The trading volumes of the cryptocurrency markets are rising again. It is a growth in line with that of the financial markets, which are bouncing back after one of the worst weekly downturns in history.

In fact, since yesterday, the financial markets have been registering an increase that leads to a general upturn. All sectors are recovering, except for gold, which shows difficulties but has been performing well since the beginning of the year. The uptrend is to be contextualized with a rebound due to the profit-taking of the downward speculation positions that struck the markets last week. This is reflected in that of the cryptocurrencies which, after 7 days of red candles, closed yesterday its first day upwards.

An interesting rise that sees the participation of investors closing yesterday the third day with the highest peak in volumes since the beginning of the year. Volumes continue to rise and give a clear indication of reaction and return of purchases marking a +40% of daily trades from yesterday morning’s levels, already higher than the low trades recorded on Saturday which instead saw a similar trend to the previous week. It will be interesting to follow a possible return of purchases and assess whether it will be accompanied by the rise in prices.

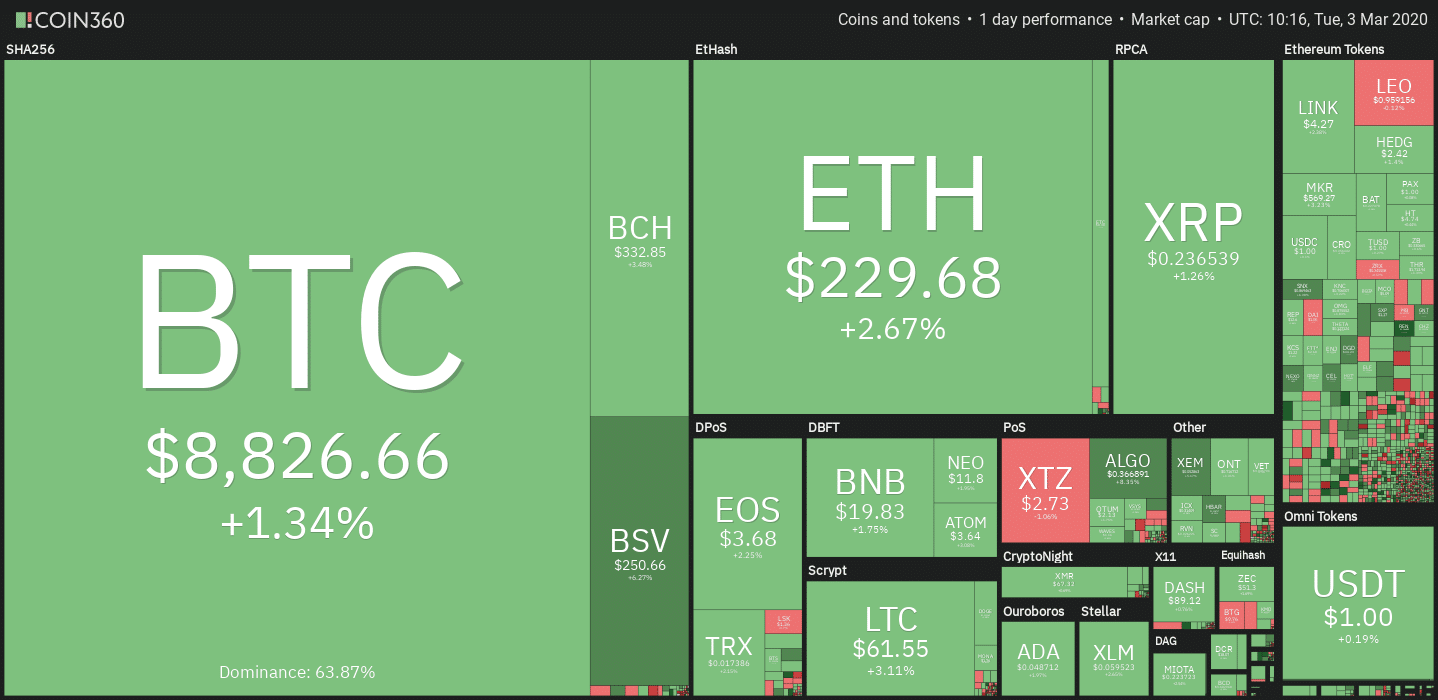

Today more than 80% of cryptocurrencies are in positive territory. Among the top 20, Bitcoin Satoshi Vision (BSV) maintains the podium, rising by 9%, followed by Chainlink (LINK), which is up 8%. These are rises that for all the main altcoins average between 6 and 8% over the 24 hours. The positive sign of Bitcoin (BTC) does not particularly stand out, which today rises “only” by 2.5%. Ethereum (ETH) rises by 4.5% and Ripple (XRP) by 3.5%.

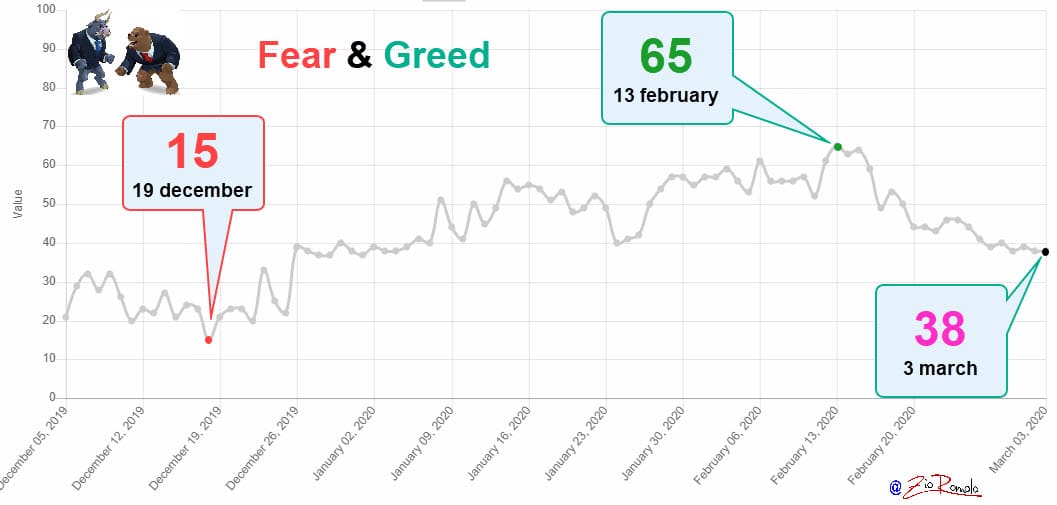

Last week’s sinking makes the general sentiment fall again with the fear & greed index touching 39 points, the lowest level since the beginning of the year, in perfect balance between December’s lows and mid-February’s highs. The index shows how the bearish action of the last 10 days also affects the sentiment of cryptocurrency traders.

This increase brings the total capitalization over 255 billion dollars. The dominance of Bitcoin that recedes just under 64%, while Ethereum remains unchanged just under 10% and Ripple at 4.1%.

Bitcoin (BTC)

Bitcoin, after testing the weekend lows of the bullish dynamic trendline, tries to give the first upward reaction signal by recovering the $8,800. It’s a signal due to downward position overlays.

A first sign of bullish turnaround would come with pushes to $9,100, former support built in early February and now become resistance. A possible violation of the lows built during the weekend, area 8,500 dollars, would project prices towards the next level of focus to be observed carefully in the $8,100 area. A break of the $8,500 would give the first sign of a downward reversal after more than two months of an upward trend. At the moment there are no signs of risk in this direction.

Ethereum (ETH)

Ethereum after leaving about 25% on the ground in less than 10 days from the mid-February highs, maintains a more solid bullish structure due to the strong elevations that characterized all the first 15 days of February, which saw Ethereum gain more than 80% in just three weeks between the end of January and mid-February.

Prices try to stabilize around the 225 dollar area that until the beginning of February was a hostile level of resistance that returns crucial. A possible consolidation would give a strong bullish signal for the coming weeks. On the contrary, a return below Saturday’s lows would begin to project prices to the test of the dynamic bullish trendline passing in the psychological threshold area of $200.