After the bullish hangover of the last few days culminated with period highs and recorded during the night between Sunday and Monday, coinciding with the reopening of the Chinese stock markets, today the red signs are slightly prevailing again, with Bitcoin leading the trend of the entire sector and currently retreating by 1%.

BTC is in line with Ethereum, which also retreats by 0.8%, whereas Ripple scores -0.5%. All three still remain close to the highs touched the night between Sunday and Monday.

The general trend indicates that the rises of the last few days are the reason for the profit-taking of the last few hours. Trading volumes are contracting and are below 100 billion dollars over 24 hours.

Among the top 10 crypto per market cap, the negative sign prevails. The one that seems to suffer the most from the daily retracement is Litecoin (LTC), which loses 2.5%: in 11th position Tezos (XTZ) is holding firm and yesterday it went beyond the all-time record of $2.10. Today XTZ is back under $2 but remains positive with +2.8%.

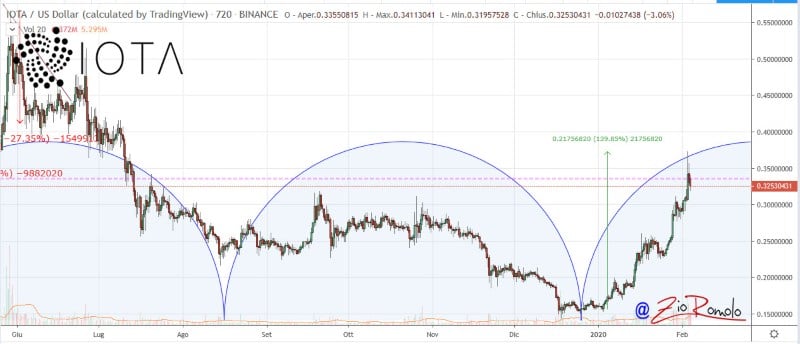

Among the big players of the last weeks’ rises, Iota today sees the price fall back by about 9%. One of the worst declines of the day. The absolute worst is Bytecoin (BCN) in 92nd position, which slips by more than 10%.

Among the best, Icon (ICX) continues to rise, adding a further 60% to the previous day’s gains. Icon in the last few hours has gone above 60 cents, the highest in the last two years that it has not recorded since November 2018. From the lows of the beginning of the year, Icon is literally flying and is among the top three of the month with a +460%.

Among the best are Aion (AION) with a +33%, and Hedera Hashgraph (HBAR) up 34%, while Enjin Coin (ENJ) is up 18%.

Overall, the market cap remains stable at $260 billion, the highest levels over the last 5 months. Bitcoin maintains dominance just above 65%, Ethereum instead falls below the 8% threshold. Ripple conquers 4.2% thanks also to the overcoming and holding of 25 cents.

Bitcoin (BTC)

After overcoming the $9,600 in the night between Sunday and Monday (highest levels since last October) Bitcoin retreats back to $9,200. Nothing worrying, but it is necessary to keep prices above $8,900 so as not to attract concerns that would only explode with prices below $8,200, relative lows at the end of January.

Ethereum (ETH)

Ethereum does better and in these hours it retraces and goes below $190, violated yesterday when it reached $195 at one step from $200. Since the end of December, Ethereum has earned 60%, among the best rises of the first 10.

ETH has plenty of room to manoeuvre up to area $170. Only a return below $155 (relative lows at the end of January) would trigger a wake-up call for the bulls.