in late September and late October.

Ripple holds better the blow of these hours, losing 3%, even though XRP has never delivered a great bullish signal in the last month unlike the rest of the industry. In the top 10, Litecoin (LTC), EOS and Binance Coin (BNB) lose 8%.

The drop of BTC: some reasons

This downturn is not particularly speculative, it is mainly due to the breakdown of the supports, as there is no sharp increase in volumes, which have remained very low.

As such, there is no short-selling, but rather a movement due to the breaking of very important technical support levels, such as the $7,800 for Bitcoin, which may have caused a lot of upside positions to be covered and therefore caused a slide that in a few minutes caused Bitcoin to lose $300.

The capitalisation collapses to 210 billion dollars, the lowest level since October 25th, confirming the nullification of the China effect that developed between October 25th and 26th. The dominance of Bitcoin is just above 66%.

The drop of Bitcoin (BTC)

Bitcoin returns to the levels of late October and this downturn cancels the rise that developed in the days of 25-26 October. In other words, BTC must rebuild the foundations for a possible return of strength.

In this delicate phase, it is necessary to observe the support in the $7,500 area, instead of going to evaluate bullish objectives, as the first level is far away, at $9,000.

Ethereum (ETH) also down

Ethereum, similar to Bitcoin, is also testing the $155 threshold for the 4th time, a level that is crucial in the event of a break, because it would make ETH stumble into a sinking driven by downward speculation. The 150-155 dollars are important levels not to be violated.

Like Bitcoin, ethereum will also have to reach the $200 threshold to give a bullish signal, but it’s a level currently not very useful to follow in such a delicate and bearish context.

For ETH it is necessary in the next few hours not to sink below 155 dollars in order not to suffer downward speculation.